Broading Stock Market Top Offers Proshare Shorting Profit Opportunities

Stock-Markets / UK Stock Market Jan 08, 2008 - 04:36 AM GMTBy: Donald_W_Dony

Much has been written recently about the current market conditions. Many research reports maintain the concept that new highs in the equity markets can be anticipated in the near future. Yet month after month, fundamental and technical evidence continues to build a picture of a cooling U.S. economy and the fledgling start of a mild recession. One of the earliest indicators of mounting economic weakness came from one of the most reliable indicators; the banks.

Much has been written recently about the current market conditions. Many research reports maintain the concept that new highs in the equity markets can be anticipated in the near future. Yet month after month, fundamental and technical evidence continues to build a picture of a cooling U.S. economy and the fledgling start of a mild recession. One of the earliest indicators of mounting economic weakness came from one of the most reliable indicators; the banks.

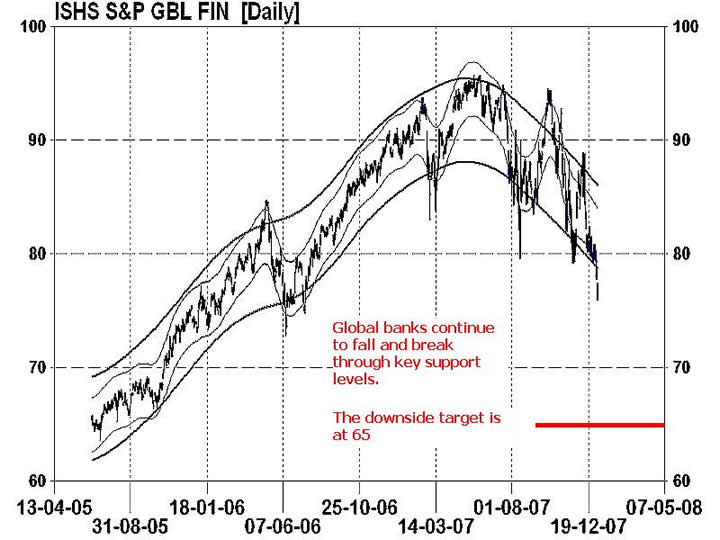

The financial sector is one of the best leading indicator for the equity markets. U.S. and Canadian banks have recently taken a hard hit on the chin with declines of 20%-30%. But is this downside pain restricted to just North American banking institutes? A quick look at Chart 1 will reveal this is not the case. The iShares S&P Global Financial ETF (symbol IXG) is made up of 229 of the major banks around the world. And it is in a free fall moving into early 2008.

What does this indicate about current market conditions? Simply that the probability of downward pressure continuing into the 1st quarter of 2008 is more likely than stock markets running to new highs.

The big question is how can investors profit from this strong downward potential?

Investors used to have few choices for their portfolios, during long periods of market tops and declines, except to wait the movement out, switch to defensive stocks or transfer to bonds. There has been an introduction over the past year of a number of excellent investment tools that allow the investor to profit from these market actions. These ETF investments are called bear funds. They are available on most North American markets (Dow Jones Industrial Average, S&P 500, NASDAQ, Russell and the TSX) and offers the investor a method of profiting during a period that would normally provide little opportunities.

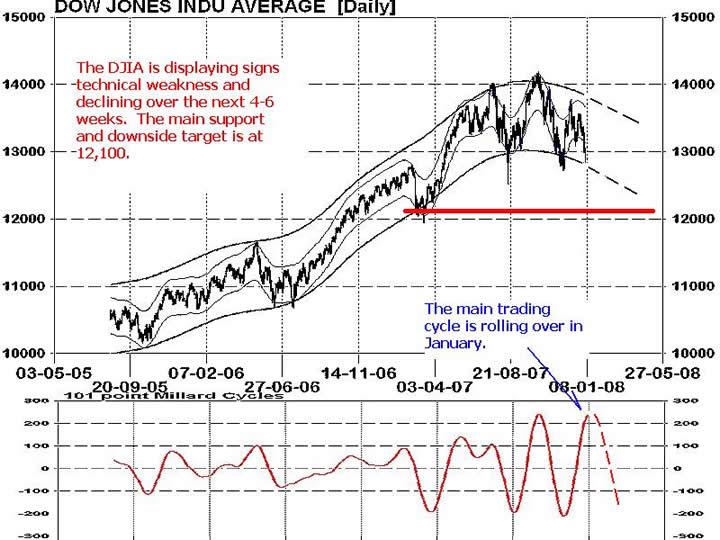

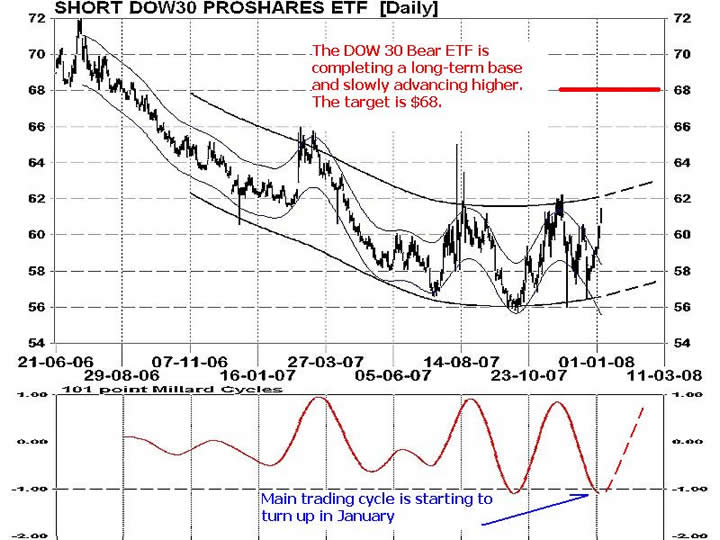

An example of how to use a bear fund ETF can be seen in Charts 2 and 3. The Dow Jones Industrial Average is presently in the process of cresting over the next 4-6 weeks with a downside technical target of 12,100. The Short DOW 30 ProShares ETF (symbol DOG) is trading in a mirrored image. DOG is completing a long-term basing pattern and beginning to advance. Just as the downside target for the DJIA is at 12,100, the upside target for the DOW 30 Bear ETF is equally impressive at $68. More aggressive investors may wish to use the leveraged 2-to-1 Ultra Short DOW 30 ETF (symbol DXD). This exchange traded funds moves twice as far as the DOW 30 (DOG).

Bottom line: Most stock markets continue to be pinned within a broad sideways consolidation as 2008 marks the mid-point of the current business cycle. Technical models indicate a major trough is expected in February which should drive most stock markets down to their mid-August 2007 lows. These levels are at the bottom of their market consolidation.

Investment approach: As 2008 is the mid-point of the 4 year business cycle, there is a greater probability of increasing weakness as 2008 unfolds and moves toward the end of the business cycle in 2010. Bear funds may provide good portfolio protection as a hedge for long-term investors or offer profit potential in the short-term if the equity markets decline.

Additional information and trading strategies with bear ETFs will be available in the up coming February newsletter.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.