UK Interest Rates held at 5.5% and on Target for 5% by September 2008

Interest-Rates / UK Interest Rates Jan 10, 2008 - 10:34 AM GMTBy: Nadeem_Walayat

The Bank of England held interest rates at 5.50% following Decembers 0.25% cut from 5.75%, with the trend inline with the Market Oracle forecast as of 22nd August 07 for UK interest rates to fall to 5% by September 2008.

Yesterdays news of the continuing deterioration of the UK economy as over indebted consumers cut back on consumption as illustrated by Marks and Spencer's announcement of a drop on Christmas sales and calls by company's chief executive, Sir Stuart Rose, joined in calls for the Bank of England to cut interest rates to stimulate the economy, would have been countered by the increasing inflationary pressures as Gordon Brown seeks to restrain the public sector pay via a three year pay deal. Which is likely to lead to major tensions with the Unions.

The Market Oracle forecast as of 22nd August 07 , is for UK interest rates to fall to 5% by September 2008, with the first cut originally scheduled to occur in January 2008 . Given the sharp drop in the housing market and signs of a fast weakening economy, the first cut occurred a month earlier than forecast i.e. December 07. However, UK inflation is expected to continue rising into January, with the Market Oracle forecast for UK inflation to peak during January 2008 and then decline sharply to below 3% by November 2008 (RPI) , which will ensure the Bank of England keeps cutting interest rates during 2008 after a brief pause, the next cut is now scheduled for March 08.

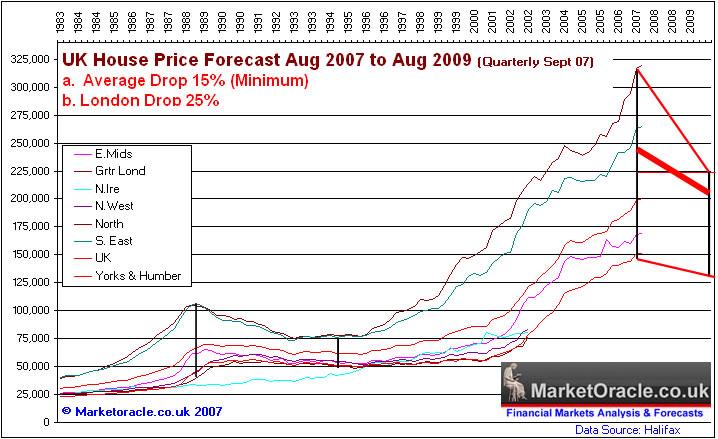

The UK housing markets fast deterioration is expected to result in annualised UK House price inflation going negative for the first time since the early 1990's by April 2008, this is expected to be followed by a sharp fall in house prices as the buy to let sector rush for the exit to take advantage of the Uk capital gains tax change effective from 1st April 2008.

The Big Freeze continues to tighten on the UK commercial property market with Britain's fourth biggest insurer, Friends Provident freezing its Property Fund in December and thereby denying over 110,000 investors the ability to liquidate their investments. The unfolding crash in the commercial real estate market may the biggest in 27 years as valuations are cut on holdings of the UK's £700 billion commercial property market. As highlighted periodically over the last 6 months, funds running short of cash in the wake of investor redemptions will be forced to sell properties and thereby driving down commercial property values in an ever increasing downward spiral.

The Market Oracle forecast is for a 15% drop in UK House over the next 2 years with London expected to drop by as much as 25%, as of 22nd August 07. (the below graph will be updated on Halifax's data release later this month).

Despite the December rate cut, the UK property market remains at historically high unaffordability levels as illustrated by the Market Oracle UK House Price Affordability Index (Sept 07).

The minutes of the meeting will be published at 9.30am on Wednesday 23 January.

By Nadeem Walayat

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.