China: Wen Indicates a 7.5% GDP Growth Forecast for 2012

Economics / China Economy Mar 06, 2012 - 03:03 AM GMTBy: Asha_Bangalore

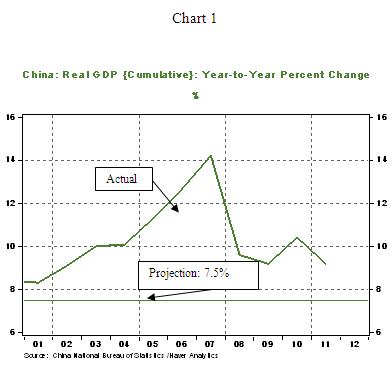

One of the major risks to the global economic outlook for 2012 has been the likelihood of hard landing in China. Much of this matter has been laid to rest with China’s premier Wen’s economic predictions at the opening of the National People’s Congress. Wen noted that Beijing projects economic growth of 7.5% for 2012 vs. the 8.0% forecast of 2011.

One of the major risks to the global economic outlook for 2012 has been the likelihood of hard landing in China. Much of this matter has been laid to rest with China’s premier Wen’s economic predictions at the opening of the National People’s Congress. Wen noted that Beijing projects economic growth of 7.5% for 2012 vs. the 8.0% forecast of 2011.

The prediction is typically set with enough room for the actual reading to exceed it. Real GDP grew 9.2% in 2011, with the fourth quarter recording only a 6.8% increase. The IMF has projected a 9.0% increase in China’s real GDP and a 4.0% gain in world GDP during 2012.

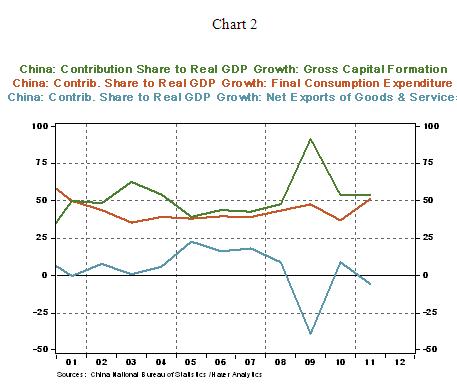

Mr. Wen also pointed out “expanding consumer demand is essential to ensuring China’s long-term, steady and robust economic development.” Consumer spending is roughly 45% of China’s real GDP in the past ten years (see Chart 2). Mr. Wen is signaling a shift in emphasis away from exports and investment expenditures. However, it is not clear how Chinese authorities can steer the economy toward this goal; this is more of a long-term rather than a near-term objective.

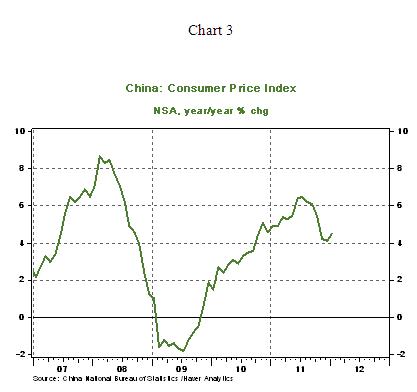

The announcement today shows a 4.0% inflation forecast for 2012. Inflation in China peaked at 6.5% in July 2011. In January, the China’s CPI grew 4.5%, a solid 200bps drop in a short span. Will this trend prevail in 2013? There is a large unknown casting a big shadow on the world economy -- Iran’s nuclear ambitions have engineered uncertainty about oil prices. Any sort of military engagement in the region can upset oil markets and trigger a large cost on the fragile world economy. Therefore, Wen’s propositions about the Chinese economy include risks. If China misses the soft-landing target, the world economy stands to lose. Stay tuned for China’s latest inflation numbers on Friday, March 5.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.