Option Trading: A Basic Explanation of Debit Spreads

InvestorEducation / Options & Warrants Mar 29, 2012 - 09:13 AM GMTBy: J_W_Jones

Welcome back to the world of options. My reality exists in three dimensions and far more combinations of potential positions than does the one-dimensional world of the stock trader.

Welcome back to the world of options. My reality exists in three dimensions and far more combinations of potential positions than does the one-dimensional world of the stock trader.

The view from my turret is ruled by the three primal forces of options — time to expiration, price of the underlying, and implied volatility. Consider for a moment the fact that each of these factors can independently impact a given option.

Multiply this by several available expiration dates and strike prices; add in the fact that individual option positions can include a variety of short and long positions at different strikes and expirations, and the potential combinations that make up an option position in a single underlying can approach a very large number.

For those traders first beginning to navigate this unfamiliar world, I think it is important to understand trade selection is manageable. There are certain families of trades that are unified by similar characteristics.

It is important to become familiar with the various trade constructions available to the knowledgeable options trader. Grouping the potential trades into related groups dramatically reduces the number of trade setups you must consider before entering a new trade.

If you are familiar with the various trade constructions, it makes discussion of a specific family member whom we may consider for employment in a trade far easier to understand.

Description of the family characteristics will take a little time, but it forms the framework on which we can hang the individual trades we will discuss in future postings.

I want readers to begin to become familiar with these patterns because it is these families of multi-legged option trades that we will return to on a regular basis to consistently perform for us.

Let me begin discussion of the various families by pointing out the redheaded stepchild of the trade constructions available. This family member, the single-legged position of being long either a put or call, is not completely without utility.

The reason for its seldom use is that for the knowledgeable options trader, this position rarely represents the best risk / reward structure given the variety of available trade constructions.

One basic and important family is that of the vertical spread. We will return several times to this family not only because of its utility in its basic form, but also because these spreads form the basic building blocks for more advanced spreads such as butterflies and iron condors.

The basic vertical spread is constructed by both buying and selling an option of the same type, either puts or calls, within the same expiration series. This is a directional spread with one breakeven point that reaches maximum profitability at expiration or when the spread has moved deep in-the-money.

It has a defined maximum profit and defined maximum loss when established. The spread is used to trade directionally in a capital efficient manner and largely neutralizes impacts of changes in implied volatility.

There are four individual vertical spread family members — the call debit spread, the call credit spread, the put debit spread, and the put credit spread. Each has its distinct and defining construction pattern. These are not the only names by which these spreads are known. Trying to keep independent option traders confined to a single set of terminologies is like trying to herd cats — it is not going to happen.

For this reason, the additional confusing and duplicative names for these spreads include bull call spread, bear call spread, bear put spread, and bull put spread. To make matters even more confusing, traders often refer to “buying a call spread” or “selling a put spread.” This multiplicity of names for the same trade structure is mightily confusing to those getting used to my world.

I am a visual learner and find that a picture is worth well more than the often cited thousand words. When I review in my mind the various option families available to use in trade construction, I think of the characteristic family portrait of each as displayed in the profit and loss, or P&L, curve.

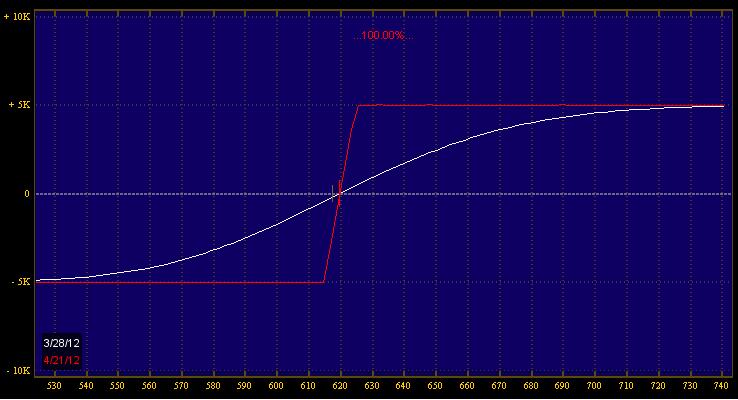

Attached below is the first in our series of family portraits, but remember within this framework is abundant room for individual variation.

This particular example is a call debit spread, a bullish position in Apple (AAPL).

We will see trades displayed in this format with many variations as we meet the different families. The solid red line represents the profit or loss at expiration. The dotted line represents the P&L curve today and the dashed line the curve halfway to options expiration from today.

In future articles I will discuss other trade constructions that are regularly employed by experienced option traders. Until then, be sure to manage your risk accordingly.

In 2012 subscribers of my options trading newsletter have won 12 out of 13 trades. That’s a 92% win rate, pocketing serious gains with the trades focusing only on low risk credit spread options strategies.

If you are looking for a simple one trade per week trading style then be sure to join www.OptionsTradingSignals.com today with our 14 Day Trial.

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.