Forestry Investments As Real Assets to Hedge Against Inflation

Commodities / Land Jun 19, 2012 - 03:26 AM GMTBy: Submissions

Adam Waldman writes: Forestry and timber investing - the very concept seems either dull or extremely alien. However any investors - especially those looking for true diversification and stable returns - are making a real oversight by ignoring the value timber and forestry investments could bring to their overall portfolio.

Adam Waldman writes: Forestry and timber investing - the very concept seems either dull or extremely alien. However any investors - especially those looking for true diversification and stable returns - are making a real oversight by ignoring the value timber and forestry investments could bring to their overall portfolio.

One question we always like to determine is where are institutional investors putting their money? This is not to say that big investors are always on the right track - they can be driven by the same emotions and herd mentality as individuals - but at least it helps give smaller investors a sense of which asset classes are seeing large allocations, which can provide an opportunity to ride a wave of money so to speak.

One asset class that has seen a substantial amount of money flowing into it recently are forestry investments. Just to give one example, Pensions and Investments Magazine recently had an article noting that the New Mexico State Investing Council in the United States was looking at allocating money into timber and farmland investments as part of a "real assets" infrastructure fund. In addition, the Financial Times recently had a series of articles on the trend towards investing in timber, including this piece.

There are a number of factors that make timber and forestry investments attractive:

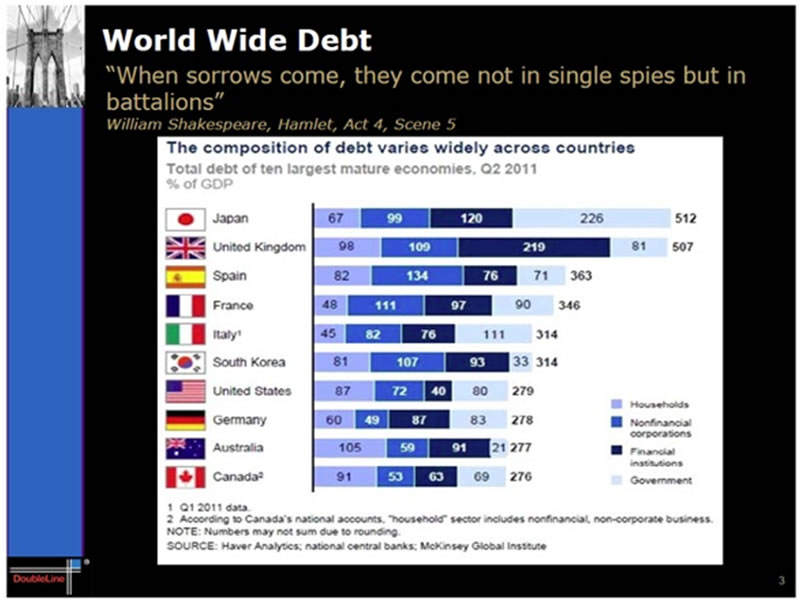

- As a "hard asset," timber investments are an excellent hedge against inflation. With the US Federal Reserve looking closely at QE3, as well as the ECB being pressured to stop the rot in Europe by buying government bonds from the Club Med countries on a massive scale, any type of inflation hedge investment is worth considering. There is generally a close correlation between timber prices and overall prices in the economy, and that sense timber can act as a hedge much like precious metals do. Indeed, if one considers the broad debt to GDP ratios of the world’s major economies, it seems inevitable that one strategy by central banks will be to create inflation to lower the real value of this debt.

- The returns on timber investing have been quite impressive. Consider some basic statistics on the returns from timber and forestry investments. In the UK, the average annualized return for the IPD (Investment Property Databank) UK Forestry index for 10 years is 10.4%. In the United States meanwhile, the National Council of Real Estate Fiduciaries in the United States (NCREIF), timber returns since 1987 through 2010 have averaged 15% a year.

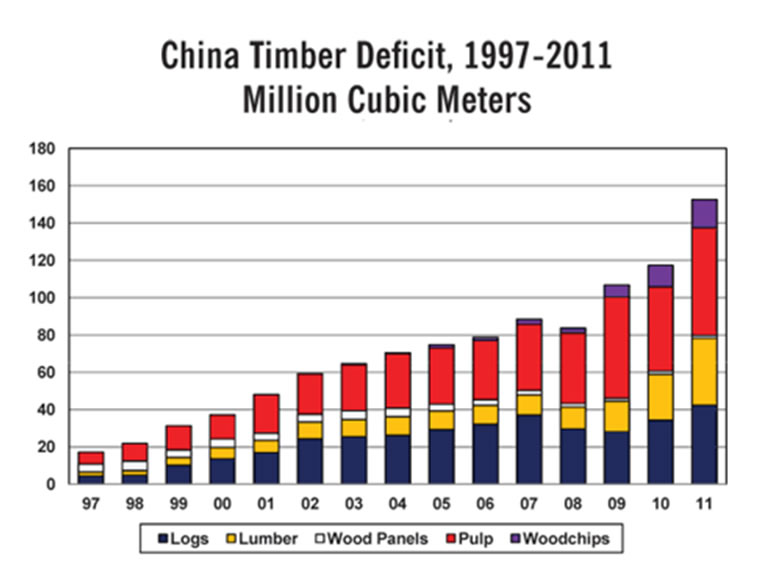

- Demand for timber is growing rapidly in China, and as the graph below demonstrates, the timber deficit in that country has been growing. As noted in our previous previous article here on Market Oracle on agriculture, China is also facing a huge challenge in feeding itself due to its shrinking arable farmland, and the country has responded both by importing increasingly large quantities of grains and corn, as well as by purchasing overseas farmland directly. We would expect that we will see the same trend of China buying what it needs as regards timber demand, putting investors on the right side of the "China trade".

4) Finally, forestry investments are also very much uncorrelated to global equities. Trees do not care whether global stock indexes go up or down, and the sources of their returns are quite different. To elaborate on this point, there are two main sources of returns in forestry investments. First, the price of the harvested lumber itself. Whilst of course prices of the lumber from the trees can fluctuate greatly depending on both economic conditions and the tree species, investors have considerable flexibility on when to harvest their timber, and if for whatever reason the price of lumber in any particular year is low, the investor can simply withhold harvesting and patiently wait until the price moves in their favor. In addition, the return from the investment comes not only from the price of the cut wood, but from the growth of the trees themselves. In the UK for example, only 4.5% of the forestry investing returns noted above were due to the price of the timber itself, meaning that over 60% of the increase was simply due to the growth of the trees.

For those that may be interested in timber investing, there are really two main options. The first is to access the asset class by investing in timber or timber related stocks. For example, one can invest in a basket of stocks through an Exchange Traded Fund such as the S&P Global Timber & Forestry Index Fund (WOOD). WOD currently owns 27 stocks, including such names as International Paper Co (IP), Weyerhauser (WY) and Rayonier (RYN).

In our view, however, the best option for forestry investments - one most individual investors tend to overlook - is direct investment in forestry in which one actually owns a plot of forestry directly. Generally speaking, direct investments in forestry have historically been an asset class that has only been available to large institutional investors (such as the New Mexico State Council noted above). However as is the case with another "real asset" - farmland - new opportunities for individuals to invest in forestry have gradually opened up. We are now seeing opportunities emerge for retail investors becoming available in regions as diverse as South Asia and Europe. Generally speaking, these types of projects tend to be turnkey solutions, where the plantation owner will handle everything from planting to the sale of the cut timber into the market on behalf of investors.

The main downside of forestry investment - particularly direct ownership - is that it is a highly illiquid asset class and should be thought of as something to be held for a good ten years. Therefore, forestry as an investment is singularly unsuited for those who may need access to their funds on a shorter-term basis.

Of course, no investment is full-proof and timber should be seen as just one small part of the "real asset" side of investors' portfolios', but if you are looking for stability, diversification and steady returns that are not correlated with global equities, investments in forestry are well worth a look.

By Adam Waldman

Adam Waldman is the Marketing Director at GreenWorld BVI. GreenWorld specializes in real asset alternative investments such farmland and forestry. All of GreenWorld’s investments have low enough minimums that they are accessible by individual investors. The aim is to allow retail investors to access such stable, "hard asset" alternative investments that pay high current income and also offer excellent opportunity of long-term capital gains.

Copyright © 2012 Adam Waldman - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.