Gold Summer Lows At Hand?

Commodities / Gold and Silver 2012 Jun 22, 2012 - 02:59 AM GMTBy: Aden_Forecast

In a key turnaround, gold bounced up from its December lows this month on fresh safe haven buying as QE3 possibilities came back to the table.

In a key turnaround, gold bounced up from its December lows this month on fresh safe haven buying as QE3 possibilities came back to the table.

The psychological $1600 level was quickly surpassed. This is essentially the level that will determine if 2012 ends up being the 12th consecutive up year for gold.

For now, we are seeing some backing and filling, which isn't a bad thing... as long as the December lows hold. This is currently a very important juncture for gold, and for silver.

Help on the Way?

When Europe or the U.S. looks vulnerable, especially in the jobs area, it quickly fuels emotions. And we all know how Bernanke feels about this... he will save the system at all costs. In fact, all of the monetary policy makers worldwide are being pressured to help the ailing global economy.

This is why the markets bounced up after their sell-off. A liquidity infusion would be bullish for gold.

Big Picture is Bullish

The big picture continues to point the way up. And the global debt crisis and record low interest rates are a bullish factor for gold too.

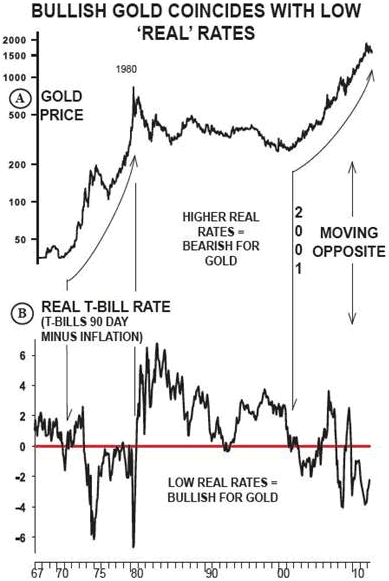

Chart 1 shows this clearly. It shows the gold price above, with the "real" T-Bill interest rate below since 1967.

When the real T-Bill rate is negative (below zero on the chart) it means that rates are providing a negative return, adjusted for inflation.

This is bullish for gold because there's no competition. Normally, an investment that pays a higher interest has the advantage. But if interest rates aren't paying interest, and neither does gold, then there is no advantage between the two.

Note that the two major bull markets in gold happened while real interest rates were mostly negative.

Even though gold peaked in September and it's been declining for nine months, the gold trend is still up, regardless of the currency it's traded in.

Plus, gold has been stronger than the other precious metals and gold shares, especially since last year when Europe started flaring up.

Another good sign for gold has been its underlying strength as the U.S. dollar has moved higher. Gold held above its December low, for instance, when the dollar index soared to an almost two year high. This type of situation tends to lead a renewed gold rise.

Demand also remains bullish. Central banks continue to be active buyers. They bought bullion at the fastest pace in five decades in 2011, and they'll likely purchase a similar amount this year, according to the World Gold Council. In fact, central banks continued buying during weakness this past month.

Gold Timing: At key juncture

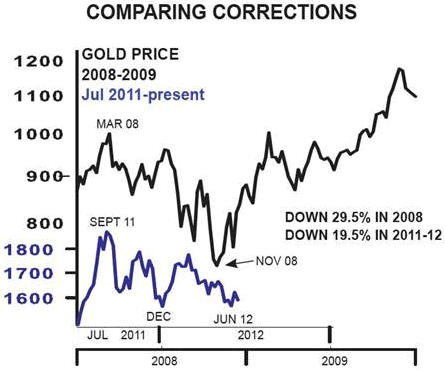

Gold's downward correction since September is now taking longer than it did in 2008.

The 2008 decline from March to November was steeper and gold lost almost 30%. The current decline has been mild in comparison, losing nearly 20%.

Chart 2 shows this comparison. Since the 2008 decline was the worst one in the 11 year old bull market, it again reinforces the importance of last December's low. This low is key. If it holds, all is well.

If it doesn't and gold breaks clearly below $1536 for a few days, we could see gold fall much further first, before a renewed rise again starts. A 30% decline, similar to 2008 for example, could take gold to the $1350 - $1400 level.

For now, so far so good. Plus, as you can see on Chart 2B, gold is near a D low area, indicating that gold is close to a low. But we must also be prepared for a possible final washout, in case it comes.

To refresh your memories, gold has moved in an impressive recurring pattern on an intermediate basis. In a bull market its best rise is what we call a 'C' rise when gold reaches new bull market highs.

The worst decline is called a 'D" decline, which is where gold is today... forming a double 'D' bottom. And it's why we're watching the December lows so closely.

Bear markets tend to start with D declines and if this low is clearly broken, it would be a bad sign.

Once the 'D' decline is over, however, the upcoming A & B moves tend to be a consolidation time, before another C rise takes off. So stay tuned.

On The Upside: Keep an eye on...

Most important is that gold stays above $1536, the December low.

Then once it rises and stays above its 65-week moving average at $1635, it will be in bullish territory. Gold could then rise to its next resistance at the $1700 level.

From there, the next hurdle will be the $1800 level. This will be a harder one to surpass because it's kept a lid on the weakness since November.

But once it does, gold could then jump up to its record high near $1900. And it'll be smooth sailing, in another leg up in this amazing bull market when new record highs are reached.

And when $2000 is eventually surpassed, it'll likely be THE level that causes an exploding bull market to take hold.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.