Turkey, Russia, Ukraine and Kazakhstan Further Diversify Into Gold

Commodities / Gold and Silver 2012 Jun 26, 2012 - 06:57 AM GMTBy: GoldCore

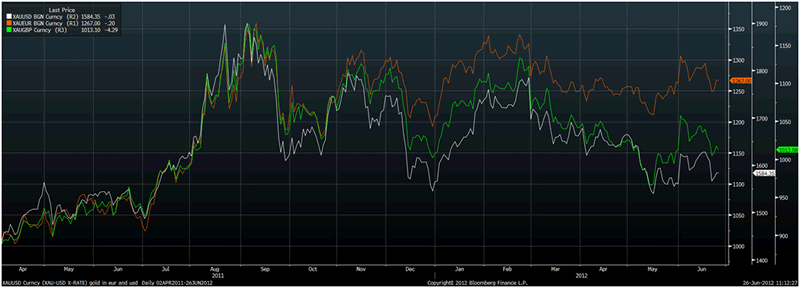

Today's AM fix was USD 1,583.25, EUR 1,267.41, and GBP 1,013.73 per ounce.

Today's AM fix was USD 1,583.25, EUR 1,267.41, and GBP 1,013.73 per ounce.

Yesterday’s AM fix was USD 1,569.00, EUR 1,256.41, and GBP 1,009.00 per ounce.

Silver is trading at $27.47/oz, €22.08/oz and £17.64/oz. Platinum is trading at $1,445.25/oz, palladium at $601.40/oz and rhodium at $1,190/oz.

Gold’s safe haven credentials were burnished again yesterday when despite falls in stock indices globally, gold rose $15.10 or 0.99% and closed at $1,586.30/oz. Gold traded sideways in Asia and continues in a narrow range in European trading holding above $1,580/oz.

Gold is hovering above $1,580/oz and consolidating on yesterday’s gains on the realisation that the EU summit this week will not solve the area’s intractable debt crisis.

Incredibly, this will be the 20th time EU leaders have met. While gold has not surged in value as many expected, gold has performed well during the period having again preserved wealth.

July options expiry later this afternoon could lead to volatile trading and there has been a pattern in recent years of price rises soon after option expiration.

Nomura Securities cut its gold price target this year to $1,754/oz from $1,791/oz, but lifted its targets for 2014 & 2015. Nomura said that central-bank buying, continuing strong Chinese demand, persistently negative real interest rates, and a growing bunker mentality for those investors who see dark scenarios on the horizon, were all positive for gold.

“The further deterioration of the economic recovery, enhanced potential for quantitative easing and continued structural problems in the euro zone lead us to believe that gold prices will stay stronger into 2014 and 2015,”Nomura analysts said in a research brief Monday.

The physical market noted bargain hunting from consumers. Premiums for gold bars were little changed at between 50 and 80 cents to the spot London prices in Singapore.

Turkey raised its reported gold holdings by another 2% in the month of May. Turkey’s gold holding rose by 5.7 tonnes in May to total 245 tonnes, International Monetary Fund data showed, making it the latest in a string of countries to increase gold bullion reserves this year.

Russia expanded its gold reserves by 15.5 metric tons in May as Ukraine and Kazakhstan increased their holdings of the metal, International Monetary Fund data shows according to Bloomberg.

Russia’s bullion reserves climbed to 911.3 tons last month when gold averaged $1,587.68 an ounce, data on the IMF’s website showed. Ukraine’s climbed 2.1 tons to 32.7 tons and Kazakhstan boosted reserves by 1.8 tons to 100 tons, the data show.

Central banks are expanding reserves due to the Eurozone debt crisis and concerns about fiat currency debasement.

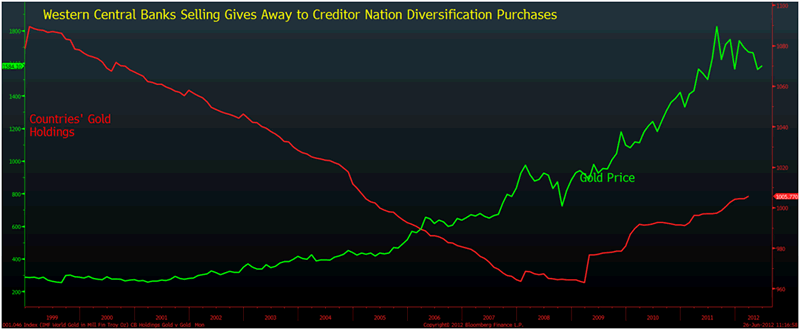

Central banks are on course to buy more bullion this year than the purchases of about 456 tons in 2011 as countries diversify their reserves.

Gold in USD, EUR & GBP – (April 2011 to Today) - Shows July August 2011 Price Rise

Turkey has allowed banks to hold more of their reserves in gold to provide extra liquidity. The central bank this month raised the proportion of reserve requirements that can be held in foreign exchange to 50 percent from 45 percent, while the limit for gold was increased to 25 percent from 20 percent. The changes will add as much as $2.2 billion to gold reserves.

Gold accounts for about 9.1 percent of Russia’s total reserves, 5.1 percent of Ukraine’s and 15 percent of Kazakhstan’s, according to the World Gold Council. That compares with more than 70 percent for the U.S. and Germany, the biggest bullion holders, according to Bloomberg figures.

Kazakhstan plans to raise the amount of gold it holds as part of its reserves to 20 percent, Bisengaly Tadzhiyakov, deputy chairman of the country’s central bank, said earlier this month.

Central bank demand and Chinese demand alone should be enough to put a floor under prices near these levels and gold looks well positioned for another summer rally akin to the one seen last July and August (see chart above).

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.