Krugman's Icelandic Economic Miracle Debate, Round 2

Economics /

Economic Theory

Jul 04, 2012 - 08:10 AM GMT

By: EconMatters

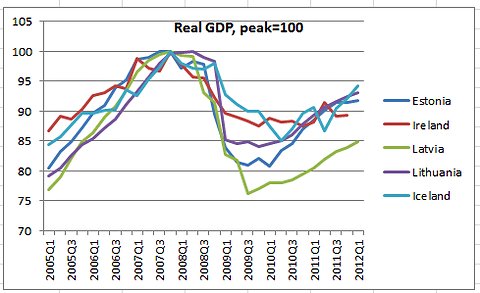

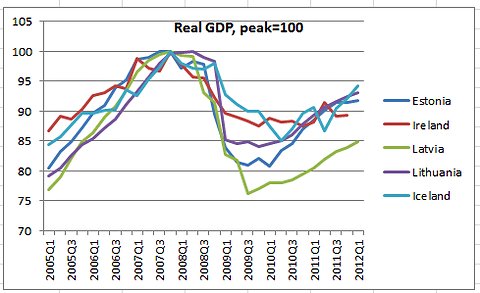

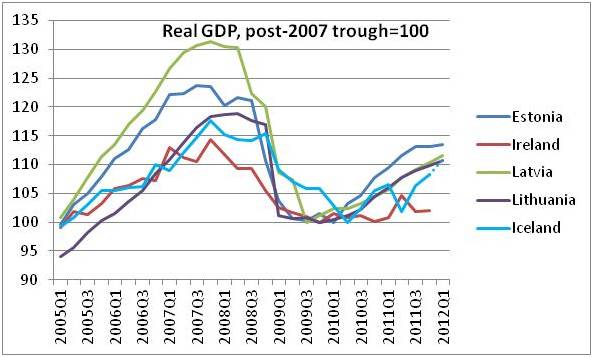

Paul Krugman has long been an advocate of Keynesian economics, and a proponent of aggressive and expansionary fiscal policy drawing parallels between Japan's decade-long deflation and the current Great Recession. Krugman also has also been writing quite extensively using Iceland as the poster child on the benefits of currency devaluation. Krugman's latest endeavor on the so-called 'Icelandic Miracle' was when he posted on his NYT blog last month with the following chart showing the seemingly much better GDP growth from Iceland compared to Ireland, Estonia, Lativa, and Lithuania, the countries either in Euro or has a currency pegged to the Euro. He then rhetorically remarked:

Paul Krugman has long been an advocate of Keynesian economics, and a proponent of aggressive and expansionary fiscal policy drawing parallels between Japan's decade-long deflation and the current Great Recession. Krugman also has also been writing quite extensively using Iceland as the poster child on the benefits of currency devaluation. Krugman's latest endeavor on the so-called 'Icelandic Miracle' was when he posted on his NYT blog last month with the following chart showing the seemingly much better GDP growth from Iceland compared to Ireland, Estonia, Lativa, and Lithuania, the countries either in Euro or has a currency pegged to the Euro. He then rhetorically remarked:

"Looking at this, would you have expected that Latvia would be lionized as the hero of the crisis?"

|

| Chart Source: NYT/Paul Krugman, June 14, 2012 |

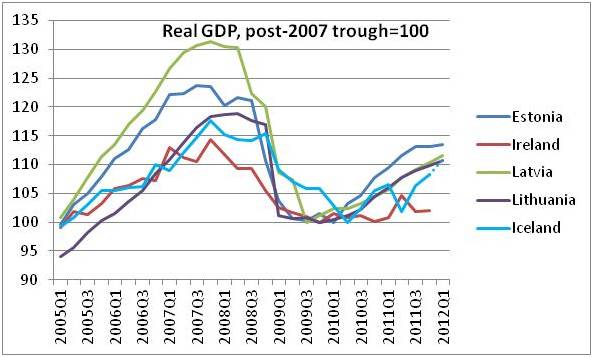

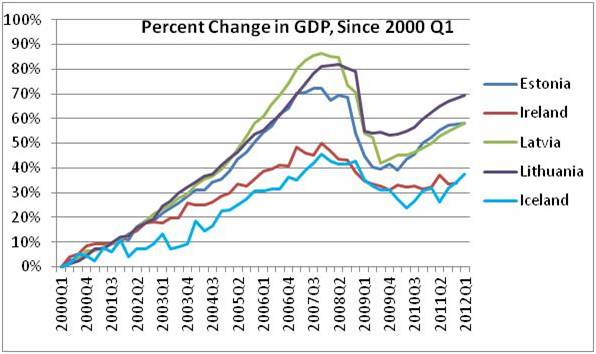

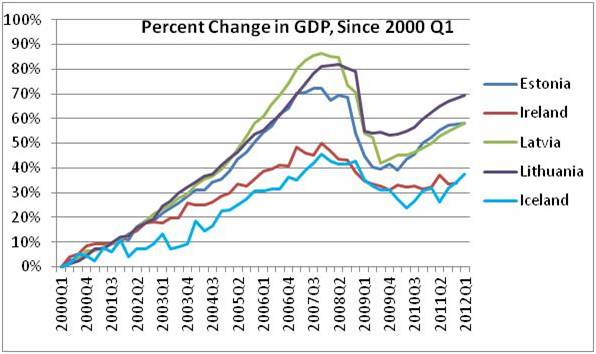

That was quickly rebuffed by the CFR (Council on Foreign Relations) with Washington Post and The Economist also weighing in and stirred up a debate on twitter. The following are the two key charts in the CFR rebuff--the main point is that Iceland looks a lot less impressive than Krugman claims if one shifts the chart starting period around:

|

| Chart Source: CFR, July 2, 2012 |

|

| Chart Source: CFR, July 2, 2012 |

This actually is the second round of the 'Icelandic Miracle' debate between Krugman and CFR. Round one took place in June 2010. Two years ago, Krugman used a similar chart showing a much higher GDP growth of Iceland relative to Ireland, Latvia, and Estonia since the 4th quarter of 2007 to support his declaration that Iceland is a "Post-Crisis Miracle." (We are not quite sure why Krugman dragged Lithuania in his 2012 post except the country has the Euro-pegged currency and fits Krugman's story.) CFR at the time quickly pointed out that "It is an illusion created by the starting date Krugman chose for his figure." [Read here for more detail on round one between Krugman and CFR,] In this second face-off, CFR laments:

"...Once again, Krugman has relied on a Potemkin-Village graphic to illustrate his wider claim, which is that Icelanders derive unambiguous net benefits from their government obliging them to hold and transact in a national currency that their trading partners will not accept. (80% of Greeks consistently reject going back to such a state.)"

Meanwhile, Washington Post completely endorsed Krugman, and in a somewhat self-contradictory post, The Economist, on one hand, seems to support Krugman's view that [emphasis ours]

"....the Baltic economies remain substantially poorer than Iceland and most euro-zone members and should therefore be expected to have a much faster rate of underlying growth thanks to the potential for catch-up. That they've essentially kept pace with rich Iceland rather than catching up points to the advantage of adjustment via devaluation, as does Iceland's good performance relative to Ireland."

On the other hand, The Economist also appears to say it was all but a number's game depending on the comparative elements involved with the following conclusion [emphasis ours]

"..... it is telling that to spin a story of growth via internal devaluation one has to resort to citing emerging markets—notably, ones that have managed very little catch up over the past 5-6 years at a time when other key emerging markets were marking enormous gains."

We say the bottom line is that regardless which country or starting year you pick to compare and chart, fundamentally, Iceland is definitely NOT the "fiscal role model" that Krugman intends for people to believe.

You might recall, Iceland suffered the biggest banking collapse in history by any country relative to its economic size in 2008 when its highly leverage banks lost access to the funding market. The tiny Nordic nation was eventually bailed out by the IMF and other Nordic countries, partly because too many Europeans had deposits into Icesave.

Afterwards, the value of the Icelandic króna currency plummeted (down 80% against the Euro since 2008), and does not even have a regular official exchange rate any more. Inflation soared (41% in about four years), while people's savings and pensions got wiped out, and real wage and home value fell off a cliff. The country has been held together mostly by IMF loans, "technical defaults" and capital control ever since. [Check here for more of the economic horror story of Iceland.]

Now, four years after the banking collapse, Iceland was able to wipe the slate clean, and has now revived its economy at 4.5% growth rate in Q1 of this year, while inflation was at an elevated level of 5.4% in June. Iceland had to raise interest rate five times since last August to contain inflation, which could get even worse as króna could depreciate even more with the current Euro crisis, and the country is still years away from fully removing capital controls, according to the Finance Minister.

Back in 2010, Krugman concluded in his post that [emphasis ours]:

"The moral of the story seems to be that if you’re going to have a crisis, it’s better to have a really, really bad one. Otherwise, you’ll end up taking the advice of people who assure you that even more suffering [i.e. austerity and the resulted deflation] will cure what ails you."

Sure, if a country could technically default on a significant portion of its debt, trash its currency, impose capital control, then there's no where else to go but up with a heck of a price to pay in terms of internal turmoil (Zimbawe is an extreme example, but yes.) Furthermore, Iceland is of relatively little significance in the global grand scheme of things, but due to the dominance of the US dollar in the global currency system, the size of the economy and population, the "Iceland model" is not even an option for the United States, which Krugman seems to intimate.

One last tibit for those preaching "the advantage of adjustment via devaluation," Iceland, in a bid to gain stability in its currency system, now is considering ditching the króna to adopt either the Euro or the Canadian Loonie instead. Poll says 70% of the Icelanders want to get rid of the króna. The Icelandic government believes an EU membership would be the best option since Europe is the largest market for Iceland. Unfortunately, Iceland most likely can't count on much support for its EU membership, as the country refused to pay back the €4 billion owed to UK and Netherland. UK, for one, has already publicly refused to back a resolution on Iceland's EU membership. The more important question is if currency devaluation is such an economic miracle cure, why is Iceland looking to adopt Euro or Loonie? And there's a reason Greece opted to still stay in the Euro.

By EconMatters

http://www.econmatters.com/

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Paul Krugman has long been an advocate of Keynesian economics, and a proponent of aggressive and expansionary fiscal policy drawing parallels between Japan's decade-long deflation and the current Great Recession. Krugman also has also been writing quite extensively using Iceland as the poster child on the benefits of currency devaluation. Krugman's latest endeavor on the so-called 'Icelandic Miracle' was when he posted on his NYT blog last month with the following chart showing the seemingly much better GDP growth from Iceland compared to Ireland, Estonia, Lativa, and Lithuania, the countries either in Euro or has a currency pegged to the Euro. He then rhetorically remarked:

Paul Krugman has long been an advocate of Keynesian economics, and a proponent of aggressive and expansionary fiscal policy drawing parallels between Japan's decade-long deflation and the current Great Recession. Krugman also has also been writing quite extensively using Iceland as the poster child on the benefits of currency devaluation. Krugman's latest endeavor on the so-called 'Icelandic Miracle' was when he posted on his NYT blog last month with the following chart showing the seemingly much better GDP growth from Iceland compared to Ireland, Estonia, Lativa, and Lithuania, the countries either in Euro or has a currency pegged to the Euro. He then rhetorically remarked: