World Central Banks Take Steps to Stimulate Economic Growth

Interest-Rates / Central Banks Jul 06, 2012 - 03:20 AM GMTBy: Asha_Bangalore

Following the Fed’s extension of Operation Twist on June 20, 2012, the European Central Bank (ECB), People’s Bank of China (PBoC), and the Bank of England (BoE) put in place new monetary policy support today as gloomy economic data have trickled in during recent weeks.

Following the Fed’s extension of Operation Twist on June 20, 2012, the European Central Bank (ECB), People’s Bank of China (PBoC), and the Bank of England (BoE) put in place new monetary policy support today as gloomy economic data have trickled in during recent weeks.

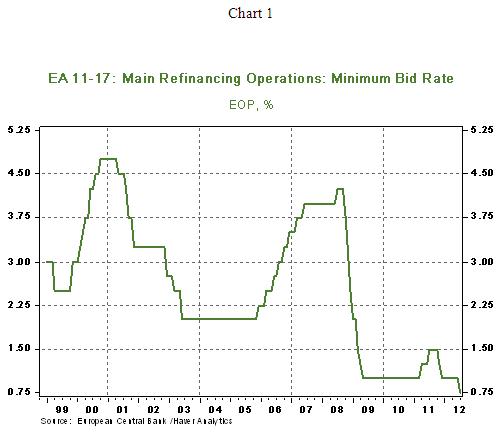

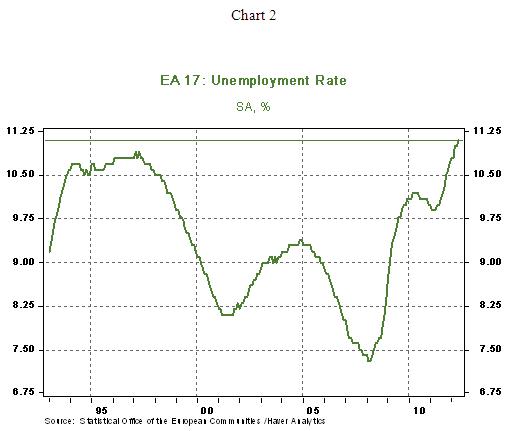

The ECB cut its policy rate to 75bps from 1.00%, a historical low and also slashed the deposit rate (interest the ECB pays to banks for overnight deposits held at the central bank) to zero in order to promote bank lending. The policy rate of 75 bps is the lowest in the short existence of the euro since 1999 (see Chart 1). The main thrust of the ECB is to stimulate economic growth which has suffered a severe setback and raised the unemployment rate in the eurozone to 11.1% in May, a historical high for the eurozone (see Chart 2).

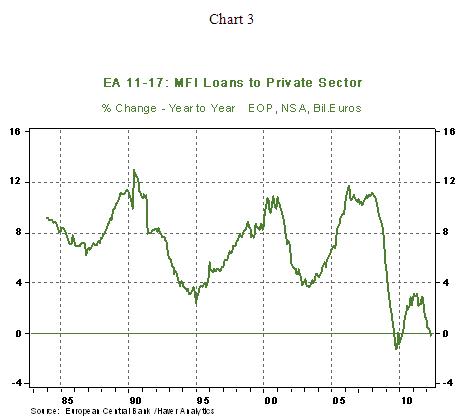

The ECB’s reduction of the deposit rate to zero is aimed at turning around the credit crunch that is underway in the eurozone. Private sector MFI fell 0.2% from a year ago in May (see Chart 3). Today’s action is designed to bring down cost of funds and also encourage inter-bank lending. However, the optimism should be tempered with the recent experience in the United States. Bank lending in the United States collapsed after the Lehman debacle in late-2008 and resumed growth only in the middle of 2011, which is a long period of time. The impaired balance sheets of banking institutions in the United States prevented a quick resumption of bank lending despite the historically low interest rate environment. Policy makers in the eurozone should be mindful of this valuable lesson from the United States when formulating their economic projections of the eurozone. If credit creation in the eurozone fades significantly in the months ahead, it would imply only a small increase in GDP in the most optimistic scenario because historically bank credit and economic growth have a strong positive correlation.

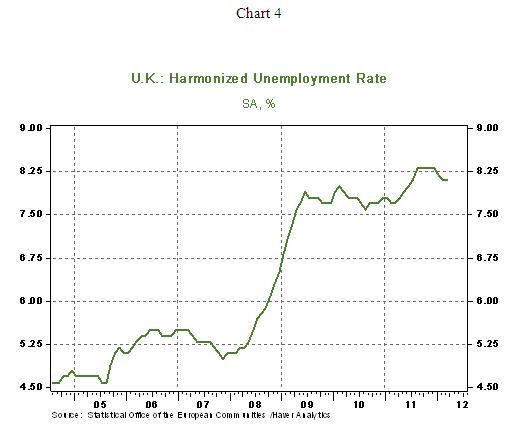

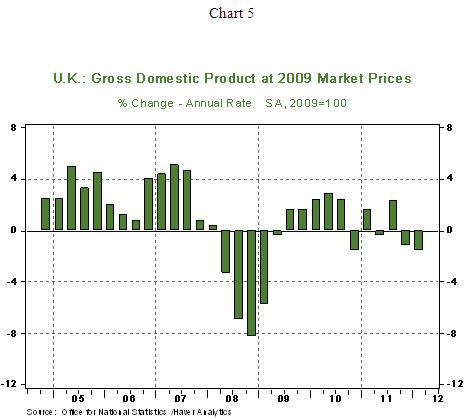

The BoE maintained its policy rate at 50 bps but plans to inject £50 billion by purchasing assets over a period of four months, taking the sum total of quantitative easing to £375 billion since the financial crisis commenced. The unemployment rate of Britain has risen to 8.1% in the United Kingdom, up from 7.7% a year ago (see Chart 4). Real GDP of the UK has dropped in three of the last four quarters.

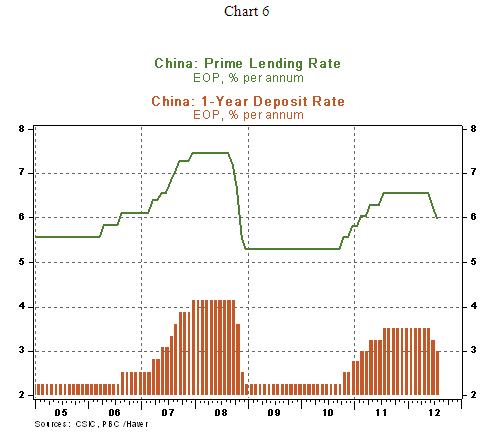

Moving farther east, the PBoC reduced the one-year lending rate 31 bps to 6.0% and cut the one-year deposit rate to 3.00% from 3.25% percent today, the second rate cut following the easing announced on June 8. In addition, lenders have the authority to lend at 30% below this benchmark, a larger measure of flexibility than the 20% reduction authorized on the June 8 when the PBoC cut lending rate to 6.31% from 6.56%. The aggressive monetary policy actions of the PBoC in a short span of time points to a growing concern about the status of the Chinese economy; several economic reports of China are scheduled for release next week – inflation (July 9), trade data (July 10), and 2012:Q2 GDP, June industrial production and retail sales (July 13).

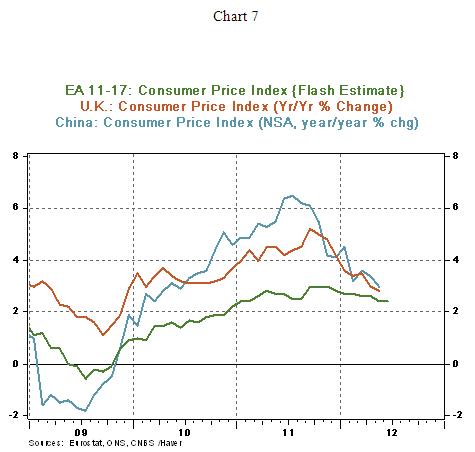

Receding inflation in the eurozone, UK, and China has allowed central bankers to implement easing of monetary policy. Essentially, central bankers have responded to the synchronized global economic slowing seen in recent weeks.

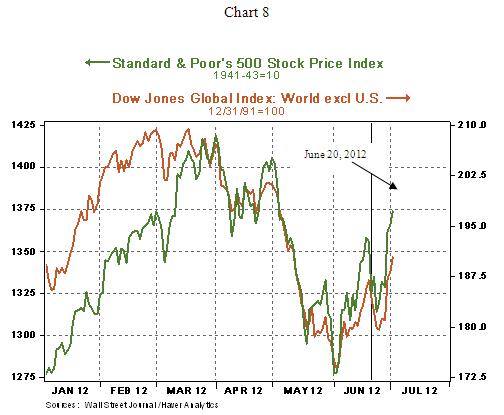

In addition to the central bank action, the EU summit of June 28-29 resulted in positive developments, albeit inadequate. Equity markets have responded positively since the Fed’s extension of Operation Twist on June 20 (see Chart 8). As of this writing, the S&P 500 is moving sideways from yesterday’s closing (1367.58 vs. 1367.23 on 7/3/2012). Equity prices in the eurozone were down slightly today (FTSEurofirst 300 eurozone – 946.30 vs. 948.1 on 7/4/2012).

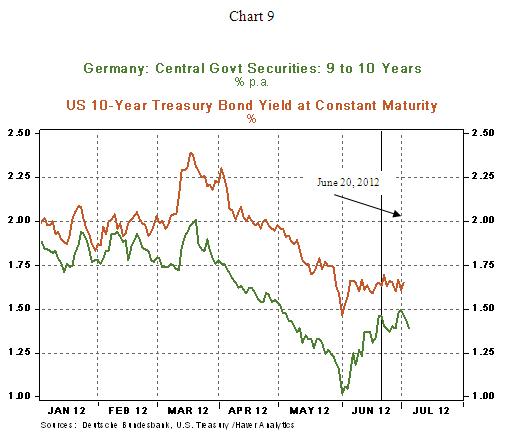

In the sovereign bond market, central bank actions and the EU summit have not reduced the safe haven flight yet. Long term German government bond yield closed at 1.39% today vs. 1.49% on July 2 (see Chart 9). The 10-year US Treasury yield was trading at 1.60% at the time of this writing, down from 1.65% on July 3 (Data points stop at July 3 for the US yield in Chart 9). Central bank monetary policy changes of the last two weeks are noticeably less aggressive compared with policy actions in 2008, given less severe economic conditions at the present time.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.