End is Near For U.S. Economic Rebound

Economics / Double Dip Recession Jul 25, 2012 - 12:02 PM GMTBy: Clif_Droke

Since the start of the global economic recovery in 2009, the status of the U.S. economy has been a perplexing one. We’ve been bombarded with conflicting reports as to the economy’s strength or weakness at various times over the past 3+ years and at any given time it’s hard to get a good read on how well the domestic economy is performing overall.

Since the start of the global economic recovery in 2009, the status of the U.S. economy has been a perplexing one. We’ve been bombarded with conflicting reports as to the economy’s strength or weakness at various times over the past 3+ years and at any given time it’s hard to get a good read on how well the domestic economy is performing overall.

When confusion prevails the best approach to cutting through the uncertainty normally begins with defining the basic terms involved. When news commentators talk about the “economy,” for instance, what they’re referring to is the sales and revenue trends of multi-national corporations such as McDonald’s, Wal-Mart, Microsoft, et al. Under this rather limited definition of economy, how well these U.S.-based multinationals are doing in foreign markets like China or India counts for as much (if not more) as how much they are selling to customers here in the U.S. Under this definition of “economy,” the global rebound since 2009 has been truly impressive.

But what of the sales and revenue trends for strictly U.S.-based companies which sell directly to U.S. consumers? And, more importantly, what about the overall economic state of those U.S. consumers? This should be the heart and soul of any discussion of the “economy,” yet it’s consistently underplayed by mainstream news commentators. To answer this question let’s look at some recent U.S. economic data.

The latest release of the Fed’s Beige Book suggested that overall economic activity continued to expand “at a modest to moderate pace” in June and early July. Excerpts from the Beige Book stated that reports on residential housing were “largely positive” and indicated that employment grew at a “tepid pace.” The Fed’s findings contradict recent news headlines from the mainstream press which suggest a weakening economy. For instance, latest retail sales figures showed a decline of 0.5% in June as middle class consumers tightened their belt in the wake of the euro zone mess.

Consider also that the latest release of the employment report generated numerous headlines suggesting the U.S. economy is “stuck in the doldrums,” as one magazine put it. While there’s no denying that job growth is tepid, there are other factors driving the domestic economy besides employment. For instance, consider that credit card debt increased in the latest reporting period by $17 billion, more than any other month in 2012.

In response to this data one analyst stated, “Consumer credit is fully in an expansion phase as banks willingness to lend has eased over the past several months.” While it’s true that consumer debt can be seen as a sign of a strengthening economy, it can also be seen as a response to weak hiring as households use credit cards to cover everyday expenses. So which is it? Are consumers taking on more personal debt to cover rising expenses, or are they spending more on discretionary items in response to rising incomes? The answer is found in the following graph.

Consumers have been spending more than they’ve been taking in, although both spending and incomes have been declining in recent months as illustrated by this chart. In fact, since the 30-year cycle peak in the year 2000 the personal income line has been making a series of lower tops. This shows the negative influence of the 60-year economic cycle, which is currently in its “hard down” phase until 2014.

While the economic prospects for Middle America are on the wane, the economy for upper class Americans, by some measures, has never been better. On the real estate front, new home sales increased from 343,000 in April to 369,000 in May, the most new homes sold in one month since April 2010. According to Briefing.com, “For the past two months, a lack of supply of foreclosure properties has forced many potential homebuyers to buy non-distressed properties. This has caused the median existing home prices to rise, which in turn, has lowered the new home price premium. Essentially, new homes have become relatively more affordable.”

New home inventories also fell from 5.0 months in April to 4.7 months in May. That is the lowest level since October 2005 and, according to one report, “will put pressure on homebuilders to increase production.”

Luxury goods sales are also on the rise. A recent issue of Businessweek highlighted the rising sales at Manhattan Motorcars, a luxury auto dealer. The dealer is sold out of Lamborghinis and waiting lists are growing as the firm heads for its best sales performance in its 17 years.

There’s no question that well-heeled consumers are spending freely and that much of this spending factors into the buoyant statistics for various U.S. sales figures including housing. The problem with relying on the rich to keep the economy humming is that the rich man’s economy is a double-edge sword: when they perceive times are good, they spending freely; when the stock market declines (the favorite economic barometer of the rich), then their spending comes to a sudden and dramatic stop.

One way of parsing the mixed economic data is to realize that the U.S. economy is currently bifurcated. The middle class consumer is becoming cautious once again while the upper class consumer is spending like there’s no tomorrow. This dichotomy of spending habits and economic outlooks among the two major classes is creating the cross-currents we’re seeing in the economic indicators. The “rich man’s economy” has essentially been the locomotive behind any gains on the economic front. This is a dangerous situation for the U.S. to be in, longer-term, since a lasting economic rebound should ideally be broad-based. More especially, it should be led by increased employment, earnings and spending among middle class consumers. We’re not seeing that, which tells us that this economic recovery is living on borrowed time.

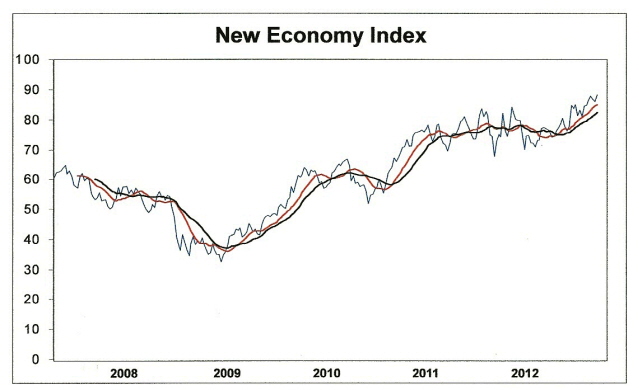

My favorite indicator for the overall state of the U.S. retail economy is the New Economy Index (NEI). This indicator is a real-time reflection of strength or weakness in the small, mid-size and large-size business sector, the employment outlook, consumer sales and transportation. Its components broadly encompass the everyday U.S. economy (as opposed to the multinational Big Business economy which has become the standard measure for Wall Street). Here’s what the NEI looks like as of last Friday. NEI is still giving a green light for the overall U.S. economy as this chart shows.

[Insert NEI chart]

NEI hasn’t given a “sell signal” for the economy since 2010, when the U.S. temporarily entered another economic soft patch. This indicator has accurately foretold each of the upward and downward turns in the retail economy since 2007 when it was first introduced. Needless to say, we’ll be relying on NEI to give us a signal for the onset of the next recession instead of the mainstream economic statistics, which tend to lag by at least 2-3 months.

The weight of evidence strongly suggests that the waning days of the economic recovery which began in 2009 are upon us. The last of the yearly cycles within the 60-year cycle series, namely the 4-year cycle, is peaking over the next couple of months. With the crisis in Europe showing no signs of abatement, and with China slowing down, this will add pressure to the global economy once we enter the final “hard down” phase of the 60-year cycle descent in 2013. The evidence is mounting that 2012 will be the last year of the post-credit crisis recovery, with 2013 likely witnessing the onset of another major recession.

2014: America’s Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to – and following – the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America’s Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form – namely the long-term Kress cycles – the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.