Fiat Currencies from Nullifying to Negative Nominal Interest Rates

Interest-Rates / US Interest Rates Jul 25, 2012 - 12:27 PM GMTBy: Axel_Merk

The once unthinkable might become policy: negative nominal interest rates. Investors should care as they may be increasingly punished for not taking risks. Yet masochistic investors believe they may be the prudent ones given the risks lurking in the markets. What are investors to do, and what are the implications for the U.S. dollar and currencies?

The once unthinkable might become policy: negative nominal interest rates. Investors should care as they may be increasingly punished for not taking risks. Yet masochistic investors believe they may be the prudent ones given the risks lurking in the markets. What are investors to do, and what are the implications for the U.S. dollar and currencies?

|

When investors deposit money in a bank, they are giving the bank a loan. Some investors aren’t so sure whether zero or close to zero percent interest compensates them for the risk of lending money to the bank, although FDIC insurance where applicable may alleviate that concern. But there are plenty of deposits that are not FDIC insured, such as money market funds. Such funds must invest in risky assets to cover their expenses and pay any yield; many prime money market funds have been chasing yields, investing in U.S. dollar denominated commercial paper issued by European banks (see Making the U.S. Dollar Safer: Return OF Your Money); money market funds reduced, but by far not eliminated the practice. Investors shall be forgiven for thinking that they do not get properly compensated for the risks they are taking on.

As such, there has been what is often referred to as a flight to “safety,” government securities. To the dismay of central bankers that like to kick start economic growth, this flight is taking on pandemic proportions. Germany was in the news recently for having sold 2-year notes with a negative yield. German bills had previously sold at negative rates, but it was a first for notes. In Europe:

- August 23, 2011: Switzerland sold CHF 599 million 6-month bills at -0.1%, a negative yield for the first time for Switzerland.

- January 9, 2012: Germany sold EUR 3.9 billion 6-month bills at -0.0122%, a negative yield for the first time amid safe haven demand.

- July 9, 2012: France sold EUR 3.9 billion 3-month bills at -0.005%, a negative yield for the first time for France.

- July 16, 2012: The Netherlands sold a total of EUR 2.4 billion of 3.5-month Treasury Certificates at -0.041% and 6.5-month Treasury Certificates at -0.029%.

- July 17, 2012: Belgium sold EUR 1.5 billion 3-month bills at -0.016%, a negative yield for the first time for Belgium.

- July 17, 2012: The European Financial Stability Facility (EFSF), let’s call it a precursor to Eurobonds, sold EUR 1.488 billion 6-month bills at -0.0113%.

In the U.S., inflation protected securities (TIPS) have sold with negative yields at auction for some time:

- U.S. Treasury sold $10 billion 5-year TIPS at -0.635%, a negative yield for the first time at a U.S. debt auction as investors bet the Fed may be successful in sparking inflation.

- U.S. Treasury sold $15 billion 10-year TIPS at -0.046%, with investors willing to pay a premium to guard against the threat of rising consumer prices.

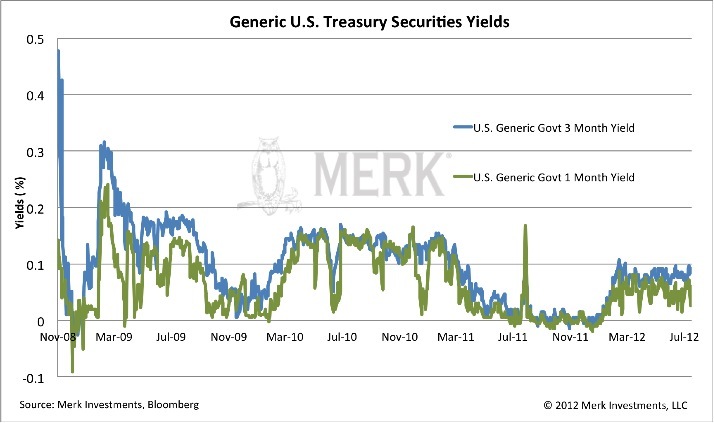

What is noteworthy about these is that the negative yields were auction results. In the secondary market, Treasury securities have flirted with negative yields periodically throughout the crisis:

|

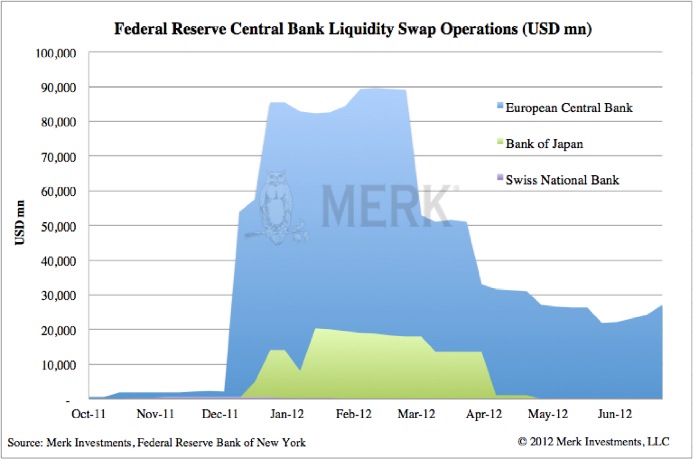

Negative yields late last year were, in our assessment, directly linked to the flight of U.S. money market funds out of European commercial paper, causing funding strains for such European financial institutions. The world’s policy makers were alarmed as European banks in turn have been the primary players in providing U.S. dollar denominated funding to emerging markets. Confused? It’s an illustration of the “contagion,” how a crisis in Europe can affect the globe. Always eager to lend a friendly hand, the Federal Reserve opted to open a “swap line,” making cheap U.S. dollars available to central banks around the world, most notably the European Central Bank:

|

The negative yields on U.S. Treasuries dissipated once the Federal Reserve provided the loans to the ECB (there was one dissent at the time at the Fed, arguing that such swap lines are fiscal, not monetary policy and ought to be authorized by Congress).

Anywhere in the world, the question of how to hold a currency becomes ever more important. When investors hold the U.S. dollar, do they hold cash on hand (good luck doing that with larger amounts)? Deposits in a bank? In money market funds? In U.S. Treasuries?

Similarly, to the extent that one holds the euro, how do investors seek to hold the currency? In a German bank? In a Spanish or Greek bank? In a Spanish Treasury bill? In a German or Dutch bill? Should the euro break apart, one could buy a longer dated German security in the assumption that such security will be converted to a new Deutsche Mark and appreciate in value versus the current euro. We have argued since 2006 that there may not be such a thing anymore as a safe asset and investors may want to take a diversified approach to something as mundane as cash – the message is finally understood.

This analysis might be most relevant for the countries not mentioned. Japan, the eternal low yielding country being the first that may come to mind. Indeed, in recent years, short-term Japanese Treasury bills were at times yielding a “high multiple” of those in the U.S. That is, they were yielding around 0.10% annualized, which was a high multiple of close to 0.01% in the U.S. during certain times. But Japan is taking the lead once again: in recent days, the Bank of Japan scrapped a 0.10 percent yield floor for government bond purchases, opening the door to the possibility of buying debt with negative returns. That is, for the first time, it may become central bank policy to endorse negative yields.

Investors not interested in negative yields can look at other currencies not listed above. We favor currencies of countries that have higher rates not because we are interested in chasing yields, but because such countries may be more removed from the crises and thus be able to focus on sound monetary policy rather than subsidizing governments, banks or consumers.

Alternatives are to buy riskier assets, such as equities; or invest in property, plant & equipment. Those are the types of activities central bankers would like to encourage us to do. But there’s also a good reason to accept the negative yields: there’s a saying that in a crisis, the winners are those that lose the least. Investors may have good reason to be on the sidelines, namely the belief that better prices may be available for riskier assets down the road. Central bankers are spooked by such attitudes, afraid of deflation; as such, they may be tempted with even lower rates, punishing savers. So get prepared for a negative interest rate environment. And we are talking about nominal rates only, before taking inflation into account.

Please sign up to our newsletter to be informed as we discuss global dynamics and their impact on currencies. Please also follow me on Twitter to receive real-time updates on the economy, currencies, and global dynamics.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.