Gold Mines In South Africa See Strikes As Industrial Unrest Spreads

Commodities / Gold and Silver 2012 Sep 03, 2012 - 07:49 AM GMTBy: GoldCore

Today’s AM fix was USD 1,686.00, EUR 1,341.72 and GBP 1,061.65 per ounce.

Today’s AM fix was USD 1,686.00, EUR 1,341.72 and GBP 1,061.65 per ounce.

Friday’s AM fix was USD 1,657.75, EUR 1,319.03 and GBP 1,047.68 per ounce.

Silver is trading at $31.78/oz, €25.38/oz and £20.09/oz. Platinum is trading at $1,546.70/oz, palladium at $629.50/oz and rhodium at $1,025/oz.

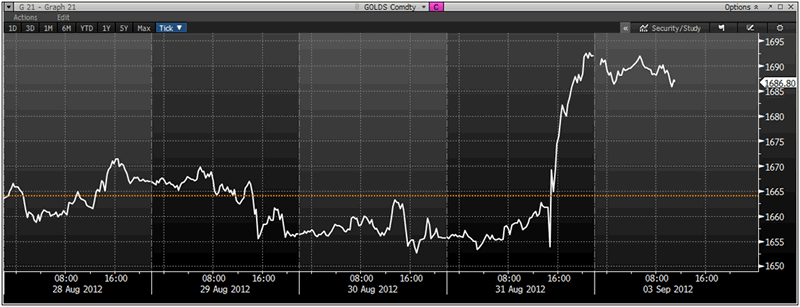

Gold Price August 28th- September 3rd – (Bloomberg)

Gold surged $36.50 or 2.21% in New York on Friday and closed at $1,691.80. In volatile trade, gold hit $1,663.47 then fell back to $1,649.19 immediately after Bernanke’s Jackson Hole speech was released, but soon afterwards it climbed back higher to hit $1,692.70 late in the session and finished with a gain of 2.21%. Silver surged to $31.745 and finished with a gain of 4.56%.

It means that gold was 1.3% higher for the week and 4.5% higher for the month of August.

Silver was 3.5% higher for the week and a massive 12.5% higher for the month of August.

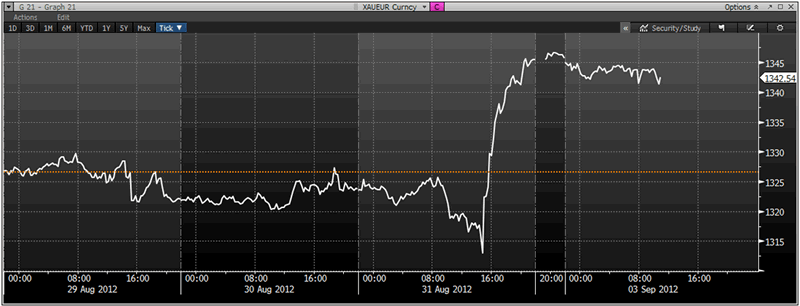

XAU/EUR – August 29th–September 3rd – (Bloomberg)

Gold has consolidated on Friday’s gains and remains near its 5 month high today. US Fed chairman, Ben Bernanke gave a gloomy assessment of the US economy on Friday which means that some form of QE is now almost certain.

The gold price has surged 5% over the last few weeks as investors see that more bond buying and money printing policies by the US Federal Reserve are imminent.

Market watchers await the ECB policy meeting on Thursday September 6th and how it will lay the foundation for the US Fed meeting the following week on the 12th and 13th.

Coordinated action is possible and Mario Draghi will take centre stage at the ECB policy meeting Thursday with guidance regarding a possible interest rate cut and the possibility of bond market intervention.

Today’s Eurozone manufacturing sector PMI (Purchasing Managers' Index) contracted for the 13th successive month in August.

Today is a holiday in the USA, investors await data on Friday for the key US nonfarm payrolls report. It is expected to show payroll growth at only 100,000 which signals how weak the US is at present.

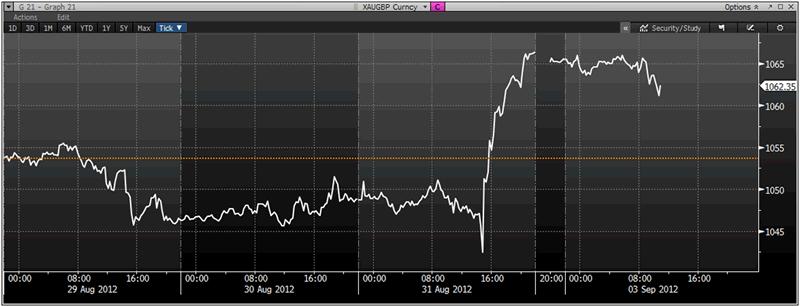

XAU/GBP – August 29th–September 3rd – (Bloomberg)

The European Stability Mechanism has yet to be ratified and is in the hands of the German Constitutional Court. Next Wednesday September 12th, the 16 judges that sit on the FCC of Germany will deliver their ruling on the fund’s constitutionality in order to make the fund operational. Rejection by the FCC could lead to volatile markets.

China's PMI surprised on the downside with 49.2 in August dropped from 50.1 in July, said data released on Saturday showing the increasing fragility of the Chinese economy.

Some 12,000 workers at a gold mine operated by Gold Fields have gone on strike, in the latest industrial strife to hit South Africa's mining sector.

Julius Malema, the expelled leader of the youth wing of South Africa’s ruling African National Congress, will address Gold Fields Ltd. workers who started an illegal strike at the continent’s biggest gold-mining complex.

About 12,000 employees at the East section of Gold Fields’ Kloof-Driefontein operation started a strike on Aug. 29, demanding the immediate replacement of union branch leadership.

Illegal strikes have been spreading across South Africa’s mining industry after 44 people died in violence associated with a stoppage at Lonmin Plc’s Marikana mine in the North West province last month. Malema addressed miners at Lonmin after police shot dead 34 of the protesters gathered near the mine.

A decline in support for the National Union of Mineworkers, South Africa’s largest labor union, is opening space for other organizations to recruit, leading to unrest at operations and divided, protracted pay talks.

The KDC mines, which employed 26,685 workers including contractors last year, produced 1.1 million ounces of gold in 2011, or 31 percent of Gold Fields’ output. The East section produces 1,660 ounces of gold daily, spokesman Sven Lunsche said by phone on Aug. 31. This is the biggest unprotected stoppage Gold Fields has faced in at least three years.

“We’re not letting any outside political parties onto the property,” Lunsche said by phone today. “It could endanger the security of the mine in a very volatile situation.”

The South African political situation is destabilising an already fragile economy and this has led to the rand falling in value recently.

The mass of people in South Africa remain desperately poor including the lot of the miners, while improved since Apartheid times remains very tough.

There is a new corporate scramble for Africa's natural resources. Pundits predict that foreign investment in mining across the continent is set to increase by an astonishing 40 per cent this year and the top 40 mining companies in the world achieved record profits last year of $133 billion between them.

The World Bank and others continue to flag the mining industry in particular as the engine of Africa's future economic growth - the auditor Ernst & Young issued a report last year entitled "Africa: A Golden Opportunity".

Resource nationalism is an increasing response to this across the developing world and could result in the nationalisation of extractive industries in Africa and around the world.

Some fear that the stage is set for Resource Conflict 2.0 which could result in supply issues with regard to certain key commodities.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.