QE Infinity Won't Work, What the Banks Are Really Afraid Of ...

Stock-Markets / Credit Crisis 2012 Oct 18, 2012 - 06:53 AM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Dallas Federal Reserve President Richard Fisher recently offered a stunning assessment about our policymaking central bankers down in Washington.

Keith Fitz-Gerald writes: Dallas Federal Reserve President Richard Fisher recently offered a stunning assessment about our policymaking central bankers down in Washington.

They're winging it.

In a talk before a Harvard Club audience, Fisher presented a candid assessment about all the levers the Fed has been pulling in the aftermath of the 2008 financial crisis. And that includes the recently announced QE3.

"Nobody really knows what will work to get the economy back on course. And nobody-in fact, no central bank anywhere on the planet-has the experience of successfully navigating a return home from the place in which we now find ourselves. No central bank-not, at least, the Federal Reserve-has ever been on this cruise before."

I don't know about you, but the idea that four years and trillions of dollars into this quantitative easing voyage we're still sailing without a compass isn't just appalling.

It's terrifying.

Yet this ship of fools sails on.

The problem is, Fisher is right: QE3 won't work. QE1 and QE2 didn't fix this mess. Nor will QE4, QE5, onwards to infinity.

What's more, there's a cottage industry of pundits and consultants who'll agree.

Trouble is, just like Fisher and his colleagues at the Fed, none of them can tell you why it won't work.

That's what we're going to do here today.

We'll start by giving you the lowdown on how this nation's central bankers view "Quantitative Easing." Then we'll show you how the Fed thinks QE is supposed to work.

Finally, we'll punch some (actually, many) holes in in the Fed's hull by discussing why it's not working.

We'll even demonstrate what could still be done to fix this wretched mess.

Quantitative Easing (QE) is a Great Theory, But...

The latest version of QE calls for the New York Fed (the central bank's trading arm) to buy $45 billion of U.S. Treasuries and $40 billion of mortgage-backed securities a month from dealers and banks.The Fed then intends to "sterilize" these purchases by selling 1- to 3-year bonds through the end of the year - until it runs out of short-term paper to sell. A "sterilized" intervention is one that doesn't increase the money supply.

But beginning in 2013, the Fed plans to continue doing the same thing - effectively continuing "Operation Twist," but without the sterilization, because it has no more short-term paper to sell.

In plain terms, this means the Fed will monetize nearly 50% of the entire U.S. budget deficit in 2013. That will boost its balance sheet from the current $2.8 trillion to approximately $4 trillion - or 24% of U.S. GDP - by the end of the new year.

There isn't a big list of players here. And that's extremely important to understand.

Even the Fed's own Website tells us there are only 21 counterparties - including U.S., Canadian, British, French, German, Japanese, and Swiss banks.

The upshot: The risks are highly concentrated - in just this list of financial institutions:

- Bank of Nova Scotia, New York Agency.

- Barclays Capital Inc.

- BMO Capital Markets Corp.

- BNP Paribas Securities Corp.

- Cantor Fitzgerald & Co.

- Citigroup Global Markets Inc.

- Credit Suisse Securities (USA) LLC.

- Daiwa Capital Markets America Inc.

- Deutsche Bank Securities Inc.

- Goldman, Sachs & Co.

- HSBC Securities (USA) Inc.

- J.P. Morgan Securities LLC.

- Jefferies & Company Inc.

- Merrill Lynch, Pierce, Fenner & Smith Incorporated Mizuho Securities USA Inc.

- Morgan Stanley & Co. LLC.

- Nomura Securities International Inc.

- RBC Capital Markets LLC

- RBS Securities Inc.

- SG Americas Securities LLC

- UBS Securities LLC.

This is not unlike buying the last egg at the grocery store... if nobody wants it the price will be low, but if everybody wants it, you can bet you'll have to pay a premium.

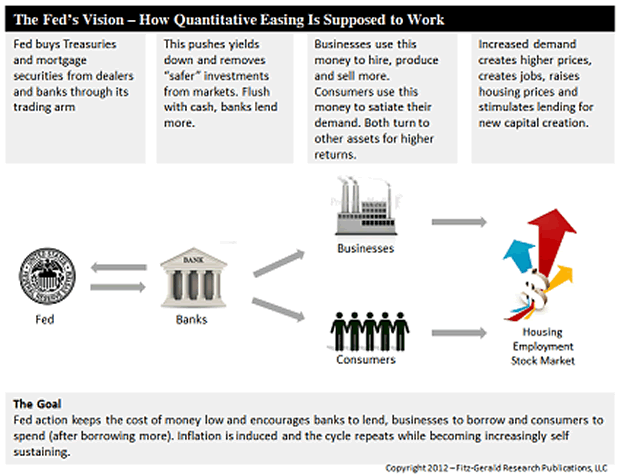

The idea is that, flush with cash and with fewer opportunities for higher returns, the banks will take on more risk and boost their lending to businesses and consumers.

With more money available - and at cheaper "prices" (lower rates) - that money will then work its way through the economy.

Businesses would use the cheap money to expand their operations, make capital purchases, produce more and hire workers to make it all happen. Firms are expected, according to the model, to build inventory in anticipation of the higher demand to come.

Then there are the consumers, who in good times account for 70% of what makes the U.S. economy go. Those folks, too, will borrow more of this abundant, cheap money to pay for products and services. That, of course, bolsters demand, boosts corporate profits, and spurs hiring. That hiring, in turn , puts additional money in consumer wallets, which accelerates spending, and starts the whole cycle anew.

Consumers are also expected to invest in housing. The Fed presumes both are the result of more or better wages ahead.

The Fed's grand plan is also supposed to benefit the stock and bond markets. The yield-starved, zero-interest-rate environment the Fed is deliberately creating will force businesses and consumers to turn to stocks, bonds, capital purchases, and other assets in pursuit of higher returns. At least according to the Fed.

Over time, Team Bernanke hopes this will reflate everything from stocks to housing. It believes that increased demand creates jobs, stimulates new capital creation, raises housing values and leads to higher prices.

The hope is that there's enough capital injected into the banking system to create a self-sustaining cycle of "capital creation."

It's a great theory.

But that's the problem.

It's a theory.

The central bank's master plan is constructed mostly by academics and policy wonks with a decidedly political agenda - all of whom appear to believe in the fallacy of perfect information as part of their decision making.

So what are they missing? Let's take a look.

What the Banks Are Really Afraid Of ...

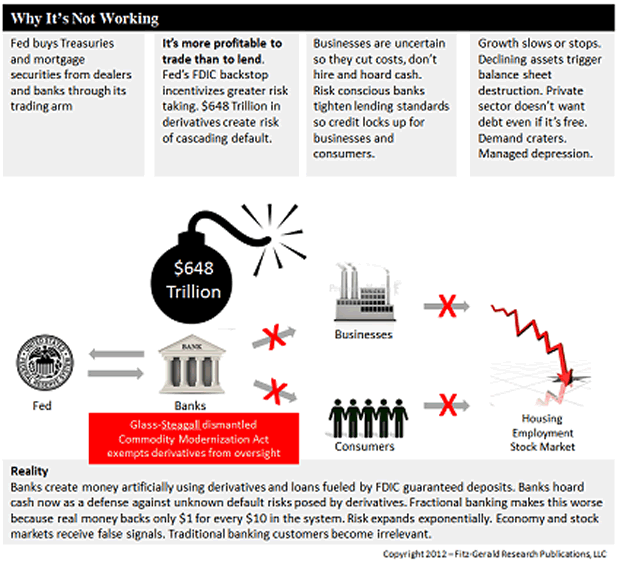

A key reason the Fed can't clear away the financial-crisis fallout is that it doesn't understand why the banks engaged in the risky behavior that caused the crisis in the first place. As Fisher's comments suggest, it also doesn't understand the implications of the moves it's making now.Given that, it's no surprise our central bankers are so ill-prepared to deal with the witch's brew they've now created.

Let's start with FDIC insurance. When the Glass-Steagall Act (technically the Banking Act of 1933) was repealed in 1999, the protective wall that separated the more-staid commercial banking world from its risk-taking investment-banking counterparts was demolished.

The new "bank holding companies" could now

reach through the proverbial firewall and finance their high- risk trading activities using FDIC- insured deposits as the anchor.

Some would say fuel.

Then, as part of the Commodity Modernization Act of 2000, derivatives and other exotic investments were specifically exempted from reporting and public- exchange requirements in a move that further incentivized and even encouraged risk-taking.

Taken together, it was as if Washington had dumped a barrel of jet fuel on an open campfire: It started a blaze that just about burned the whole forest down.

With access to an entirely new pool of capital and an implicit government guarantee, big banks moved rapidly out on the risk curve as CEOs like Dick Fuld (Lehman Brothers), Martin J. Sullivan (AIG), Charles Prince (Citi), and James Cayne (Bear Stearns) realized that trading - and not banking - provided a direct pathway to obscene profits.

Some experts don't believe this could have happened in private markets, where risk is directly a function of capital on hand rather than the implicit guarantee of the U.S. f ederal government.

I agree. Banks would have had to quintuple their capital before anybody in their right mind thought about taking on that much risk. The markets would have made that impossible.

That brings us back to the present.

The Fed believes that it has to provide liquidity to these very same banks under the misguided assumption that the banks will turn around and release it to the public.

But not having enough money to lend was never the issue. It was the implicit f ederal backing and destruction of protective regulations that made too much money available the first time around.

Here's the real issue - the one thing that terrifies these massive institutions.

They're afraid of each other.

That's right... they're so afraid of each other, and of the potential implosion of the $648 trillion derivatives playground that they created and have now handcuffed themselves to that they're forced to forever watch one another, and to hoard capital for that future "what if" day of reckoning.

And they need to be that afraid.

Thanks to the unholy combination of a fractional reserve system, leverage that at one point approached 100-1 on some instruments and the almost-total lack of supervision of unregulated trading activities for the last 12 years, estimates suggest there's only one "real" dollar in the system for every $10 they've created .

And nobody knows who's got it.

Practically speaking, the world of high finance has become murkier than ever. And traditional banking customers have become all but irrelevant.

Not surprisingly, this lack of clarity in the financial system translates directly into uncertainty in the business community. CEOs are responding in the only ways they can and, like banks, are hoarding cash.

Apple Inc., for example, is sitting on more than $117 billion in cash, 63% of which is offshore. Berkshire Hathaway is sitting on $162 billion. General Electric Co. has $122 billion tucked away.

The nation's chief job-creation engine - the small business sector - is also adrift and listing. Small ventures don't have the luxury of building up huge cash stockpiles, so they depend on various forms of revolving debt. Many can't get the loans they need despite flawless credit because banks obsessed with their own survival have tightened up their external lending standards so much that no money escapes.

The nation's banks once went out of their way to find reasons to give money out. No longer. And America's entrepreneurial spirit is being crushed in the process.

Companies of all sizes are

holding down costs, delaying investments as long as possible, and are hiring only when absolutely necessary.

And, as the controversies over recent jobs reports underscore, that lack of hiring is the most damaging reality of all.

Until that changes, the economy isn't going to get well again.

Having been badly burned by an orgy of easy credit and profligate spending, consumers have had enough, too . They're deleveraging. Many don't want debt - even if it's free.

Unlike the government and the banks, which exist in some sort of fantasy land, consumers have to live within their means.

So growth slows to a crawl, or grinds to a halt . This results in balance sheet destruction once productive assets go into decline.

Ultimately, demand craters.

Once that happens, it's only a short drop into a managed depression that lasts for decades - as we see in Japan, where an entire generation has lived its whole lif e in a functional depression, no-growth malaise.

The Path We Don't Want to Travel

Indeed, Japan is now entering the third decade of what was supposed to be a single "Lost Decade." The Nikkei is off 80% and that nation's combined private, corporate and public debt is now over 500% of GDP.

And that brings me to where I believe the Fed's plans are so badly flawed.

Money created in a vacuum that is not backed by real savings and real assets creates false economic signals. These false signals, in turn, lead directly to additional economic misallocations.

What I mean by that is the money gets diverted into areas of our economy that have marginal value (like the banking system) instead of being funneled to where it can do the most good (job-creating technology or manufacturing) to help those who need it most (America's hard-working-but-still-struggling middle class households).

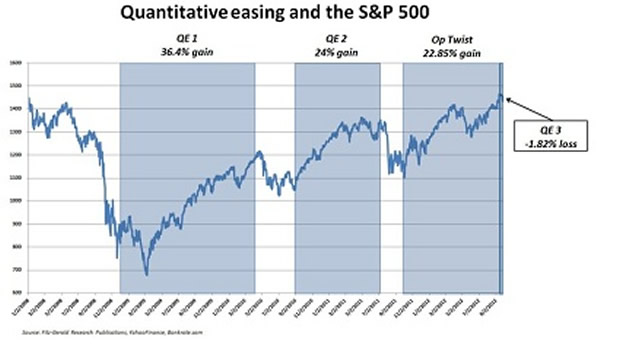

So yes, the stock market will rally in the short term, but as the weight of these debt burdens becomes greater, the cumulative effect of each new round of stimulus lessens.

And that's what's precisely what's happening now.

Take a look. With each successive round of QE, the gains become smaller in magnitude and shorter in duration.

At some point in the future - a point that Fisher and his Fed colleagues readily admit they can't identify - quantitative easing will fail to have any impact whatsoever.

But rest assured: Everyone is Washington is focusing their energies on making sure it happens on someone else's "watch."

Three Steps the Fed Can Take Now To Fix the Problem

To keep that from happening, we need to do what a long-winning sports team does when it falls on hard times - get back to the basics, to the fundamentals that made it great.

In this case, those "fundamentals" are the Fed's basic mandate. According to that mandate, as amended in 1977, "The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates." [emphasis mine].

And this kind of a long-run focus doesn't include propping up a banking system with liquidity it neither needs nor deserves.

In fact, here are the three steps Fed leaders can take right now if they are truly interested in acting in accordance with their mandate:

- Force banks to choose: Either you're an investment bank or a commercial bank - but you can't be both. If you're lending to consumers and businesses, you get the FDIC insurance and the implicit backing of the U.S. federal government. If you're trading derivatives, you're on your own.

- Reintroduce risk: All gain, no pain doesn't work. It's never worked. Success, by its very definition, includes the potential for failure. The Fed has to let failure happen. History, as legendary investor Jim Rogers pointed out to me years ago, "is littered with the bones of failed financial institutions." Why should this time be any different? Printing money is a short- term fix that only digs us into a deeper hole.

- Require capitalization: Lasting economic development is driven by real savings, not fiat money and financial engineering. Responsible parties assume the risks and deserve the profits. Today's Wall Street robber barons aren't responsible, and they aren't deserving.

Along with Fisher, I think I think this country needs to "sober up" and get its act together.

More of the same isn't a solution that will work this time.

Source :http://moneymorning.com/2012/10/18/qe-infinity-wont-work-but-heres-what-will/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.