Stock Market Thrill is Gone – Rally Tired or Just Resting?

Stock-Markets / Stock Markets 2012 Oct 18, 2012 - 10:18 AM GMTBy: PhilStockWorld

For anyone who's been paying attention for the last two years – that's usually not a good thing and, as we noted yesterday, it was a strong Euro and a weak Dollar that was driving our little rally. The Dollar bottomed out at 79 and the Euro topped out at $1.314 and the Euro's strength sent the Yen back up to 79.30 to the Dollar (weaker) and that led to a 2% Nikkei rally last night. As you can see from the chart on the right, the S&P for the week is 1% behind UK and Germany and 2.5% behind France and Italy (+4%) and Spain (+7%) – so we have a lot of catching up to do if this rally is real and sustainable.

For anyone who's been paying attention for the last two years – that's usually not a good thing and, as we noted yesterday, it was a strong Euro and a weak Dollar that was driving our little rally. The Dollar bottomed out at 79 and the Euro topped out at $1.314 and the Euro's strength sent the Yen back up to 79.30 to the Dollar (weaker) and that led to a 2% Nikkei rally last night. As you can see from the chart on the right, the S&P for the week is 1% behind UK and Germany and 2.5% behind France and Italy (+4%) and Spain (+7%) – so we have a lot of catching up to do if this rally is real and sustainable.

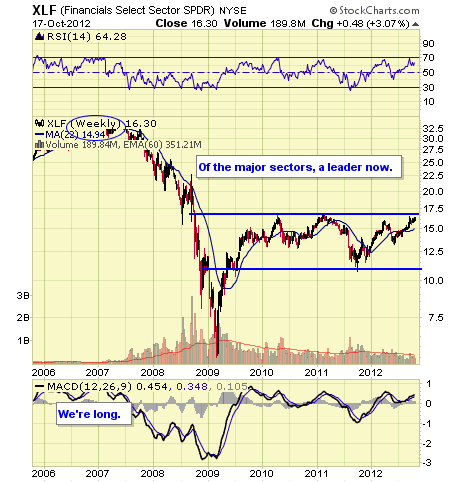

Still, I sent out an Alert to Members early this morning noting that the Global Markets were holding up well as of 6am and that was encouraging. Yesterday we discussed taking advantage of the run-up in the Russell to make a TZA hedge to lock in some of our gains (see main post) but we still haven't covered XLF (target $16.50 – see Dave Fry's chart) and we're still bullish on AAPL as well. We cashed that ISRG play, as planned for $9 on the spreads (200x = $1,800), spending .30 x 200 ($60) to buy back the callers so that, with the $200 we were paid to take the position is just short of our $2,000 goal at net $1,960 – not bad for a day's "work".

Still, I sent out an Alert to Members early this morning noting that the Global Markets were holding up well as of 6am and that was encouraging. Yesterday we discussed taking advantage of the run-up in the Russell to make a TZA hedge to lock in some of our gains (see main post) but we still haven't covered XLF (target $16.50 – see Dave Fry's chart) and we're still bullish on AAPL as well. We cashed that ISRG play, as planned for $9 on the spreads (200x = $1,800), spending .30 x 200 ($60) to buy back the callers so that, with the $200 we were paid to take the position is just short of our $2,000 goal at net $1,960 – not bad for a day's "work".

In Member Chat this morning, we discussed GOOG's outlook for earnings this evening and decided they were more likely topping than popping so we have that risk to the Nasdaq for tomorrow. IBM was an 80-point drag on the Dow yesterday but it did manage to finish flat and advancers led decliners on the NYSE by 2:1 so the conditions are still there for a rally and hopefully what we have here a a pause that refreshes and not a triple top from the mid-September highs.

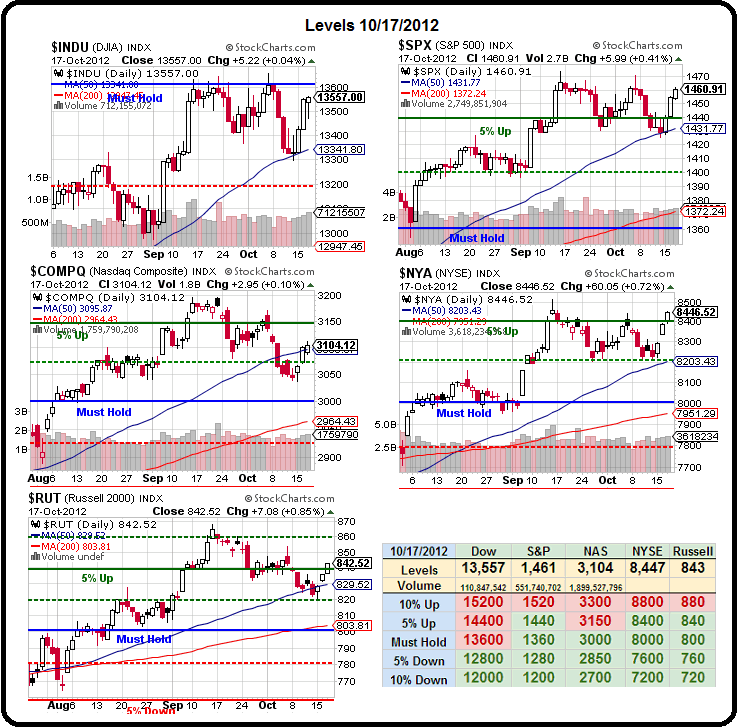

The Nasdaq and the Russell are, in fact, in downtrending channels and, for the Nasdaq, their fate rests on GOOG tonight and AAPL next Thursday – but it's still a long way back to the highs at 3,200.

As you can see from the Big Chart – the Dow still needs to prove itself over 13,600 and the great shame of it is that it should have popped right over yesterday, if not for IBMs $10 drop that sucked 80 points out of the index, which finished the day at 13,557. In Dow news this morning, VZ was in-line but TRV knocked it out of the park with a .61 per share beat of $1.61 expected (38%) and Revenues were also a 10% beat. Already TRV is up 2% pre-market but, unfortunately, it's only a $72 stock so it won't have the impact IBM did yesterday.

TRV is in the XLF as well so we may get our $16.50 this morning as MS also did a nice job and USB caught an upgrade this morning after yesterday's earnings so, on the whole, there is no reason for the market not to keep the upward momentum going. TRV is up 20% this year and is responsible for 120 of the Dow's 1,250-point gain.

8:30 Update: Oops, we got some terrible unemployment numbers with 388,000 people losing their jobs last week vs. 365K expected and last week's 342,000 but the number includes a holiday (Columbus Day) and those 3-day weekends can cause serious distortions. Still, it gave the Futures a little love-tap lower and, since it's the Appleconomy, that's 388,000 less IPhone customers this week and AAPL took a quick dip all the way back to $636, where we'll be happy to press it if we get that price at the open.

Our friends at SVU put in a good report this morning and are up to $2.25 pre-market. This is one of our favorite cheap stocks with a $415M market cap, which just happens to be the exact same as the amount of free cash flow they generated in the first 3 quarters of this year. Although the headline number is a loss of .52 per share, it's pretty much all non-cash impairment charges and write-downs that don't stop cash from pouring to the bottom line. They've refinanced $1.65Bn in debt and are reducing overall debt by $450M – all part of the reason we doubled down on their recent dip in our Income Portfolio, which only needs SVU to hit $2.50 to realize some very serious gains. There's also rumors of a potential buy-out, maybe it will be discussed at the 10am CC.

Our friends at SVU put in a good report this morning and are up to $2.25 pre-market. This is one of our favorite cheap stocks with a $415M market cap, which just happens to be the exact same as the amount of free cash flow they generated in the first 3 quarters of this year. Although the headline number is a loss of .52 per share, it's pretty much all non-cash impairment charges and write-downs that don't stop cash from pouring to the bottom line. They've refinanced $1.65Bn in debt and are reducing overall debt by $450M – all part of the reason we doubled down on their recent dip in our Income Portfolio, which only needs SVU to hit $2.50 to realize some very serious gains. There's also rumors of a potential buy-out, maybe it will be discussed at the 10am CC.

We liked NLY yesterday as a new trade idea (see morning post) and that trade is still playable and this morning Compass Point upgraded CMO based on it's $13.35 book value and $12.48 price so I think we're on the right track calling a bottom in the REIT sector.

ALU is another stock we picked up on the dip and they are popping as well as they announce 5,500 job cuts to save $1.6Bn and, for a change, they are almost all foreign jobs being cut. Our break-even on ALU is way down at 0.635 – also in our Income Portfolio so contgrats to all who played that one!

As we expected, oil is collapsing today, now $91.31 (9am) as the pressure mounts to get out of those November contracts, which close on Monday. We shorted yesterday, as planned, off the $92.50 line and then our re-shorting line was $92, which they were kind enough to cross this morning. We're not expecting a huge dip as there were only 85,000 contracts left open on the NYMEX (down from over 400,000 at one point) and we figure they can leave 20,000 for delivery (20Mb) so 65,000 contracts to roll or cancel over 3 trading days is probably not enough to get us below $90 so, if anything, we'll be looking for an opportunity to go long around there – once we see enough contracts rolled out.

Gasoline is falling too, down to $2.72 so Jack Welch can add that to his list of conspiracies as that's sure to cheer the consumers up this weekend. Now, unfortunately, the Euro has failed $1.31 and the Dollar is poking back to 79.25 and that's knocking our futures down across the board

Overall, we're not going to be too worried by Dollar-induced index weakness. XOM and CVX won't like the $1.50 dip in oil and that's a drag on the Dow but those will turn around once they roll those oil contracts and IBM should be done being a drag and, overall, we're right in-line with our September 25th review of the Dow components and that means 14,000 is still in sight but we can't afford any more IBMs as the rest of the component earnings come in.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.