XAU Gold Stocks Index Brought Down Through Derivatives Market Manipulation

Commodities / Gold & Silver Stocks Feb 23, 2008 - 09:09 AM GMTBy: Rob_Kirby

Who remembers when the effects of the sub-prime contagion and subsequent freeze-up of the debt markets began to make itself visible?

Who remembers when the effects of the sub-prime contagion and subsequent freeze-up of the debt markets began to make itself visible?

For those of you who might be unaware, it was the summer of 07 – and I'd like to present this little picture of how the DOW JONES reacted to the impending financial seizures and ‘broke down' as a little refresher:

Remember any of those huge down days in July and early August last summer [07]?

I sure do.

For those of you with good memories – how about a little refresher as to what happened to the resources / precious metals / mining and exploration stocks versus the price of gold over the same time period?

Remember how equities indexes that represent the precious metals sector [HUI, XAU] all got ‘smoked' despite the dramatic advance in the price of gold with the yellow metal fulfilling its historic role as THE-GO-TO-ASSET in times of financial upheaval?

Now how many of you remember THE REASON pundits ‘floated' [or flaunted, perhaps?] in the mainstream financial press to explain why gold equities were being dumped – en masse – while the price of gold was rocketing higher?

For those of you who do not remember, pundit after pundit made claims then - that investors were selling their gold equities to meet margin calls or because they were the only investments that they owned with profits in them.

This was THE ONLY REASON offered at the time, or since, to explain this completely counter-intuitive de-coupling of the precious metals equities from the underlying.

That is – until now:

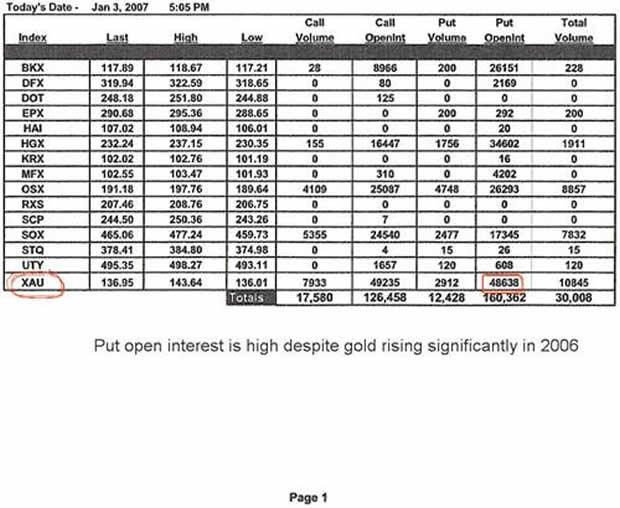

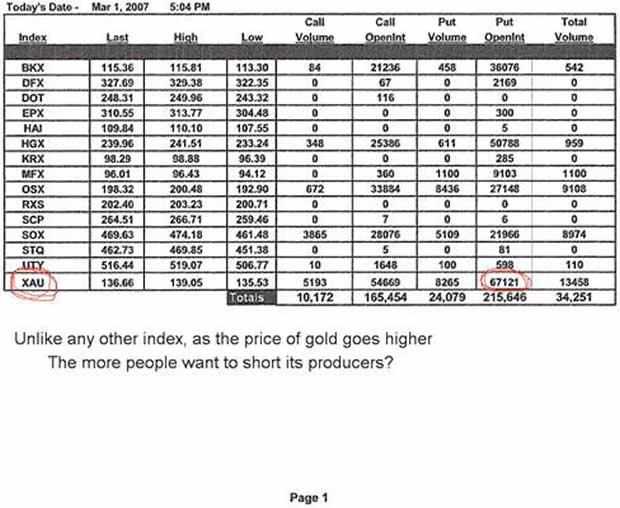

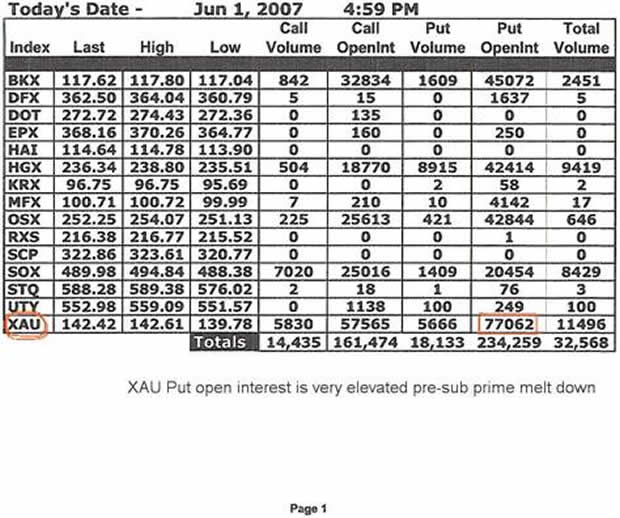

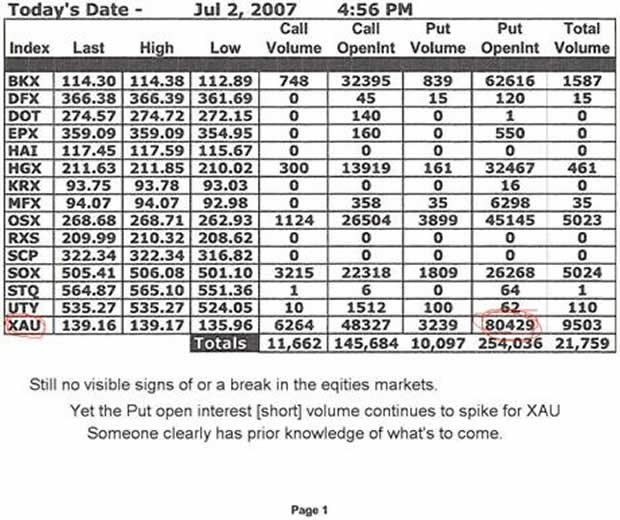

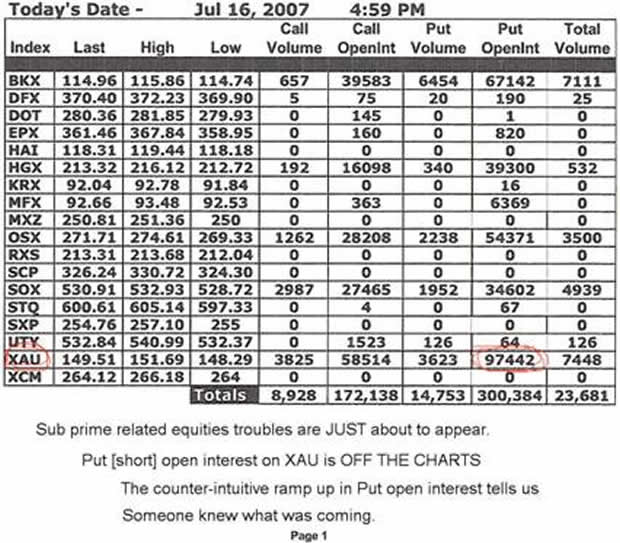

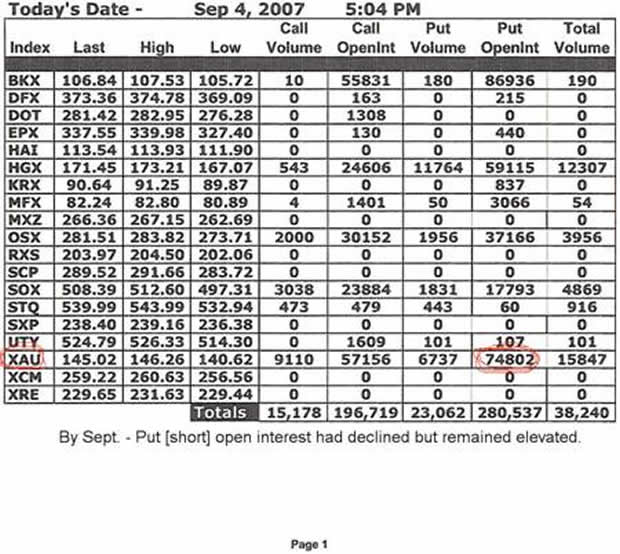

By examining historical Put / Call open-interest data on the Philadelphia Exchange's XAU index – we can clearly see a pre-emptive build in Put [short] open interest on the XAU Index Futures that is counter-intuitive to the upward price movement in the underlying precious metals prices.

The bloating of the open interest in the XAU Puts [ a precious metals derivative ] was DIRECTLY RESPONSIBLE for the collapse in the XAU. These derivative induced sales of equities had NOTHING TO DO with raising cash to meet other commitments as widely reported. This was a show of overwhelming brute force by placing ‘levered bets' [I prefer the term fore-knowledge] to bring precious metals equity values DOWN prior to predictable dollar-negative news / events [like Iran telling Japan that they would only accept Yen for Crude oil shipments].

Someone clearly did not want investor sentiment aroused by soaring precious metals prices. Here is the chronology:

Source: http://www.phlx.com/products/sectors/vol2007/vol010307.pdf

Source: http://www.phlx.com/products/sectors/vol2007/vol030107.pdf

Source: http://www.phlx.com/products/sectors/vol2007/vol060107.pdf

Source: http://www.phlx.com/products/sectors/vol2007/vol070207.pdf

Source: http://www.phlx.com/products/sectors/vol2007/vol071607.pdf

Source: http://www.phlx.com/products/sectors/vol2007/vol090407.pdf

You see folks - the sub-prime debacle has been a banking-led crisis from the beginning. Isn't it strange that Put [short] open interest build in the mining stocks has been consistently and overwhelmingly MORE than that of the BKX [KBW Bank Index] and the MFX [Mortgage Finance Index]?

Precious metals equities have categorically been ‘ambushed' to prevent the buzz or same investor excitement that helped propel the last great gold bull market in the 1970's. Monetary Authorities and their agents were absolutely behind this massacre in the precious metals equities – derelicts with their paper derivatives.

Then, they lied and spread false rumors to cover their tracks.

Their real Achilles Heel – however – is their increasing lack of physical metal and/or their increasing reluctance to sell their remaining vaulted stocks to continue suppressing demand for the real thing - physical metal – bars and coins.

But that's another murky, disingenuous story for another day.

The physical markets for precious metals are tight [little supply] and growing more so by the day.

Got physical gold yet?

By Rob Kirby

http://www.kirbya nalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research.

Many of Rob's published articles are archived at http://www.financialsense.com/fsu/editorials/kirby/archive.html , and edited by Mary Puplava of http://www.financialsense.com

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.