Credit Contagion Spreads from Monoline Insurers to VIE's

Stock-Markets / Credit Crisis 2008 Mar 01, 2008 - 11:09 AM GMT

The next 3-letter acronym for toxic securities: “VIE” - While banks are lending another $3 billion to Ambac, a bond insurer, in the hope of staving off more rating downgrades, yet another entity looms large in the field of risk management. Suddenly, a new class of structured investment vehicle called Variable Interest Entities (VIEs), now contain toxic properties. It appears that the VIEs are bond issues that participate in the Auction Rate Securities (ARS) market. These bonds have a clause in their covenant that, if an auction fails to provide adequate liquidity, the yield on the bond resets (higher, of course) to a “fail rate.”

The next 3-letter acronym for toxic securities: “VIE” - While banks are lending another $3 billion to Ambac, a bond insurer, in the hope of staving off more rating downgrades, yet another entity looms large in the field of risk management. Suddenly, a new class of structured investment vehicle called Variable Interest Entities (VIEs), now contain toxic properties. It appears that the VIEs are bond issues that participate in the Auction Rate Securities (ARS) market. These bonds have a clause in their covenant that, if an auction fails to provide adequate liquidity, the yield on the bond resets (higher, of course) to a “fail rate.”

Two weeks age, I mentioned that the failed auctions are having the unforeseen effect of raising yields to a level that cannot be paid by the issuer. For example, it was reported that the Port Authority of New York and New Jersey participated in the ARS program and the failure at the auction caused the yield to climb from 4.3% to 20%. The Port Authority quickly reset the interest rate to 8%, but it was a totally unforeseen development. This has a direct impact on the credit rating of the Port Authority. There are many more hospitals, school districts and municipalities that are being faced with this unforeseen consequence of participating in the ARS programs sold them by Wall Street. Suddenly, a whole new set of securities are turning toxic for both the issuers who are facing lower credit ratings and the possibility of default and the investors, who are being held hostage to the failed auction markets.

Did he say bank failures?

That's right. Federal Reserve Chairman Ben Bernanke told the Senate Banking committee that he expected to see some “ failures of small regional banks invested in real estate.” Indeed, the Wall Street Journal reports that the FDIC is rehiring retired staff that is experienced in handling insolvent banks. Now that the camel's nose is in the tent, don't be surprised by failures of larger banks, as well. You may find out about your bank by contacting Veribanc, Inc., a rating company that provides independent and unbiased information about banks and credit unions in the United States . They may be reached at (800) 442-2657 or email service@veribanc.com . There is a $10 charge for the first bank or credit union rating and a smaller fee for each additional rating. I contacted Veribanc, Inc. and was told that the fourth quarter credit union reports are in and that they expect to have the fourth quarter bank reports in next week. The outlook for banks just got gloomier . Don't get caught in a failed bank.

Personal Income Train Wreck.

The Bureau of Economic Analysis reports that Personal Income increased $32.2 billion or .3% in January. This is down from a Personal Income increase of $54.0 billion in December. If it hadn't been for “Bonus payments and gains on the exercise of stock options boosted private wage and salary disbursements; pay raises for federal civilian and military personnel boosted government wage and salary disbursements; and cost-of-living adjustments to several federal transfer payment programs boosted personal current transfer receipts,” personal income would have risen only .2%. Compare that to the Consumer Price Index , which rose .5% in January.

Personal Saving is still negative. “Personal saving -- DPI less personal outlays -- was a negative $6.2 billion in January, compared with a negative $8.2 billion in December. This amounts to a negative .1% savings rate for January, the same percentage (reported) as December. It is surprising that personal saving was not even more negative.

Meanwhile, consumer spending was flat after inflation for the month of January.

Ready to tumble even more.

|

Feb. 28 (Bloomberg) -- U.S. stocks tumbled the most in a week after slower-than-forecast economic growth, rising jobless claims and Federal Reserve Chairman Ben S. Bernanke's warning of possible failures among smaller banks deepened concern a recession is inevitable. |

``We're still seeing the fallout from housing, and the credit crunch is still unfolding,'' said Alan Gayle, senior investment strategist and director of asset allocation at Trusco Capital Management in Richmond , Virginia , which oversees $17 billion of equities. ``It seems like every credit rock you turn over has something crawl out from underneath it.'' They're called cockroaches.

How low will rates go?

|

WASHINGTON ( MarketWatch ) -- Now that Federal Reserve Chairman Ben Bernanke has signaled that more rate cuts are on the horizon, the natural question arises: how low will interest rates go? The answer from leading Fed watchers is 2%, most likely by the summer. For rates to move lower, economic weakness would have to be much more intractable than now envisioned, they said. "I think 2% makes sense for a host of reasons," said Chris Rupkey, chief financial economist at Bank of Tokyo Mitsubishi in New York . I agree. |

Carried away by an “irrational exuberance.”

|

NEW YORK ( MarketWatch ) -- Gold futures gained Friday, having hit a record high of $978.50 an ounce overnight, continuing to draw support from weakness in the U.S. dollar and rising investment flows into commodities.” The “irrational exuberance” being shown by investors is due to the decline in the dollar and higher inflation. Will it change soon? |

Japan hit by economic worries.

|

Japan 's Nikkei market fell by 2.3% on Friday (not shown) to 13,603.02 overnight. Investors in Japan suddenly became jittery after Fed Chairman Ben Bernanke's testimony about the declining health of U.S. Banks. The jitters were especially evident with Japanese banks, leading the decliners in the Nikkei Index. The next leg of the decline is beginning in Japan , too. |

Shanghai Composite faces a test of confidence.

|

HONG KONG ( MarketWatch ) -- China shares listed in Shanghai could face a test of confidence in coming days as the calendar counts down to March -- a month that coincides with a blockbuster IPO and the expiry of a lock-up period on a big number of shares. The hefty fund raising and deluge of newly tradeable shares at a time of wobbly stock prices could undercut China 's richly priced equity markets, some analysts say. |

The U.S. Dollar at lowest level in 31 months.

|

The US dollar dropped to its lowest level in 31 months against the yen, hit by concerns about the US economy and the banking sector following remarks by Federal Reserve Chairman Ben Bernanke. Who wins and who loses? Business Week has an interesting insight into how the declining dollar affects different players. Currency traders were unimpressed by the support for the dollar voiced Feb. 28 by President George W. Bush, who said: "We believe in a strong dollar policy, and we believe, I believe, our economy's got the fundamentals in place to grow and continue growing." We certainly do, don't we? |

Fannie is still behind the 8-ball.

|

Feb. 27 ( Bloomberg ) -- Fannie Mae, the biggest source of financing for U.S. home loans, told lenders it will probably ban their use of appraisals by in-house employees or those arranged by brokers. Fannie Mae distributed the proposal, a response to New York Attorney General Andrew Cuomo's yearlong mortgage probe, to lenders in a ``talking points'' memo this week, according to a person familiar with the document. The memo was published on American Banker's Web site yesterday. Isn't that like shutting the barn door after the horses have left? |

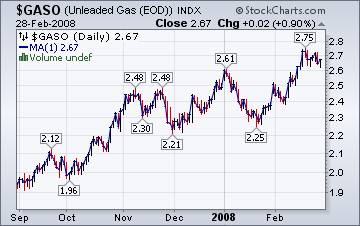

Even higher prices for gasoline coming?

|

The Energy Information Administration's This Week In Petroleum claims that gasoline consumption is lower than that of a year ago and reserves of refined petroleum are almost 8% above their 5-year average. So why the high gasoline prices? Blame it on the price of oil, they say. Crude oil prices are over $100 per barrel, compared to $60 per barrel a year ago. That difference accounts for a $.95 per gallon increase, while actual prices have only increased by $.75. That means the potential for higher prices is high. |

In a word, “Frigid” in the Midwest .

|

The Natural Gas Weekly Update reports, “Natural gas spot prices generally increased on the week at most market locations, in a week of mixed trading. Coming off a period of extreme cold, moderating temperatures and easing pipeline constraints resulted in price declines heading into the weekend on Friday, February 22. A return of cold weather to most of the Lower 48 States contributed to rebounding prices with the resumption of trading on Monday, February 25. This price rally resulted in net gains on the week posted at most market locations outside of the Mid-continent and Rocky Mountains regions.” |

Heads, I win…Tails, the bank loses…

Many new homeowners with variable rate mortgages and no money down are looking at their situation as a type of rent-to-own proposal . If property values go up and interest rates stay down, they will stay in their homes. But if the reverse happens, they will walk, not having anything to lose by going back to renting.

“I think I could make a case that some borrowers were ‘renting' (with risk), rather than owning,” Nicolas P. Retsinas, director of the Joint Center for Housing Studies at Harvard University , said in an e-mail message.

For some people, then, foreclosure becomes something akin to eviction — a traumatic event, and a blow to one's credit record, but not one that involves loss of life savings or of years spent scrimping to buy the home.”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program starting in March.

I will be a regular guest on www.yorba.tv starting on Thursday, March 6 th at 4:00 pm EDT . Stay tuned for news and views!

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.