China's Gold Imports From Hong Kong Double To New Record

Commodities / Gold and Silver 2013 Feb 05, 2013 - 02:05 PM GMTBy: GoldCore

Today’s AM fix was USD 1,678.00, EUR 1,240.02, and GBP 1,063.57 per ounce.

Today’s AM fix was USD 1,678.00, EUR 1,240.02, and GBP 1,063.57 per ounce.

Yesterday’s AM fix was USD 1,664.25, EUR 1,224.52, and GBP 1,057.47 per ounce.

Silver is trading at $31.94/oz, €23.65/oz and £20.34/oz. Platinum is trading at $1,707.50/oz, palladium at $758.00/oz and rhodium at $1,200/oz.

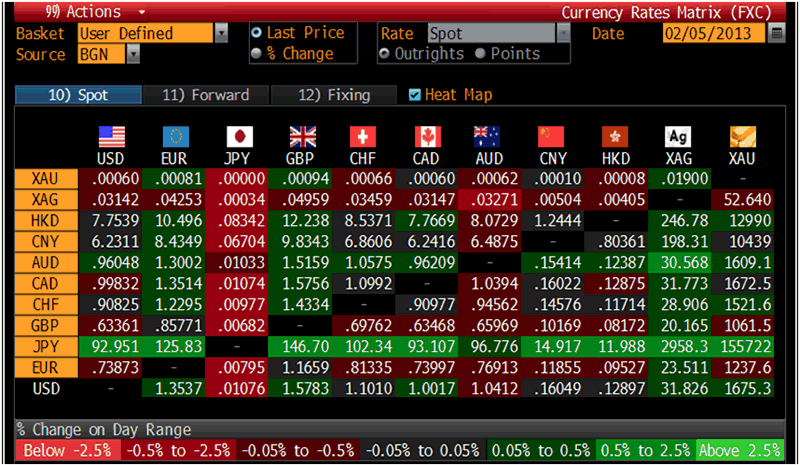

Cross Currency Table – (Bloomberg)

Gold climbed $5.70 or 0.34% in New York yesterday and closed at $1,673.50/oz. Silver inched up to $31.86 in Asia, then it fell back to $31.38, and then rose to a high of $31.91, but eased off in afternoon trade and finished with a loss of 0.35%.

Gold rose to a new record nominal high on the TOCOM at 0.156 million yen per ounce. The resignation of Bank of Japan Governor, Shirakawa on March 19 is pressuring the yen as is increased tensions in the Pacific between China and Japan - Japan accused China of targeting a Japanese naval vessel and helicopter.

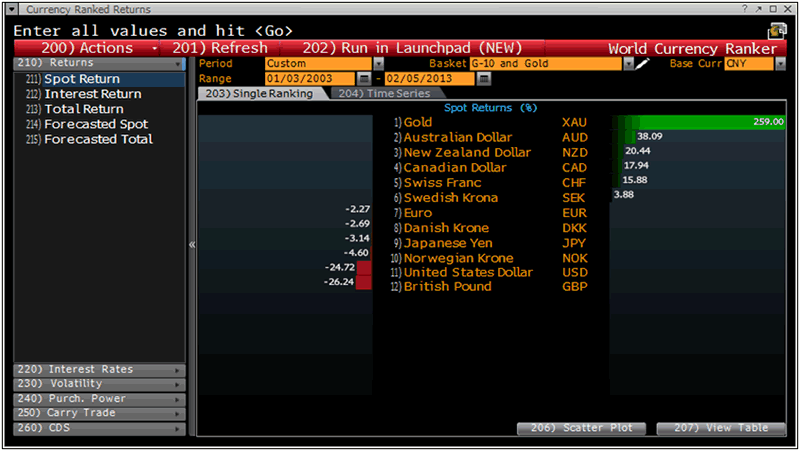

Currency Ranked Returns - Chinese Yuan in G10 Currencies and Gold Since 2003

Platinum and palladium edged off multi month highs today as profit taking set in after recent gains.

Those who look through a rose coloured glass of mixed economic data see a recovering global economy and this perspective and supply issues may have helped propel palladium and platinum to outperform gold and silver so far this year.

Platinum futures rose to their highest point in nearly 17 weeks as output contracted at Anglo American Platinum Ltd. (AMS), the world’s biggest producer.

Anglo American, said that production fell just over 8%. “Supply challenges” will continue this year, the company noted. Global platinum output fell 10% in 2012, according to estimates by Johnson Matthey.

Gold has been trading in a narrow range between $1,660/oz and $1,680/oz since the end of last week. A break above $1,680/oz should see us quickly challenge $1,700/oz and a break lower could lead to a testing of support at $1,650/oz.

Today U.S. ISM non-manufacturing PMI reports at 1500 GMT, but investors await the ECB meeting’s monetary policy decision on Thursday.

Physical buying in Asia is quiet ahead of the Chinese Lunar New Year which starts on Saturday.

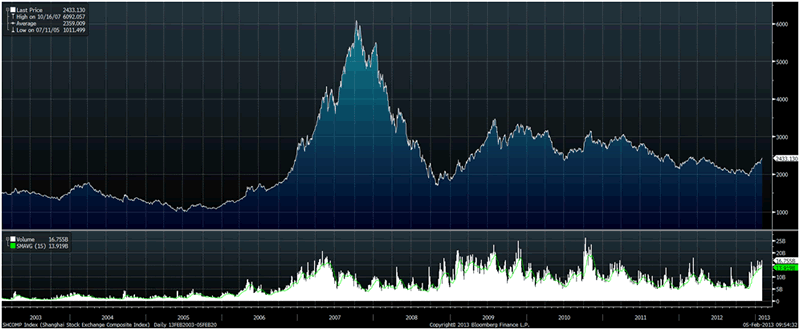

Shanghai Composite Index- 1993 To Today

Gold imports into mainland China from Hong Kong almost doubled to new high in 2012 as Chinese people continue to play catch up in terms of gold ownership. The Chinese were forbidden from owning gold for over 50 years.

Rising incomes, economic jitters and concerns about currency debasement and inflation in the world’s second largest economy led to increased demand in China which contributed to gold seeing another year of gains.

The very poor performance of the Chinese stock market in the last 10 years (see chart below) and concerns about property bubbles are also leading Chinese investors and savers to diversify into gold.

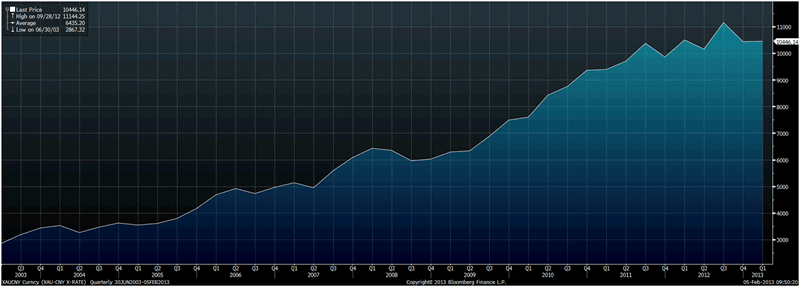

Gold in Chinese Renminbi- 1993 To Today

Mainland China imported a whopping 834,502 kilograms or 834.5 metric tons of gold, including scrap and coins in 2012.

This compared with about 431,215 kilograms or 431.2 metric tons in 2011, according to Bloomberg calculations based on data from the Census and Statistics Department of the Hong Kong government.

Imports in December 2012 rose to a monthly record of 114,405 kilograms, according to data from the department today.

The unrealised important fact is that the people of China were banned from owning gold bullion by Chairman Mao in 1950. This prohibition continued until 2003 and it means that the per capita consumption of over 1.3 billion people is rising from a very small base.

Since the market in China was liberalised, gold in yuan terms has risen by 259% while the stock market has performed poorly.

Even after the significant increase in demand seen in recent years - Chinese per capita gold ownership remains well below that of the levels seen in India.

Culturally, India is known to have the greatest affinity for gold in the world. China had a similar cultural affinity prior to the "cultural revolution" and in time its levels of gold ownership will likely rival those seen in India, Vietnam (see below) and other Asian countries.

Chinese people experienced hyperinflation in 1949, within the lifetime of many Chinese people living today. Therefore, like in Germany, there is a greater awareness of what can befall a nation and a people when a paper currency is debased.

Many market participants and non gold and silver experts tend to focus on the daily fluctuations and “noise” of the market and not see the “big picture” or major change in the fundamental supply and demand situation in the gold and silver bullion markets. This is particularly due to investment, store of wealth and central bank demand from China and the rest of an increasingly wealthy Asia.

The doubling in demand in 2012 is solely private demand and does not take into account official Chinese buying.

It is worth noting that the People’s Bank of China’s gold reserves are very small when compared to those of the U.S. and indebted European nations. They are miniscule when compared with China’s massive foreign exchange reserves of more than $3 trillion.

The People’s Bank of China is almost certainly continuing to quietly accumulate gold bullion reserves. As was the case previously, they will not announce their gold bullion purchases to the market in order to ensure they accumulate sizeable reserves at more competitive prices. They also do not wish to create a run on the dollar – thereby devaluing their sizeable reserves.

Expect an announcement from the PBOC, sometime in 2013 or 2104, that they have doubled or even trebled their reserves to over 2,000 or 3,000 tonnes.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.