US Treasury Bonds The Biggest Bubble In History About to Pop

Interest-Rates / US Bonds Feb 28, 2013 - 07:16 AM GMTBy: Jeff_Berwick

The US Treasury Bond market is the longest unbroken bull market known to the financial world. For more than 30 years it has trended higher in nominal US dollar terms.

The US Treasury Bond market is the longest unbroken bull market known to the financial world. For more than 30 years it has trended higher in nominal US dollar terms.

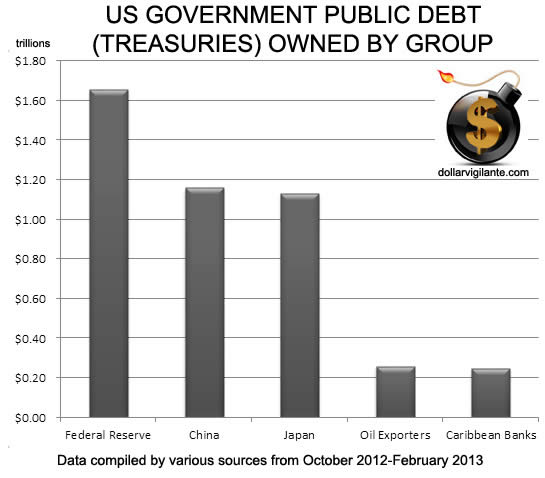

Of course, it has been helped greatly by price fixed and market fixed, Ben Bernanke, who has now bought up more Treasuries, by far, than any other identifiable group, but didn't pay for them out of production; he just did it with the pressing of a button, using a pretty fat finger!

At the current rate, with the Federal Reserve buying up every penny of newly issued government debt in 2013, and then some, it won't be too much longer before the Federal Reserve owns more than China, Japan, the oil exporters and Caribbean bank centers combined.

Considering it is a group of private central bankers that can print money to buy as much of anything they want it should really have people raising some eyebrows! But, aside from the fraud involved, let's take a look at how the issuance of debt is following the exact path of a bubble.

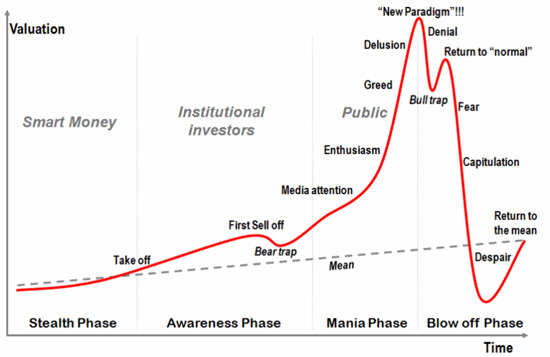

Stages of a Bubble

First, there is the money printing. This is the distinguishing feature of a bubble, its ultimate cause; and there is no more direct form of this model than the central bank printing money to buy the government's debt right out of the gate.

Jean-Paul Rodrigue is a Canadian most noted (in 2008) for his "bubble model", charting four "phases of a bubble". According to the model, while the "smart money" has purchased during the earlier "stealth phase", institutional investors begin to buy during "take off". Following media coverage, the general public begins to invest leading to steep rise in prices as "enthusiasm" and then "greed" kick in. "Delusion" precedes the peak.

Here is the progression, according to Rodrigue:

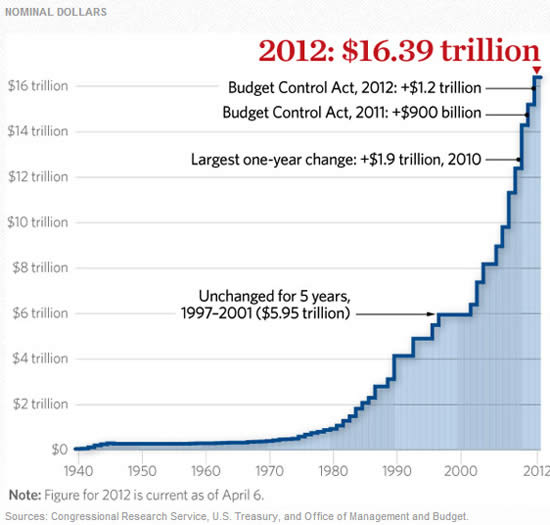

On a tip from good friend, Jeremy Martin, of the well-known Cambridge House conferences that we regularly attend, we decided to take a look at the entire US debt as plotted by the Heritage Foundation:

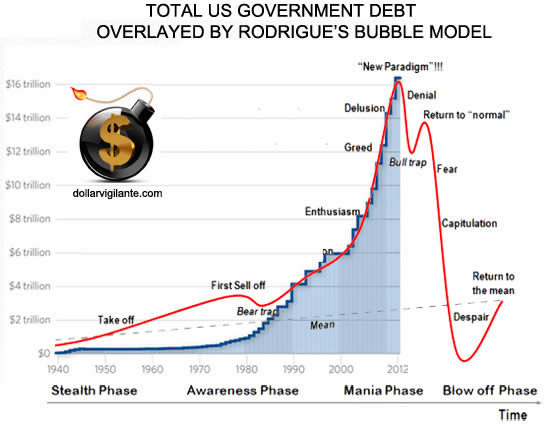

We then plotted Rodrigue's "bubble model" over top of the US debt data:

It's not perfect but it fits the model almost exactly. Where do you think Treasury bonds will head from here? TDV's Senior Analyst, Ed Bugos, is eyeing the Treasury Bonds for what could perhaps be the short of the century. He hasn't told subscribers to pile in yet, but I can

Subscribe to TDV Premium for more expert information on when and how to profit from the coming collapse and protect yourself from the collapse with investments in gold, silver and precious metals stocks and foreign real estate.” tell from his twitchy finger over the "short" button on his online brokerage account that he is getting very close.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.