Surprising New Paradigm in the Gold and Silver Markets!

Commodities / Gold and Silver 2013 Mar 06, 2013 - 02:53 PM GMT How many times have we heard that the precious metals stocks are so oversold and cheap that they can’t go any lower and have to rally. They just can’t go any lower because the low in 2008 was the absolute low that will never be hit again as it was just an extraordinary event. A precious metal stock crash that was a once in a lifetime thing. So based on that low many PM investors bought their precious metals stocks thinking they were buying on the cheap. I’m wondering if they still think the precious metals stocks were a good buy at that 2008 crash low in the ratio charts?

How many times have we heard that the precious metals stocks are so oversold and cheap that they can’t go any lower and have to rally. They just can’t go any lower because the low in 2008 was the absolute low that will never be hit again as it was just an extraordinary event. A precious metal stock crash that was a once in a lifetime thing. So based on that low many PM investors bought their precious metals stocks thinking they were buying on the cheap. I’m wondering if they still think the precious metals stocks were a good buy at that 2008 crash low in the ratio charts?

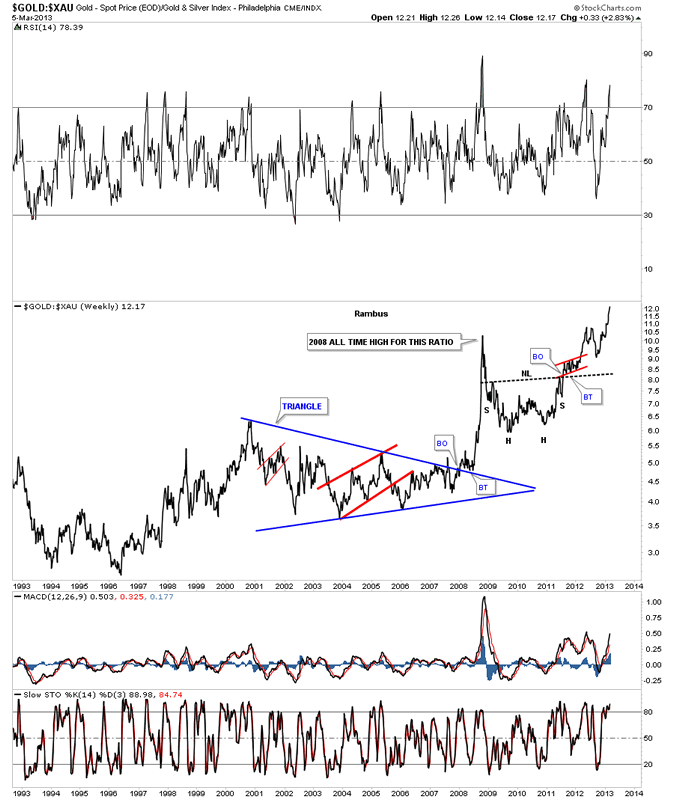

Lets look at the Gold to the XAU ratio line chart that shows the high in 2008 that was supposed to be the new benchmark for the pm stocks being oversold. As you can see on this weekly chart that the 2008 all time high for this ratio was not the concrete ceiling that everyone thought it would be. Its been making new all time highs on almost a daily basis that doesn’t show any signs of topping at the moment.

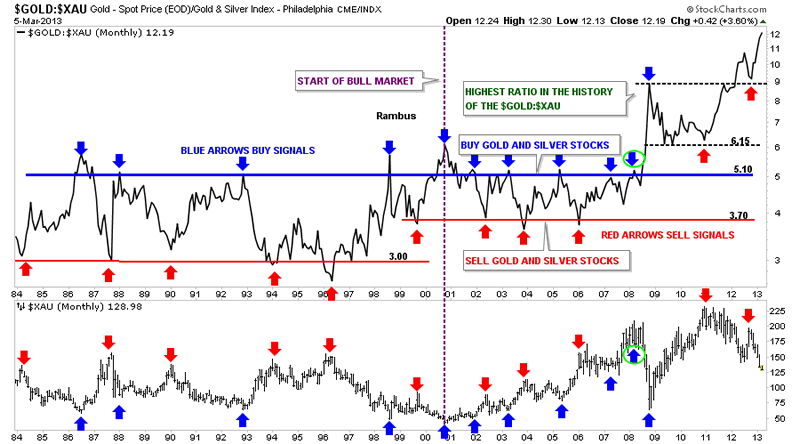

Below is a very long term monthly chart for the gold to XAU ratio. As you can see this ratio chart behaved very well trading between the blue and red horizontal trendlines for many years. The crash in 2008 for the ratio started a course of events that have significantly changed the landscape. The blue horizontal trendline was always a good place to buy precious metals stocks for years as it shows they became very oversold when the ratio got up to 5.10 or so. When the ratio got down to the 3.70 area, red trendline that was a good place to sell and take profits. When they say, this time is different, usually that means nothing has really changed except the perception of a change. In this case something really did change and its not just a perception of a change. The 2008 crash actually did change things. All the old highs at the blue horizontal trendline have now been acting as support once it was broken to the upside. Maybe the fundamentalist can figure out what has changed for the precious metals stocks compared to gold. We will know in time but for right now this ratio chart is telling to be wary of the precious metals stocks.

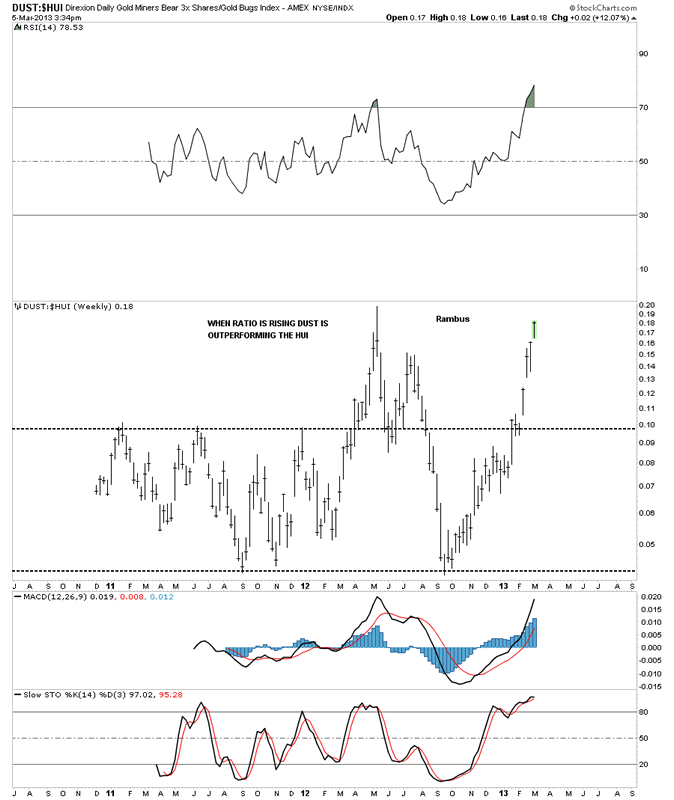

This next ratio chart compares DUST to the HUI. A rising price shows DUST outperforming the HUI and a declining price shows the HUI outperforming DUST. Which investment would you rather have been in since last October? The chart below needs no annotations.

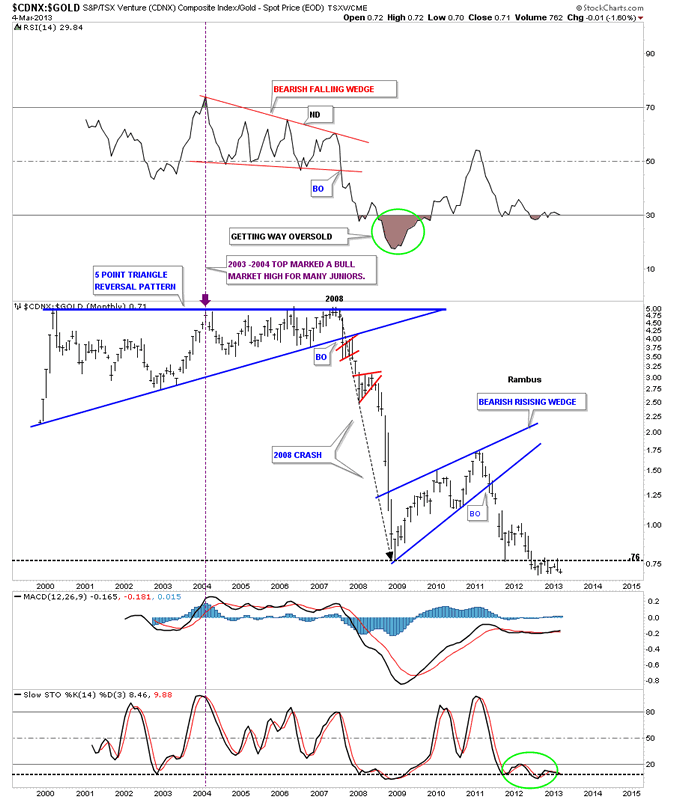

Lets compare the CDNX to gold to see if the juniors have fared any better than the large cap PM stocks. You can see the crash that occurred at the high in 2008 had a fairly decent recovery off the bottom but the CDNX fell way short of making it all the way back to the previous top. It instead built the blue bearish rising wedge that has taken the price action below the impregnable 2008 low. As you can see this ratio has gone nowhere for almost a year now trading below the 2008 low which had been holding resistance.

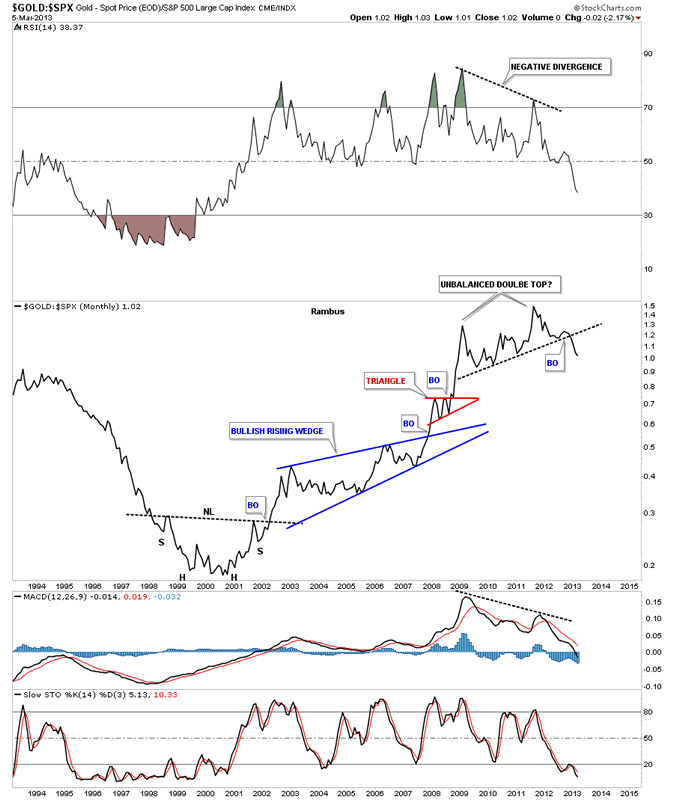

I think this next ratio chart is very telling and is strongly suggesting that the bull market that gold has enjoyed vs the SPX is over for now. You can see the very nice inverse H&S base that launched the bull market for gold against the SPX. That was a reversal pattern. Now note the unbalanced double top that has broken down. The double top is a reversal pattern that is reversing the 13 years bull market for gold to the SPX. These charts talking are talking to us if we care to hear what they are saying.

Gary (for Rambus Chartology)

FREE TRIAL - http://rambus1.com/?page_id=10

© 2013 Copyright Rambus- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.