How to Safely Hedge Your Stocks Portfolio in Uncertain Times

Portfolio / Learning to Invest Mar 08, 2013 - 03:08 PM GMTBy: Investment_U

David Eller writes: What a year 2013 has been. The S&P is up 6% and we’re 3% away from all-time highs. The Dow Jones broke through 14,000…

David Eller writes: What a year 2013 has been. The S&P is up 6% and we’re 3% away from all-time highs. The Dow Jones broke through 14,000…

Can things get better from here? Can they even stay this good? Nobody knows where the markets will go, but there are ways to protect yourself and sleep easy at night.

Personally, I’m not a believer in short selling individual stocks. The deck is stacked against you. The Fed wants asset prices to increase, company management teams want stock prices to rise and sell-side investment analysts constantly prop up share prices of weak corporations. This is just too much to compete with when there is easier money to be made buying stock of good companies.

However, if you are concerned about protecting gains, short selling an index can be an effective way to lock in profits, without liquidating your portfolio. Why go to the trouble?

Let’s say you’re fully invested in The Oxford Club’s Oxford Trading Portfolio. This consists of 25 stocks in diverse industries. It could make sense to keep your positions on for tax purposes, to capture the dividends, or just because you think these stocks will outperform if the market sells off. How can you protect yourself?

Some methods are better than others, so we analyzed the five major pullbacks over the last three years to find the best ways to hedge. We also uncovered some useful takeaways that can help you protect your hard-won gains.

Shorting SPY isn’t an efficient hedge.

The first option that comes to mind is shorting the S&P 500 tracking stock, the SPY. It makes sense this would protect your downside on a one-for-one retreat in the S&P 500. But unfortunately, empirical evidence shows this isn’t the case.

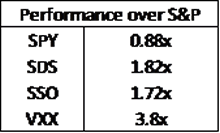

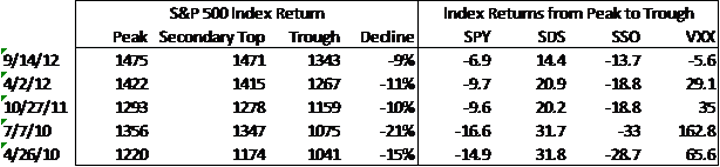

According to the second table, the SPY only pulled back 88% of the decline. And in Table 1, it retraced a smaller percentage than the S&P in each of the five pullbacks. While it is possible to short the SPY to protect gains, it clearly isn’t efficient.

Buying VXX is like juggling chainsaws.

The most dangerous method may also be the most talked about. The financial press loves to discuss a fear gauge known as the VIX. If you time an investment in this security perfectly, you can see dramatic returns. During the market sell-off between April 2 and June 4 of 2012, the VXX returned 29% compared with a 9.6% drop in the S&P. It also increased by 3.8 times the pullback of the S&P 500 on average over the last five meaningful declines.

The returns are great… But in my opinion, investing in this security could be compared with juggling chainsaws. Your timing has to be perfect. If you had left the position on until June 20, the return would have dwindled to -5%, even though the S&P was still down -6%.

The VXX loses money every day in a normal market because of the way it rebalances. Each day, the VXX has to buy a certain percentage of VIX contracts, two months out, while selling that same percentage of contracts one month out. Because time is a component of option value, the longer-dated options usually cost more. This drives down the value of the fund as cheaper contracts are replaced with more expensive ones.

Buying SDS is expensive, but doesn’t require a margin account.

Inverse index ETFs such as SDS are another option – and you don’t need a margin account for this strategy. The SDS tries to mimic performance that is twice the inverse of the daily return of the S&P 500. If the S&P falls 2%, the SDS should rise 4%. We back-tested this security against the SPY and found it tracks the index closely.

The SDS is volatile, but it does what it claims to do. However, it can eat up a lot of your buying power. When you sell a stock short, you borrow the security from your broker and sell it to somebody else. Margin interest is not paid on the total value of the security. It is only paid on the dollar value the position moves against you. Imagine you sold short 100 SPY at a price of $150. If the position moves against you to $151, you would be paying margin interest on $100 instead of $15,100.

Shorting SSO provides both leverage and correlation with the S&P 500.

The SSO is the reverse of the SDS. It is a levered, long ETF that tracks the S&P 500 closely. On average, it fell 1.72 times the range of the S&P 500. If a person wanted to fully hedge a $100,000 portfolio, it could be done with $58,000 ($100,000 / 1.72 = $58,140). The investor would also only need to pay interest on the loss of the hedge, rather than the full amount.

If you have a diversified portfolio, you are naturally hedged against an upward drift in the market; shorting an index or buying an inverse ETF are ways to accomplish this goal. But remember, some methods are more volatile and require a margin account, so be sure to consider your personal situation and tolerance for risk when selecting a strategy.

Good Investing,

by David Eller,

Source: http://www.investmentu.com/2013/March/how-to-safely-hedge-your-portfolio-in-uncertain-times.html

Copyright © 1999 - 2012 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.