The Hidden Costs of Gold and Silver Miners’ Optimism

Commodities / Gold and Silver Stocks 2013 Jun 18, 2013 - 03:29 AM GMTBy: Casey_Research

By Andrey Dashkov, Research Analyst:

By Andrey Dashkov, Research Analyst:

The junior resource sector is struggling financially, something most investors seem to agree on – and rightly be wary of. Here at Casey Research, we've analyzed both producers and explorers to see how profitable (or value-adding) they may be under current market conditions. The rather obvious conclusion, shared by many company executives, is that now is the time to be frugal.

Producers have started to focus on cutting costs and pulling back from development projects that have diminished prospective returns or otherwise unacceptable risk profiles.

Developers have sinned in their own way, too: as gold prices rose year after year, the price assumptions used in economic studies likewise went higher and higher. Some used assumptions that were too optimistic. And now that trend is coming back to bite them – as well as any investor who buys into those assumptions.

Naturally, when the gold price continued rising, it seemed to justify using a higher gold price when calculating how profitable a mine might be. This worked well to persuade banks to loan money and investors to buy stock, and some mines were built without enough consideration of a protracted price reversal, which has caught less prepared companies and investors off guard.

We believe gold will rebound and head higher, as you know, but that hasn't happened yet, and some mines that went into construction or production based on unrealistic assumptions are facing greater costs and lower revenues, resulting in net incomes far below investors' expectations.

All of this is fairly predictable, but that doesn't prevent many executives from making bad decisions, and it only adds to the overarching skepticism about the future of the industry.

Some of this could have been avoided during the feasibility stage.

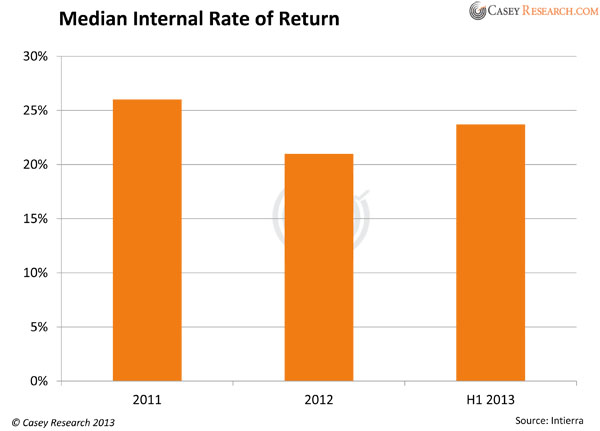

For the following chart, we pulled data on 86 Canadian economic studies filed on gold (and multi-metal projects containing gold) from 2011 onward. The studies cover projects in scoping, prefeasibility, feasibility, and expansion stages.

Consider: if the gold price is significantly lower now than, say, a year ago, the internal rate of return (IRRs) of these projects should be lower, too (given similar cost structures and interest rates). But that's not the case. There was a drop in 2012, but so far in 2013, companies are on average projecting almost the same rates of return they were in 2011.

IRRs will probably continue to look good despite the current correction in the gold price, simply due to the fact that a project is only attractive to potential investors and financiers if it provides an IRR greater than 20%, preferably 30%, on an after-tax basis. Anything below that is difficult to finance under normal market conditions, let alone during the present weak metals environment.

To achieve such high IRR numbers, management teams have to carefully think through multiple ways to optimize project economics, including cost control, allocation of capital resources, optimal production capacity, life of the mine, and other issues. That's fine, but one has to wonder why things weren't as optimized before – we can only conclude that some companies continue to use unrealistic assumptions. Whether that's misplaced optimism or malfeasance has to be determined on a case-by-case basis.

This means that IRRs alone may be misleading benchmarks. Investors doing their due diligence need to look past the flashy economic numbers and consider the inputs that went into producing the IRR – and that includes gold price assumptions, which are one of the simplest and easiest-to-spot signs of excessive optimism.

Now, almost any economic study includes several scenarios to test how sensitive the resulting IRR (or net present value) is to the underlying premises. In most cases, however, there is a "base case" scenario that serves as a benchmark. The problem arises when the gold price drops below it, even if temporarily, as the investment community becomes confused and surprised.

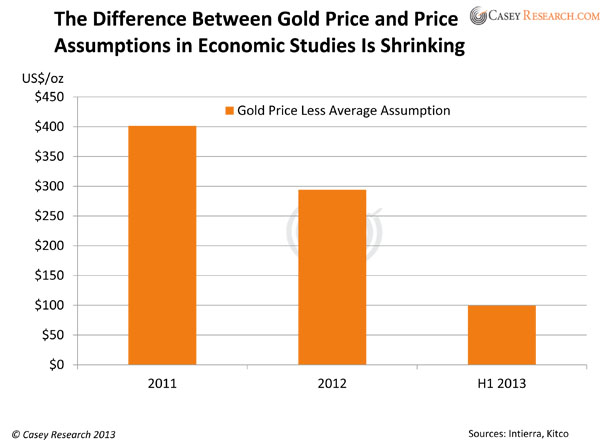

That's why we sometimes evaluate economic studies with lower gold price assumptions than what is used as a base case. The next chart shows why this is important.

Our sample of Canadian economic studies filed since 2011 shows that while the annual gold price is 1.8% lower than this year's average price (so far), the gold price assumptions used in economic studies have increased by almost 24% – not in relative terms, but in absolute terms: from $1,170 to $1,450. Worse, some of the projects in the sample hardly worked at a gold price below $1,700.

What does this tell us? First, base-case scenarios outlined in economic studies published over the past three years should be viewed with caution. What looks like a reasonable price projection for a rising market does not work too well during a falling or stagnant one. Again, we do see our market sector resuming its northward march, but until that happens, developers with such high assumptions are simply not going to get the money they need to build their mines.

Second, using aggressive gold price scenarios is very risky. In the short term, current lower price levels will produce quarters of weak income and operating cash flow, all to the detriment of the shareholders. Projects with assumptions currently above spot will not get financed. Conservative price assumptions and economic robustness are what preserves shareholder value in the long term.

Third, many development-stage properties will never reach production.

What to Do

First, realize that this is not the end of the sector. It's normal for some development-stage properties to never become mines, for reasons beyond gold price assumptions.

Second, gold supply won't decline in the short term due to aggressive price assumptions. Remember that there is a significant time lag between development and production; there are mines coming onstream now whose economic studies from several years ago were based on lower gold prices. Most of those projects should continue contributing to new mine supply. In fact, some analysts predict that although the gold price may remain flat for a while, mine production will rise in 2013. CPM Group estimates gross additions to reach 5.2 million ounces, 53% of them from new operations.

It's worth repeating that in the current market, it's better to be flexible than large. Mining higher-grade areas in a flat gold price environment should help sustain both costs and margins, while the developers should be more conservative when it comes to forecasts. In our opinion, flexibility and prudence are the ways to win in a weak metals price environment.

The best way for precious-metals investors to win in such an environment is to seize the opportunity and buy the best mining stocks while they're deeply discounted. Such a contrarian play is the way many fortunes have been made... and you can do it, too. Casey Research has created a unique, free webinar focusing on the insights of investing legends like Doug Casey and Rick Rule; Downturn Millionaires: How to Make a Fortune in Beaten-Down Markets will show you how it's done. Watch it now and get started on your fortune.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.