Trend Changes in Financial Markets: 7 Key Market Calls

Stock-Markets / Elliott Wave Theory Aug 02, 2013 - 08:50 PM GMTBy: EWI

Elliott Wave International is dedicated to helping subscribers anticipate the next major market turn. No, we don't always "get it right" - yet the examples below speak for themselves.

Elliott Wave International is dedicated to helping subscribers anticipate the next major market turn. No, we don't always "get it right" - yet the examples below speak for themselves.

1. In 2005, EWI called the 2006 real estate turn.

Some say real estate can't go down because far too many people are concerned about a real estate bubble, a worry that is now even greater than it was for stocks at the March 2000 NASDAQ peak ... it is actually another sign of a top when participants are dismissive of the warnings.

The Elliott Wave Financial Forecast, July 2005

House prices peaked in July 2006. By April 2012, the Associated Press reported, "Home prices have fallen 35% since the housing bust."

2. In 2007, EWI called the stock market turn.

Aggressive speculators should return to a fully leveraged short position now. We may be early by a couple of weeks, but the market has traced out the minimum expected rise, and that's enough to act upon.

The Elliott Wave Theorist, Interim Report, July 17, 2007

Those aggressive speculators were rewarded. From an Oct. 9, 2007, high of 14,164, the Dow Industrials tumbled to 6,547 by March 9, 2009.

3. In 2008, EWI called the crude oil turn.

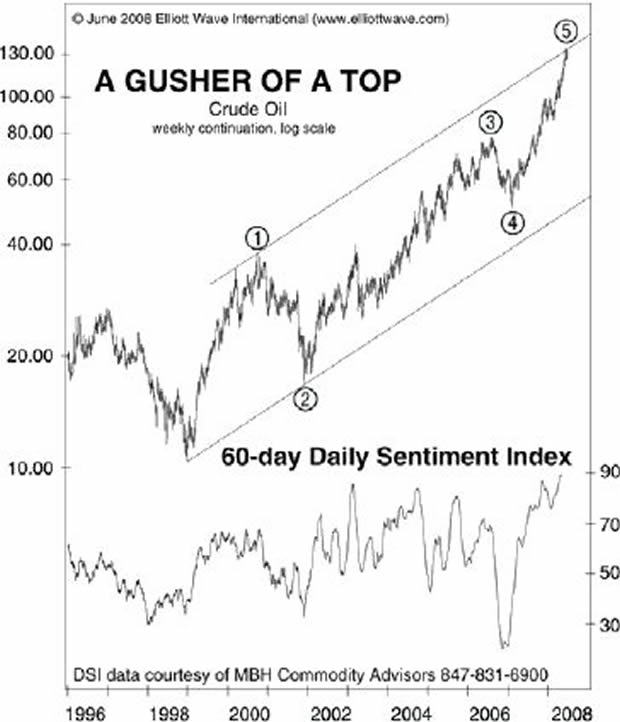

Less than six weeks before the $147 high in the price of oil, the June 2008 Financial Forecast observed that "The case for an end in oil's rise is growing even stronger." The chart below was published in that issue:

Note that the sentiment index on the chart shows bullish sentiment reaching 90%.

By December 2008, the price of oil had declined 80%.

4. In 2011, EWI called the retracement high in the CRB Index.

The CRB index has reached the upper end of its corrective-wave trend channel while simultaneously reaching a Fibonacci 50% (1/2) retracement of the 2008-2009 decline, as it completes an A-B-C rally. This index should soon begin another wave down that takes it below the 2009 low.

The Elliott Wave Theorist, January 2011

The CRB index topped less than four months later.

5. In 2012, EWI called the turn in gas prices.

The rush to extrapolate [rising prices] is all we need to conclude that the odds of ... gasoline prices going to the moon are extremely low.

The Elliott Wave Theorist, April 2012

Gasoline prices topped during the same month that issue published.

6. In 2009, EWI called the turn in stocks.

The majority of investors thought that the period from October 10 to year-end 2008 was a major market bottom. But over the past four months The Elliott Wave Theorist, The Elliott Wave Financial Forecast and the Short Term Update have repeatedly stated, without equivocation, that the market required a fifth wave down. There were no alternate counts. The Wave Principle virtually guaranteed lower lows, and now we have them.

I recommend covering our short position at today's close.

The Elliott Wave Theorist, Special Investment Issue, Feb. 23, 2009

The Dow Industrials hit a major low just 10 days later!

7. In 2012, EWI called the trend change in bond yields.

Investors' waxing fears will cause them to start selling bonds, which will lead to lower bond prices and higher yields. ....

If rates do begin to rise as we expect, most observers will probably be fooled.

The Elliott Wave Theorist and Financial Forecast, Special Report, June 2012

On July 5, 10-year bond yields climbed to 2.72%, its highest level since July 2011.

In each of these forecasts, the consensus opinion was on the opposite side. Most investors never saw these major trend changes coming. Again, we're not perfect -- no forecasting service is.

Come see what we see.

|

You'll get some of the most groundbreaking and eye-opening reports ever published in Elliott Wave International's 30-year history; you'll also get new analysis, forecasts and commentary to help you think independently in today's tumultuous market. Download Your Free 50-Page Independent Investor eBook Now >> |

This article was syndicated by Elliott Wave International and was originally published under the headline Trend Changes in Financial Markets: 7 Key Market Calls. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.