Microsoft: Look at This Chart Before You Decide to Invest

Companies / Microsoft Sep 03, 2013 - 11:54 AM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Judging from the 7.28% "Ballmer Bounce" that followed his announcement, the markets love the idea of long-suffering Microsoft CEO Steve Ballmer stepping down.

Keith Fitz-Gerald writes: Judging from the 7.28% "Ballmer Bounce" that followed his announcement, the markets love the idea of long-suffering Microsoft CEO Steve Ballmer stepping down.

So do a lot of investors who believe now - finally - it's time to buy Microsoft.

But is it?

Can the company bring in a new CEO with vision? Can it finally begin to understand content? And is it willing to jettison employees and products that aren't "worth" what the legacy suggests?

I could write you some long, eloquent essay on the merits of corporate turnarounds.

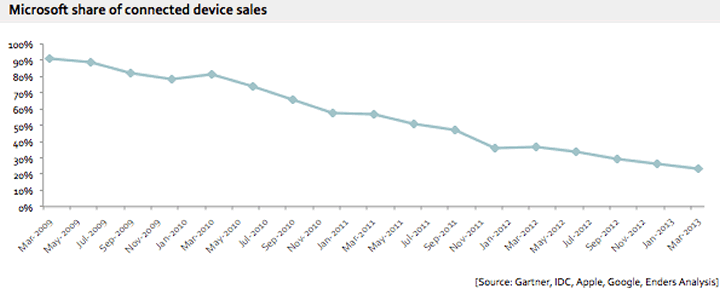

Instead, I'm going to show you one simple chart...

To me, it's clear: All good brands have their day.

As recently as March 2009, the Redmond-based behemoth enjoyed a 90% market share in connected devices running Microsoft systems.

Today that's shrunk to less than 25%, which leads me to believe that Microsoft has had its day.

Some could argue that's because the number of devices has increased dramatically over the same time frame. But remember, there are going to be 7 billion interconnected devices on the planet by the end of this year and roughly 50 billion by 2020 - seven for every person alive on the planet today.

Apple recognized this early and changed the game with its tablets and its iPhones. Ballmer misjudged their impact and was dismissive. So did Palm, RIM, Dell, Gateway, Wang... and we know where they are today, after watching their share of interactive utilization and connected devices plummet.

Apple stock shot up more than 5,300% since January 2001. And Microsoft...

Well, let's just say that to call it "stagnant" is an insult to truly stagnant stocks. It's returned 24.26% over the same time period - and that only comes after a 23% rally since the top of 2013 alone.

As for the previously mentioned Ballmer Bounce...

The market quickly gave most of it back, dropping 5% over the following three trading sessions. It looks like the Street doesn't believe a new CEO will have any more luck righting the listless Microsoft ship.

My good friend Barry Ritholtz, CEO of Fusion Capital, put it this way during a recent conversation: "Microsoft stopped setting the agenda 18 years ago."

I agree. Windows was its defining moment, and the company has been playing a game of "me too" ever since.

The real question: Can the stock recover now that Ballmer is going out the door? I wouldn't bet on it.

The Numbers Are Going in the Wrong Direction

About all the company has going for it is legacy contracts that keep Windows and Microsoft Office alive - but only if you're a clod like me who simply cannot work with Google Docs and who finds the Appleware not broadly enough used to warrant a shift away from windows. Or a government contractor who's contractually restricted from any logical alternatives.

If you want to talk devices, the story is the same. Droid phones now account for 79% of worldwide shipments, which is a 14.49% increase in just 12 months. Microsoft is a puny 4% of the market, and Blackberry - remember them? - is a mere 3%. Even Apple is losing share, so I wouldn't bet on a Cupertino comeback either, while we're on the topic.

Still, diehard fans insist that Microsoft can recover.

I don't see how.

The company has to make up ground in just about every category I can think of - smart devices, tablets, desktop computing, cloud computing, form hardware... even office productivity, where substitutes are supplanting the spinning blue Windows "wheel of death" we used to see when a Microsoft-based system crashes.

This is not the 1990s, and consumers are not discovering technology for the first time. Today they're cautious, cynical, and, perhaps most importantly, fickle. Brand loyalty is going by the wayside as devices become platform insensitive. Just ask the "dude, you're getting a Dell" guy.

What's more, Microsoft's business model of small incremental improvements doesn't cut it in an era of instant updates. People just don't give a hoot about a few more farkles on the desktop.

If anything, they've become resistant to too much change. The tiles in Window's latest edition are a great example and the primary reason why my company hasn't upgraded. I don't want to have to figure out how to use software that should be instinctive. We, like many other companies I am familiar with, are moving away byte by byte from Windows and from Office, too, even if we can't let go entirely... yet.

And finally, Microsoft has long pursued everything under the sun, using its size as a weapon. Now it's a liability. Microsoft, despite trying to continually position itself as a growth company, is now a sad version of its former self. At best, Microsoft has transitioned into a value company, although even that's debatable.

As the old Japanese proverb goes, to begin is easy - to continue is hard.

Timeless Insights: Eight Reasons Mimi Would Sell Microsoft...

Source :http://moneymorning.com/2013/09/03/microsoft-look-at-this-chart-before-you-decide/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.