Gold: An Attitude Adjustment For Institutional Banks

Commodities / Gold and Silver 2013 Sep 06, 2013 - 06:23 PM GMTBy: Clif_Droke

The last couple of weeks have witnessed changing attitudes of large institutions concerning the gold price. A growing number of institutional analysts are become bullish - some them ultra bullish - on gold's near-term outlook. What makes this unusual is the fact that only a few weeks ago they were singing a bearish tune. The swift attitude adjustment is a testament to the strong impact of rising prices on the investor psyche.

The last couple of weeks have witnessed changing attitudes of large institutions concerning the gold price. A growing number of institutional analysts are become bullish - some them ultra bullish - on gold's near-term outlook. What makes this unusual is the fact that only a few weeks ago they were singing a bearish tune. The swift attitude adjustment is a testament to the strong impact of rising prices on the investor psyche.

For instance, it was recently reported that Citigroup expects gold will rise to $1,500-$1,525 - a gain of over 6% from today's prices. Moreover, Citigroup's Tom Fitzpatrick's forecast that gold could reach $3,500 "in the next couple of years." He also sees silver jumping to $100/oz.

Joining the bullish bandwagon for gold is Societe Generale, but with a twist: SOCGEN analyst Albert Edwards foresees a stock market crash on the horizon; he also believes the gold price will climb to $10,000 as investors rush into safe haven investments. Back in June, SOCGEN analysts Michael Haigh, Jesper Dannesboe and Robin Bhar argued that ETF selling and plummeting jewelry demand would result in a Q4 gold price of $1,200/oz. SOCGEN also recommended dumping safe havens like gold in exchange for buying bank and consumer retail stocks back in June. Talk about a reversal of sentiment!

Sounding a more level-headed note, Goldman Sachs recently weighed in on gold's near-term prospects. Goldman has been rather quiet after correctly predicting the May-June gold sell-off and subsequent market bottom. Of the major institutions, Goldman is by far the most accurate when making forecasts, though I should point out that even mighty Goldman sometimes gets it wrong. (Remember the blown $200/barrel oil forecast in 2008?)

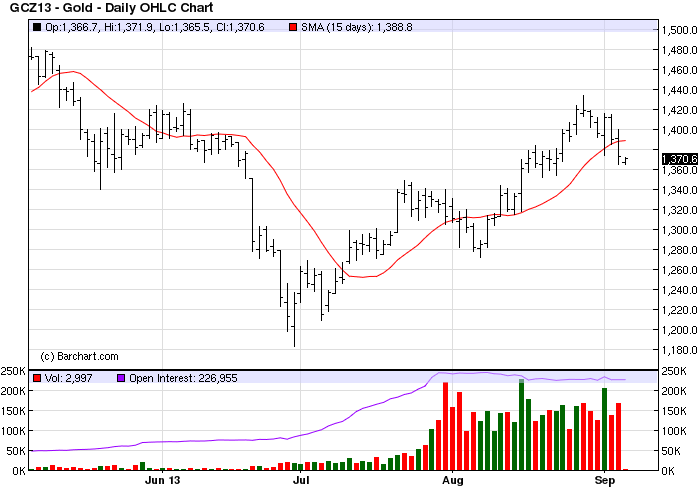

According to The Economic Times, Goldman Sachs raised its gold forecast for the second half of 2013 to $1,388/oz. from $1,300/oz. based on the metal's recent price action. The firm is maintaining its intermediate-term and long-term price forecasts, however. Of the major institutions that have made gold price forecasts, Goldman Sachs seems to be the most balanced and realistic.

"We believe the recent uptick is a result of investors positioning themselves for an increase in inflation rates and speculation regarding a potential military strike on Syria," the bank said in an equity research note dated Sept 2.

According to The Economic Times, Goldman said it expects gold prices to ease, longer term, on improvement in the U.S. economy and the reining in of an accommodative Federal Reserve monetary policy.

As noted previously, the implication of these high-profile institutional predictions is that sentiment among the big banks on the metals is becoming optimistic bordering on giddy. This isn't exactly a good sign from a contrarian perspective. Already gold has violated its 15-day moving average to technically break the immediate-term uptrend. While this may prove to be merely a temporarily "pause that refreshes" for the metal, conservative traders should treat the signal with respect and wait for the buyers to reassert themselves by retaking the 15-da MA.

I would also point out that the non-commercial short position among gold speculators, after rising to a multi-year record level recently, has dropped precipitously in recent weeks. Analyst Tyler Durden has pointed out that short positions in the gold futures and options market have dropped for six of the last seven weeks. "The 60% drop in the non-commercial short position represents a massive 81,700 contracts (8,170,000 ounces or ~$10.6 billion worth of notional 'paper' gold)," he wrote. He further noted, "Gold's 21% rise from the lows in the last 2 months is among the fastest rises since 1999 ; and GLD holdings have risen for the last 6 days in a row."

The sharp decline in gold short positions gives us another reason to exercise caution in the near term since bearish sentiment is rapidly being replaced by bullish sentiment. This can create irrational expectations for short-term gains among speculators. Should these gains be disappointed it can result in a potentially sharp pullback in the gold and silver prices.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets? Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you're buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the "smart money" pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you'll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.