When Inflation Strikes Back

Stock-Markets / Inflation Nov 13, 2013 - 12:49 PM GMTBy: Clif_Droke

Is there such thing as too little inflation? To listen to some economists the answer is an emphatic “no!” Fed chief Ben Bernanke certainly doesn’t believe in the concept of low inflation. Neither does ECB president Mari Draghi. But the question must be asked: with so much official opposition to low inflation, how will America’s middle class ever fully recover from its current malaise?

Is there such thing as too little inflation? To listen to some economists the answer is an emphatic “no!” Fed chief Ben Bernanke certainly doesn’t believe in the concept of low inflation. Neither does ECB president Mari Draghi. But the question must be asked: with so much official opposition to low inflation, how will America’s middle class ever fully recover from its current malaise?

Economists were shocked last week when Europe’s inflation fell to a “dangerously low” annual rate of 0.7 percent. It’s commonly assumed that when the rate is that low, companies, households, and even governments have a difficult time reducing debt. What economists fail to consider, though, is that low inflation is beneficial to the working class because it lowers the cost of living, which can outweigh the cost of servicing debt. Since food, fuel and housing costs make up the bulk of the middle class budget a lower inflation level will only help the struggling middle class and can even serve to stimulate consumption.

One of the major flaws in the Fed’s inflationist response to the credit crisis is that retail prices for many goods were never allowed to fall. Consequently, the unnaturally high price levels that were established between 2004 and 2008 were never “corrected.” This means that when the next long-term inflationary cycle begins in late 2014 consumers will likely be forced to contend with even higher prices in the years ahead. There is a reason why a 60-year boom/bust cycle exists: it’s nature’s way of cleansing the economy of imbalances and excessively high (or excessively low) prices. When central banks refuse to let the natural cycle take its course it only creates long-term imbalances which in turn can result in major social, political and economic conflagrations.

In the U.S. it was recently announced by the Labor Department that consumer prices for September rose by only 1.2 percent year-over-year. This came short of the Fed’s arbitrary 2 percent inflation target, giving the Fed yet another reason to consider its ill-advised stimulus measures. While a case could be made for the Fed’s intervention in the immediate wake of the 2008 credit crash, its continued stimulus over the last five years has paved the way for future inflation – and significant trouble for the U.S. middle class.

According to The New York Times, inflation is “not rising fast enough” for Washington’s liking. The article by Binyamin Appelbaum stated economists are nearly unanimous in asserting that “a little inflation is particularly valuable when the economy is weak.” That’s not the testimony of history or even the recent past. Just ask Japan: for the better part of 20 years the country experienced extremely low inflation and periods of deflation, yet consumers were content with the low cost of living that enabled them to get by when the economy was slack. Moreover, inflation is an indirect form of taxation since it erodes the savings and purchasing power of consumers and thereby chokes off economic growth.

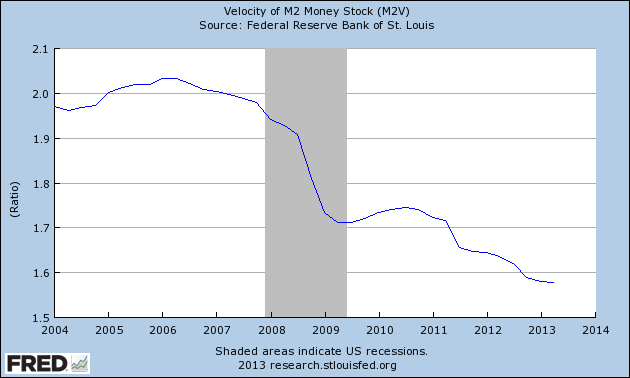

Apparently, Ben Bernanke’s successor Janet Yellen is another believer that a controlled amount of inflation is a good thing. Like Bernanke, she’s being encouraged by policymakers to continue the Fed’s policy of artificial inflation for the sake of juicing the economy. The fallacy behind this policy is that by keeping the Fed funds rate at or near zero and providing copious amounts of liquidity, demand can be stimulated. Far from being the case, creating artificial inflation by money printing will do nothing to increase spending on a broad scale, as the chart showing monetary velocity suggests. Instead, the evidence strongly suggests that the Fed’s QE program has only succeeded in increasing the demand for money itself, that is, money that is kept in safe havens and not spent directly into the economy.

There’s an old saying that has become trite through its frequent repetition: “Be careful what you wish for, you just might get it.” This bromide rings true, however, when applied to the current Federal Reserve policy. By obsessing over the lack of inflation in the U.S. economy these past five years, the Fed will very likely be surprised by the vigorous growth of inflation in the years following 2014 after the commencement of a new economic Super Cycle. The trillions that were created by the world’s central banks to fight deflation will then become tinder for the fires of inflation that will sooner or later be kindled.

Gold

The price of gold fell sharply on Tuesday, declining 1.23% in a day of active trading. The downside move was blamed on investor speculation that the Fed would begin tapering its QE monetary policy as soon as December. Such speculation has been rife in recent weeks and has consistently been “whipsawed” by the Fed. It’s akin to short-term “noise” and should be ignored as such. What can’t be ignored, however, is the action of the gold price.

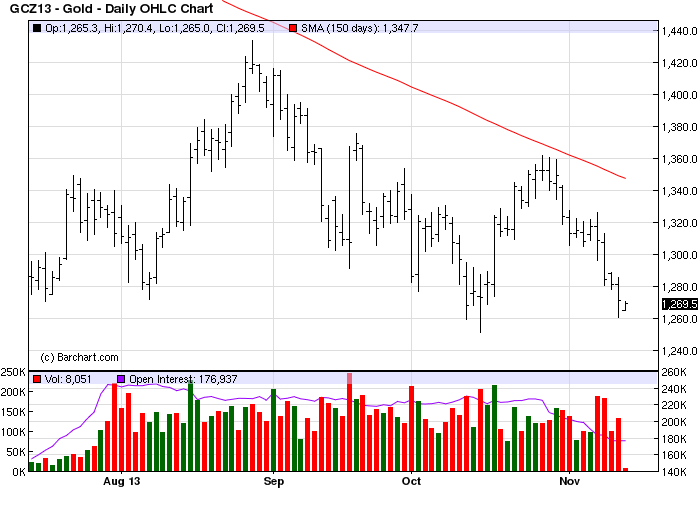

Historical evidence suggests that perhaps the single best indicator for tracking the gold price in a bear market is the 30-week (150-day) moving average. The dominant direction of gold tends to follow the slope of this psychologically important trend line during the course of a bear market. This has certainly been the case so far this year, as the following graph shows.

Gold has now returned to its previous closing low from mid-October of $1,268. This is the all-important “moment of truth” for the metal. A close below this benchmark level would pave the way for additional technical selling since many algorithm and technical traders will view this as a “double bottom failure.” A self-fulfilling prophetic decline could then ensue as momentum traders seize the initiative to push gold even lower. It would likely be a short-lived affair but could be a nasty spill if $1,268 is decisively broken.

Stock Market Cycles

Take a journey with me as we uncover the yearly Kress cycles - the keys to unlocking long-term stock price movement and economic performance. The book The Stock Market Cycles covers each one of the yearly cycles in the Kress Cycle series, starting with the 2-year cycle and ending with the 120-year Grand Super Cycle.

The book also covers the K Wave and the effects of long-term inflation/deflation that these cycles exert over stock prices and the economy. Each chapter contains illustrations that show exactly how the yearly cycles influenced stock market performance and explains where the peaks and troughs of each cycle are located and how the cycles can predict future market and economic performance. Also described in this original book is how the Kress Cycles influence popular culture and political trends, as well as why wars are started and when they can be expected based on the Kress Cycle time line.

Order today and receive an autographed copy along with a copy of the booklet, "The Best Long-Term Moving Averages." Your order also includes a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter:

http://clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.