New U.S. Recession 2014-2015 90% Chance

Economics / Recession 2014 Feb 03, 2014 - 10:22 AM GMTBy: Jas_Jain

Q: Have Bernanke, Krugman and Yellen predicted any recession, in their career, before it happened?

Q: Have Bernanke, Krugman and Yellen predicted any recession, in their career, before it happened?

A. N-O-NO.

Q: Have Bernanke, Krugman and Yellen predicted recoveries before they happened?

A: YES, always.

Q: Do they predict that recovery would continue for years, at least the next three years, with a growth above 2%?

A: All the time.

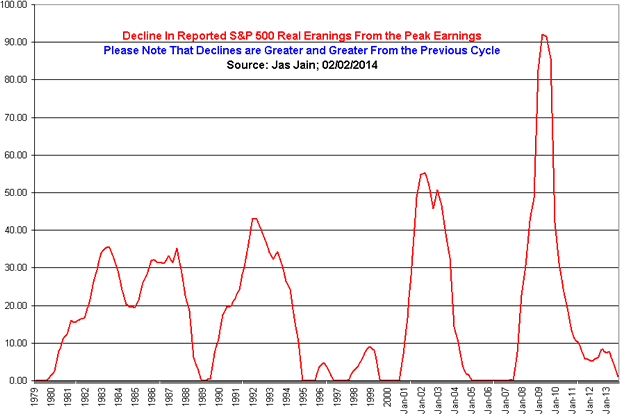

Q: Does Wall Street ever predict that an earnings decline of 35-90% could happen within the next two years?

A: Never.

Q: Does it happen?

A: Yes, with a fair amount or regularity (pl. see the attached graph).

Any honest person would call such behavior purposely misleading and fraudulent, no? They remain oblivious to the business cycle despite its permanence. Economists and Wall Street commit "periodic," or cyclical fraud, very predictably.

Q: Who have the best record at predicting recessions?

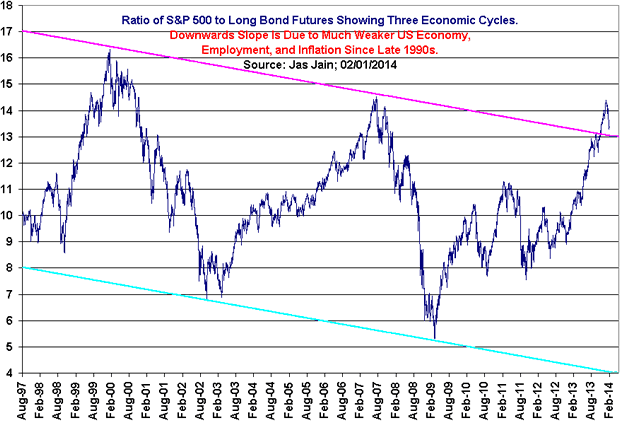

A: Financial markets, most notably, commodities, the Scam Market and the US Treasury markets, e.g., the yield-curve inversion.

I have developed a methodology of characterizing the business cycle using two financial market indicators, S&P500 and US Treasury bond futures. Based on the attached graph I am predicting that a US recession is very likely, close to 90% chance, to begin during 2014Q2-2015Q1 with most likely date being September 2014. This should coincide with earnings declines during 2015-16. I also expect the coming recession to be much more severe than the last one and S&P 500 to make a new low.

Enjoy the Super Bowl! The next one would most likely be played during a recession. Go Broncos!!

By Jas Jain , Ph.D.

the Prophet of Doom and Gloom

Copyright © 2014 Jas Jain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.