Gold and Silver Stocks Begin Next Leg Higher

Commodities / Gold and Silver Stocks 2014 Jun 13, 2014 - 11:55 AM GMTBy: Jordan_Roy_Byrne

Yes you read that correctly. The miners have begun another leg higher because the evidence strongly supports the view that they have formed a higher low. Only time will tell for sure but the evidence is quite strong. It seems that every analyst was calling for a July low. I felt strongly that the miners would make their next low after Gold broke below $1200. I was far more confident in the bullish case at the June 2013 and December 2013 bottoms. I was even skeptical after Tuesday’s upside explosion. However, the weight of the evidence today argues that the miners have made a higher low and are starting their next leg higher.

Yes you read that correctly. The miners have begun another leg higher because the evidence strongly supports the view that they have formed a higher low. Only time will tell for sure but the evidence is quite strong. It seems that every analyst was calling for a July low. I felt strongly that the miners would make their next low after Gold broke below $1200. I was far more confident in the bullish case at the June 2013 and December 2013 bottoms. I was even skeptical after Tuesday’s upside explosion. However, the weight of the evidence today argues that the miners have made a higher low and are starting their next leg higher.

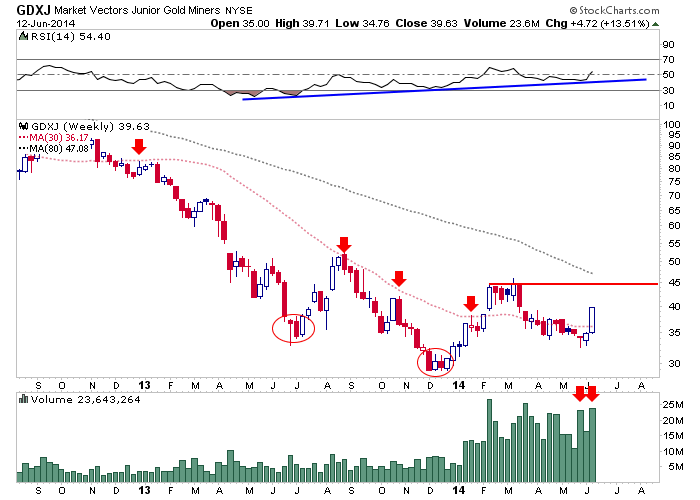

First let’s look at GDXJ which is showing leadership. I want to highlight three bullish points. First, the volume has been huge. Weekly volume will be a record. Daily volume was near records the day before GDXJ bottomed (May 27) and the day it bottomed (May 28). After Monday it appeared the miners could head lower. Tuesday GDXJ gapped up and closed at the high of the day on huge volume. Wednesday’s volume dipped only slightly while Thursday’s volume was an all time high! Strength was followed by strength. The second point is that Tuesday and Wednesday’s explosions came with the metals being up less than 1% in that entire period. The shares are showing excellent relative strength at a time when the metals are in a weak technical position. Third, note that GDXJ is set to close at a 12-week high. That is quite a bit of strength only two weeks after a low. The initial rebounds from the previous two lows were much weaker in size and intensity. GDXJ’s next resistance is $44. A weekly close above $44 marks a higher high.

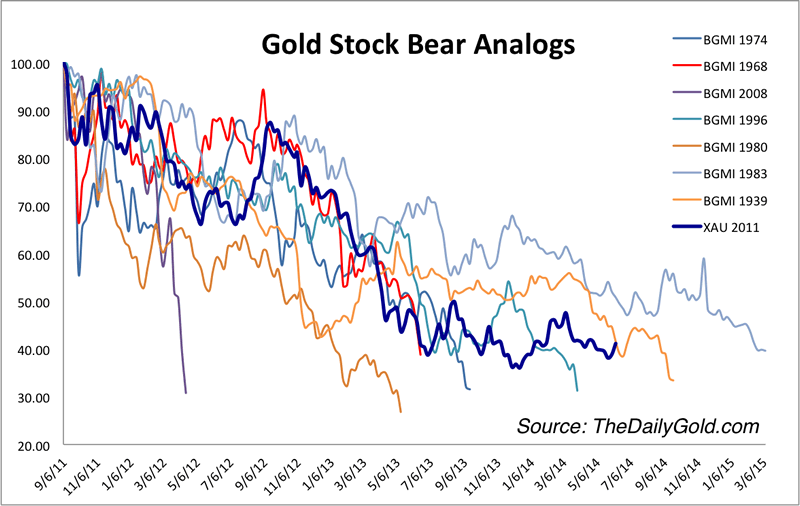

Meanwhile, history argues that its very unlikely that the bear in the miners isn’t over. The current bear would be the third longest ever. The two longest bears were the longest because their price damage was mild until the tail end. It’s not impossible that the current bear could roll over to a final low. We thought that was possible until Wednesday. However, given the aforementioned strength in the sector, it seems highly unlikely.

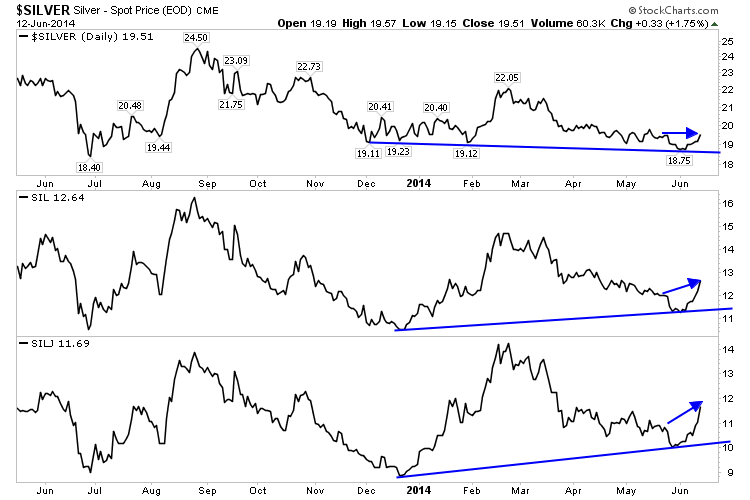

The action in Silver and the silver stocks also leads me to believe that the near term risk reward strongly favors the upside. We’ve been waiting for Silver to break below $18 because we believe it would mark a clear end to its bear market. Silver recently closed at an 11-month low and the same week closed Friday at $18.82, which marked a new weekly low for the bear market. Silver has since failed to decline further. The metal has started to rally and it could spark a short squeeze. Gross short positions reached a new all time high in each of the past two weeks. Moreover, the chart below shows the positive divergence in the silver stocks. While Silver tested its June 2013 low, SIL and SILJ were trading well above their lows.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.