What Crude Oil Says About Silver Price

Commodities / Gold and Silver 2014 Jun 26, 2014 - 06:37 PM GMTBy: DeviantInvestor

If you want to know where silver prices are going, ask crude oil!

If you want to know where silver prices are going, ask crude oil!

Crude Oil Prices:

December 1998 Crude Oil price was under $11

January 2000: Crude Oil price was about $24

July 2008: Crude Oil price topped about $147

December 2008: Crude Oil prices crashed to about $35

June 20, 2014: Current price is about $106.

Summary: Prices are volatile, spiked high and low in 2008, and have, on average, risen steadily for the past 14 years.

Politics: The situation in Iraq, a major oil producer, seems to deteriorate every day. The chaos and violence could easily spread and that chaos and violence will reduce supply and kick crude oil prices higher. Adding to the chaos, central banks will “print” more euros, yen, and dollars and governments will add to their mountains of debt. Price inflation will accelerate and the dollar will weaken further.

Demand: More cars in Asia need gasoline. Even if the world economies contract, demand for crude oil should continue to rise.

Conclusion: Crude oil prices have many reasons to explode higher and few to drop lower. The trend has been up for more than a decade. Central banks will print, politicians will instigate more wars and invasions, and each euro, yen, and dollar will purchase even less crude oil and gasoline. It is business as usual, but with an extra dollop of chaos, war, and price inflation tossed into the mix….

Dennis Gartman:

“It’s abundantly clear that Iraq as we know it will cease to exist in the not very distant future – probably within the next year and a half.”

Arabian Money:

“Only this time may be different. The geopolitical crises unfolding in Iraq and also the Ukraine do not look like passing convulsions.”

Conclusion: Higher oil prices, more military spending, more debt, more chaos, higher consumer prices.

How does this relate to silver?

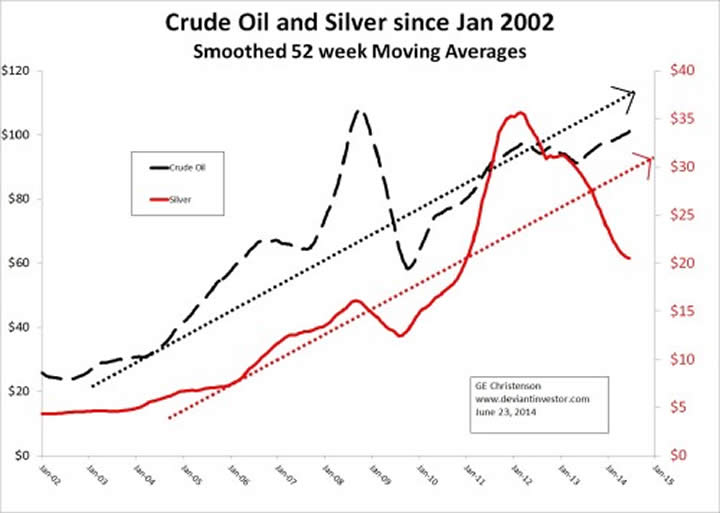

The following graph shows the price of crude oil in black – left axis, and the price of silver in red – right axis, for the past 12+ years. Both lines have been smoothed with a 52 week simple moving average of weekly crude and silver prices.

1) Crude and silver have been trending upward for 12+ years.

2) The dotted lines are approximations of their linear trends – clearly upward.

3) The 52 week moving average of crude is about $100 – below the linear trend. Market price is a bit higher with plenty of room to spike much higher as Middle-East and Ukrainian warfare escalates.

4) The 52 week moving average of silver and the current market price are both about $20 – well below the linear trend. Silver could more than double in price and not violate the 12+ year upward trend.

5) Crude oil prices are moving higher and silver prices will follow.

6) Statistical correlation between crude and silver for 12+ years of weekly smoothed prices is about 0.84 while correlation between unsmoothed weekly prices is about 0.79. Crude and silver prices are closely aligned in the long term.

Regarding gold and silver:

1) Statistical correlation between 52 week smoothed gold and silver prices is over 0.97. If gold is going higher, so is silver.

2) Richard Russell: “The Bear Market in Gold is Over.”

3) Jim Sinclair: “30 reasons, 23 new and 7 set in cement, of why the Bear phase in the bull market for gold ends this summer without any new lows.”

CONCLUSIONS:

1) Crude oil prices have been going up for 12+ years and will continue to climb. Politics and war will accelerate the price increases.

2) Silver and gold prices have bottomed and are resuming their bull markets. Expect much higher prices.

3) Rig for stormy weather – coming in from Iraq, Syria, Ukraine, Russia, South China Sea, “amateur hour” in foreign policy, more wars and invasions, and much of Asia reducing their dependence upon the dollar and Treasury bonds.

4) Preparation is essential.

5) Silver purchases are good preparation.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.