Gold Metals and Miners Bull Market Point of Recognition

Commodities / Gold and Silver Stocks 2014 Jul 09, 2014 - 05:01 PM GMTBy: Trader_MC

I think that the Metals and Miners Bull Market has just began and we are very close to the point of recognition of a new bull market which should give us an idea of what to expect going forward. As we have already seen in the past the first phase of a bull market is frustrating as many investors usually lose their positions too early and are therefore often left behind. This is how bull market works. Charts are telling me that Metals and Miners are on the verge of a massive breakout which could be the point of recognition of a new cyclical bull market.

I think that the Metals and Miners Bull Market has just began and we are very close to the point of recognition of a new bull market which should give us an idea of what to expect going forward. As we have already seen in the past the first phase of a bull market is frustrating as many investors usually lose their positions too early and are therefore often left behind. This is how bull market works. Charts are telling me that Metals and Miners are on the verge of a massive breakout which could be the point of recognition of a new cyclical bull market.

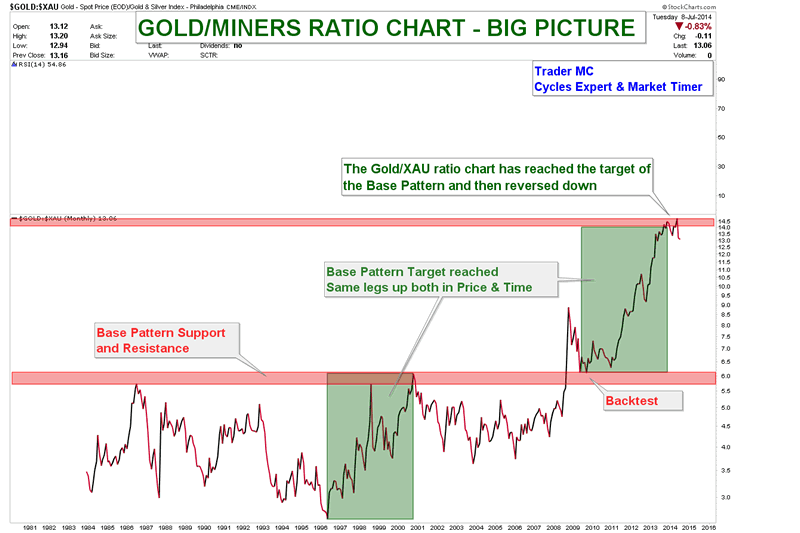

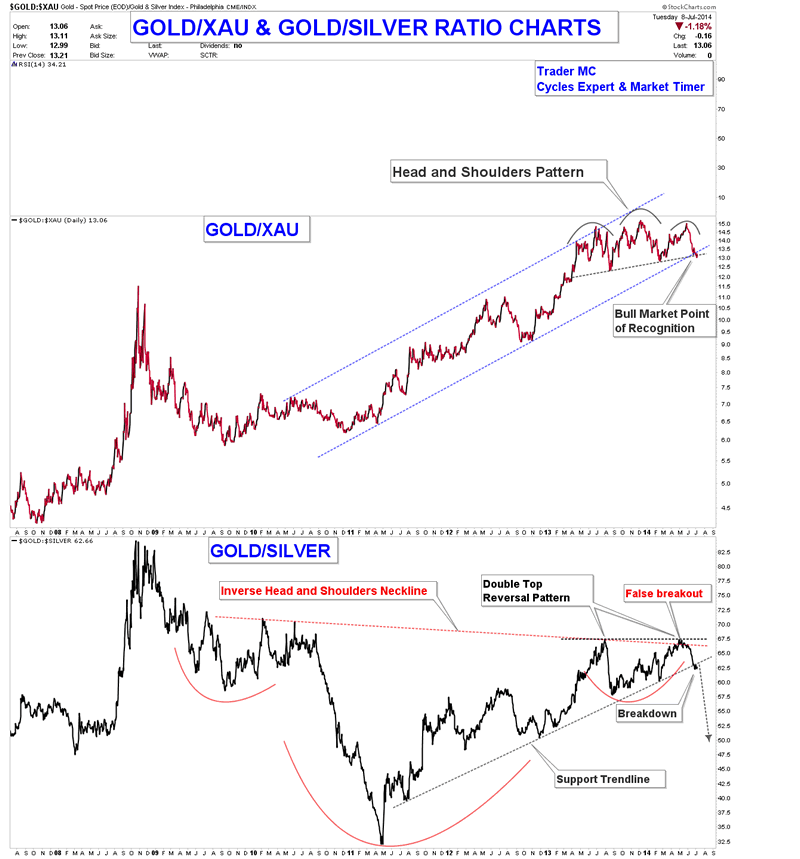

On the long term chart the Gold/XAU ratio has reached its Base Pattern Target and reversed to the downside. On the next chart you can see that the Gold/XAU ratio is very close to break below the neckline of a massive Head and Shoulders Pattern and also to break through a 3 year support channel trendline. Once these trendlines are broken, a point of recognition of a new bull market should be valid and a new impulsive leg up in Miners and Metals should be launched. You can also notice that the Gold/Silver ratio chart just broke below its long term support which is a bullish sign for the Complex Metals. Silver is outperforming Gold.

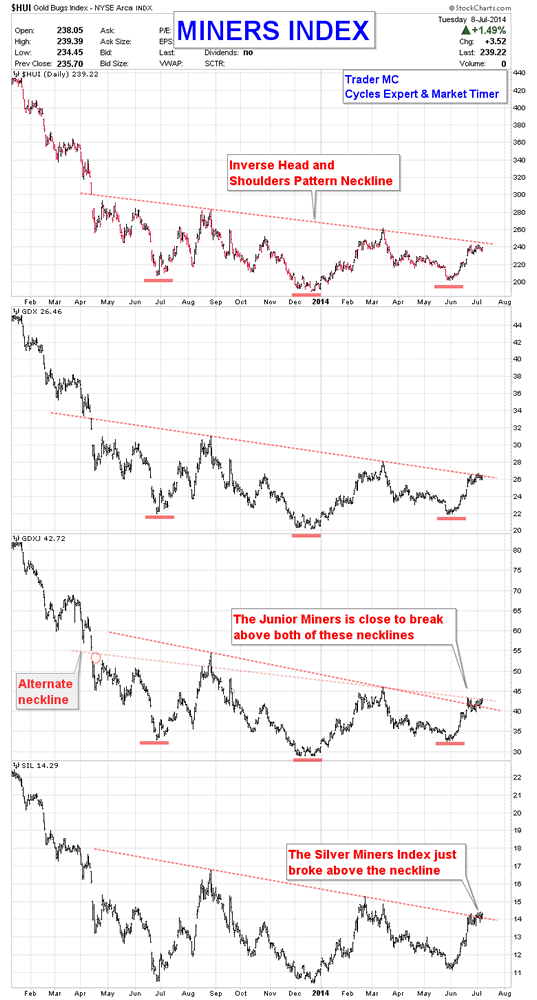

On the chart below you can see that the Miners Indexes are also on the verge of a breakout of a huge Inverse Head and Shoulders Pattern. This breakout would be also a point of recognition of a new bull market in Miners.

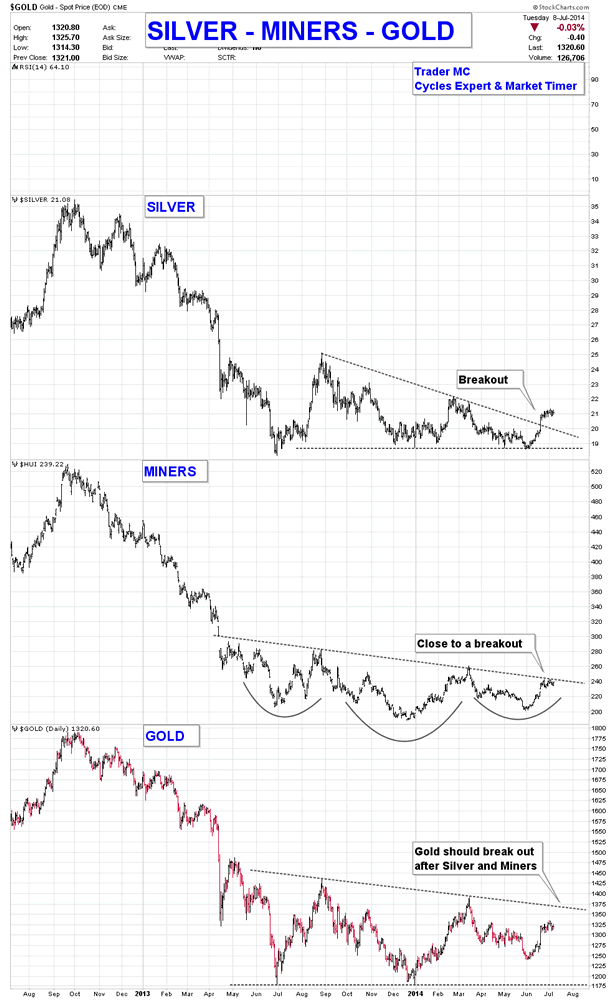

On the following chart you can see that Silver is leading Miners and Gold as it already broke out of a Triangle Pattern and the HUI Index (Miners Index) breakout should be the next one, followed by Gold. Both Miners and Silver are outperforming Gold which is what I like to see in a healthy Metals bull market.

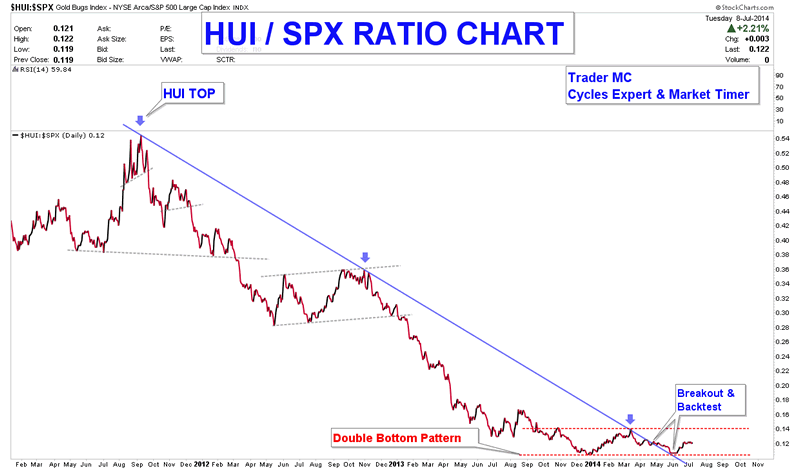

When a point of recognition occurs, price action usually reveals a new bull market which should outperform the other markets. On the following chart you can see that the HUI/SPX ratio broke through a 3 year trendline resistance and is currently forming a possible Double Bottom Reversal Pattern. A break above the upper dashed red trendline would validate this reversal pattern and should bring more investors in the Miners sector. When this breakout happens, the Miners should outperform the SPX Index.

Metal and Miners are currently at a key juncture and are very close to print a point of recognition of a new bull market. Price action will be very important in the coming days to valid this new cyclical bull market. Our first leveraged positions on May 30 in Metal and Miners seem to be taken very close to the bottom and I think that it is not the time to sell these positions but on the contrary, to hang on during corrections in order to run all the bull market and to make nice profits. Keeping in mind the big picture to control our emotions is important at the beginning of each bull market.

Trader MC

Company: Cycle Trader MC OU

Web site: http://tradermc.com

Email: contact@tradermc.com

My analysis covers different assets – Market Indexes, such as US, Europe, Emerging Markets, China, Russia etc., Commodities, Currencies (Forex Trading), Bonds and Rates. In addition to the Markets Updates for MC Members, I also post real-time Trading Alerts for MC Leveraged Members for a more aggressive strategy in all the sectors. Besides the market analysis, this site also contains Cycles Count Updates for all Market Assets, including the Forex Market.

© 2014 Copyright Trader MC - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.