Gold And Silver Low Prices Are NOT The Reason To Own Precious Metals

Commodities / Gold and Silver 2014 Aug 24, 2014 - 01:13 PM GMTBy: Michael_Noonan

"ISIS poses a greater threat than 9/11. This is way beyond anything we have ever seen. We must prepare for everything. Get ready!" US Secretary of Defense, Chuck Hagel.

"ISIS poses a greater threat than 9/11. This is way beyond anything we have ever seen. We must prepare for everything. Get ready!" US Secretary of Defense, Chuck Hagel.

Whoa, Chuckie...back off a bit, here. Just who do you think it was that helped create the Islamic State of Iraq and the Levant, aka ISIS, fund them, train them, and provide the best weapons for them? Can you spell U S, as in a part of your title description as Secretary of Defense? Are you really telling America, and the world, that you are actually that clueless?

Nobel Peace Prize recipient and primary world warmonger, Barack Obama, has been itching to start a war in Syria. Why? To stop Russia from achieving its flow of LNG from East to West, a fact to which Obama will not openly admit. Turns out, bloggers on the internet can accept some credit for exposing Obama's false flag excuses for attempting to overthrow Assad. How did Obama's war machine, [mostly CIA-led], plan to oust Assad? By backing ISIS in every way possible: funds, training and weapons. ISIS is as much of an outgrowth of Western [US] meddling in that part of the Middle East as anything else.

Is this a story familiar to most Americans? Hardly. Beyond watching reality TV programs, almost all of Americans watch mainstream media for their "news," those bought-and-paid- for organizations that spew whatever the administration wants the pablum-fed public to hear, and nothing else. The truth is, an American is 100% more likely to be killed by some local militarized cop than any ISIS member. Not only is that truth, it is a stark reality.

Several articles have appeared about the slaying of unarmed Michael Brown from as many responses written by Afghan and Iraqi veterans that admit while engaged in actual war, they were not as heavily armed and geared as Ferguson local cops, those same local militarized cops purposefully pointing their weapons at an unarmed, non-threatening public while perched atop a 14 ton armored vehicle, or while walking on the street, aiming at anyone within their range.

"Get off the streets and go home! We are not violating your Constitutional Rights!"

Say what?! You just did. Where is the outage, America? This is happening right in front of your eyes. Everywhere across this country, hundreds of local police have received free military vehicles and weapons from the Department of Defense, vehicles whose sole purpose was to engage in war. What is happening in Ferguson will eventually happen in a neighborhood near you, if not your own.

Do you think there is no connection with the Department of Homeland Security buying 3 billion rounds of hollow-point bullets and the ongoing militarization of local police departments? Did you know that even the elite's world organization, the United Nations, has outlawed hollow-point bullets? Did you know the IRS [NOT a part of the corporate Federal government], also has IRS agents now armed and supplied with bullets? All the while, Obama, and elite wannabe former NY mayor Bloomberg want to see all Americans disarmed. If you want to better understand why, reflect more on events at Ferguson.

"Uncle Sam Wants YOU!" Just not in the way you thought.

The NSA has spent billions of fiat dollars, on your tab, and spies on every American [not only Americans], but admits it has not stopped a single terrorist threat or unveiled a single plot. Again, local militarized police are a proven greater threat to Americans than any other source, and Ferguson is proof positive that Americans have NO rights when push comes to shove. Fascism is alive and well in the US, but US citizens find that almost impossible to believe.

The elites have planned the takeover of the US since the early 1800's. They think in terms of generations in executing their plans, gradually over time so that the effect is hardly noticed, like the gradual elimination of specie-backed United States Treasury Notes, and replacing them with worthless fiat Federal Reserve Notes issued by a private banking cartel. What citizen of the United States knows anything other than fiat Federal Reserve Notes as "money?"

People, on the other hand, think in terms of what is impacting their lives for the immediate term, and that is why we discussed ISIS, Ferguson, lack of Rights, a well-armed Department of Homeland Security and IRS agents, among others, the militarization of all police forces, fiat Federal Reserve Notes issued by the elite's private banking cartel, almost entirely foreign-owned.

There are many other situations that could have been addressed. The presentation of these seemingly unrelated events is not random. Instead, each is symptomatic of the overall plans of the elites to maintain control over every aspect of US citizens without said citizens being aware of how the seemingly disparate dots connect.

The end will be devastating for almost all Americans who remain unaware of being unaware. The end will also take longer than most believe possible, until it all unravels seemingly "overnight."

If you think the reasons for owning physical silver and gold are a function of the number of coin sales, the ratio of paper demand per available physical ounce, how many tonnes China, Russia, India, Turkey, and other countries own is why you should hold either or both metals, think again. The elite's drive for a New World Order is all but done, and once they have total control, if you do not have any gold or silver, you got nothing, and you will be under the total subjugation of a federal government that will make Ferguson look like a walk in the park.

Buy physical gold and silver at any price. Once the window closes, based on the ongoing and never-ending developments you read about, and they are not as random as you might think, that window will be closed to you for your lifetime and your children's lifetime. It is not just about the imminent collapse of the fiat Federal Reserve "Dollar." If you think you have personal freedom, it is an illusion. Try moving large amounts of cash around, try speaking your mind against the Federal government, local cops, try asserting what you may think are your rights in a court of law.

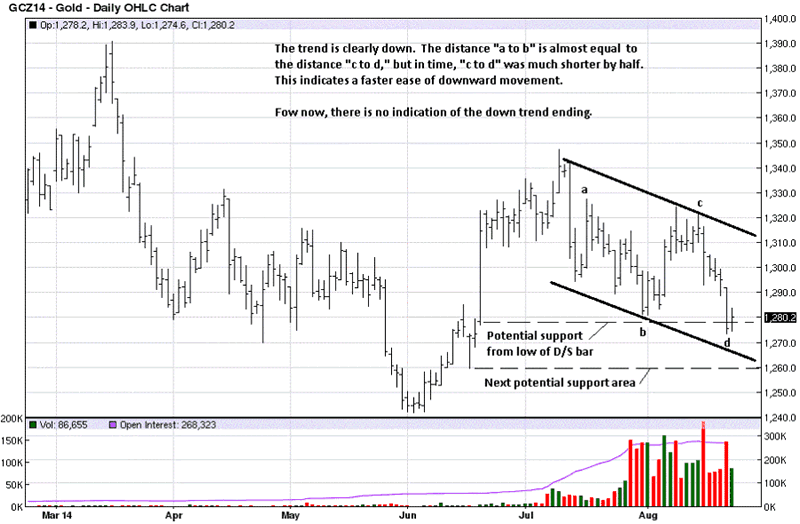

The end is nearer and nearer, just not in sight, but for those who can exercise even a minimal amount of foresight, taking self-direction has never been more important. The charts give no indication of panic by those in control of the PM market through the use of derivatives. The fact that China is endeavoring to become the next gold trade center, in control of a legitimate pricing mechanism has done nothing to alter the chart read.

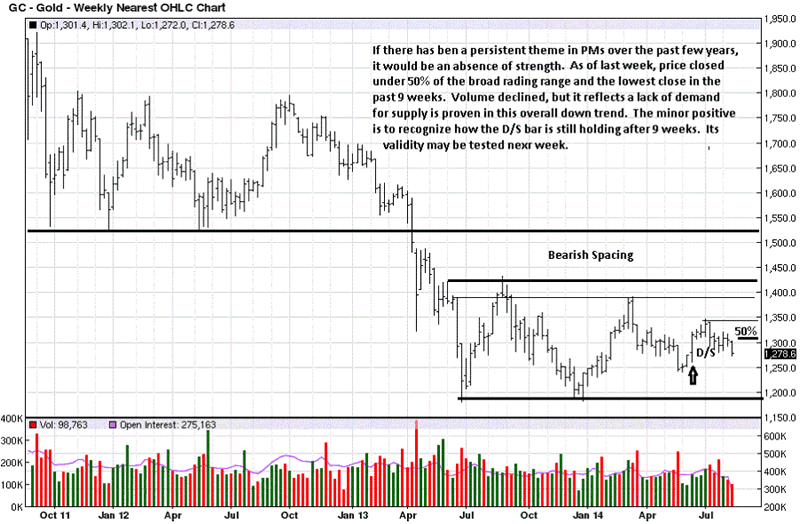

Gold has almost disappeared from the headlines this past week, and the fact that it cannot make a move out of its protracted TR explains why. There is nothing apparent over which one can be enthused for the prospects of higher prices, but one must always be prepared for events when they do happen.

What we are viewing is the current status of the price of gold, and manipulated or not, the charts are not related to the need[s] for owning the physical. We mentioned earlier in the year, the second half of 2014 may not be any different from the first half, and until we see concrete signs of change, expect more of the same in the weeks/months ahead.

The chart comments are observations of how the market has been [under]performing, but the bottom line is, not much is happening to turn this market around. We all get to deal with what is, and this is what is, for now.

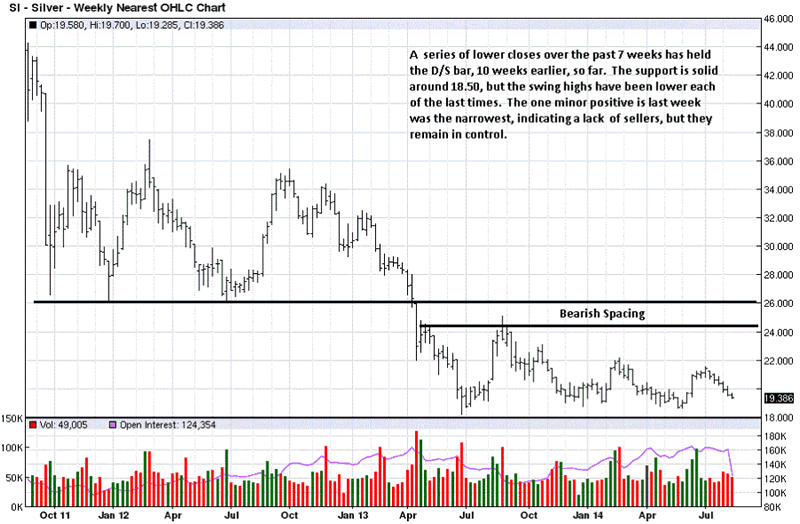

Without giving a definitive reason as to why, we are of the mind that silver could be the first metal to turn the trend, or eventually lead when the trend does turn. The gold/silver ration is around 66, after languishing around 63+ for some time. The turn in the ratio is much stronger if/when it nears 75-80:1.

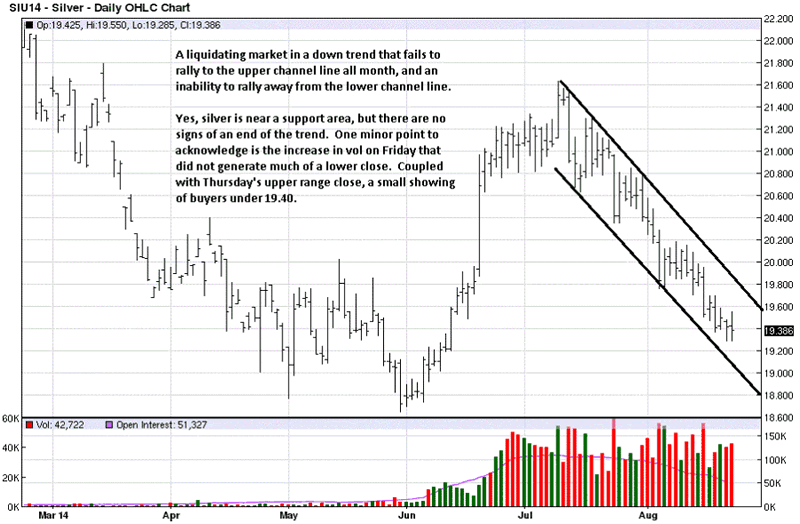

The very small weekly range could produce a buyer's upside reaction because sellers were unable to extend the range lower.

We see that same evidence of a lack of sellers to press price lower. Both Thursday and Friday did show evidence of buyers, more likely short-covering than net new longs. It takes more than that to turn a trend, but a turn in trend starts with one step at a time.

No apparent change here. Buy the physical metal for more reasons than a seemingly low price, but stay away from the long side of the paper market.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.