Full Frontal Inflation

Economics / Inflation Sep 11, 2014 - 10:49 AM GMTBy: John_Rubino

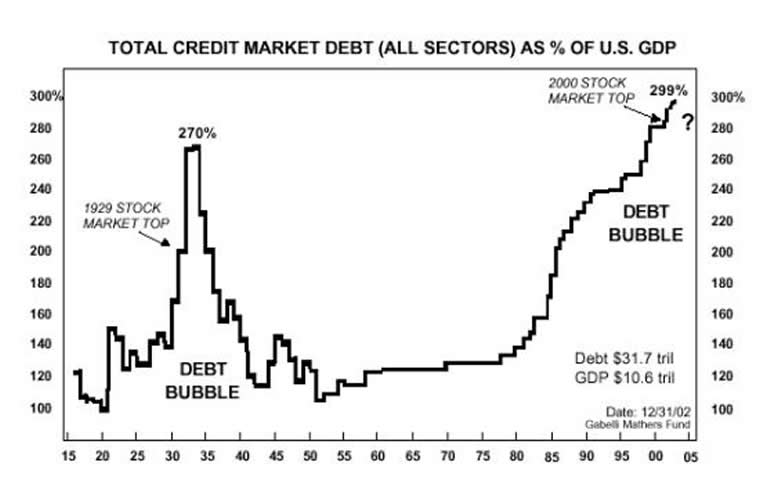

By now it’s an article of faith within the sound money community that most major countries have borrowed so much that they’re left with only two options: default on their debt through mass-bankruptcy and a new Great Depression, or inflate it away through stepped-up currency creation.

By now it’s an article of faith within the sound money community that most major countries have borrowed so much that they’re left with only two options: default on their debt through mass-bankruptcy and a new Great Depression, or inflate it away through stepped-up currency creation.

This is an investment thesis, since a given country’s choice will determine which asset classes rise and fall.

But it’s also a criticism of the people and policies that put us in this box. The presidents, prime ministers, senators, central bank heads and investment bankers who presided over the global economy of the past 30 years screwed up monumentally, leaving today’s savers, entrepreneurs and workers to clean up their mess.

Because acknowledging this stark choice between inflation and Depression is such an admission of failure, it isn’t discussed in these terms on the official side of the debate. There, the tone is more measured and the promise is that the next tweak will more-or-less painlessly return the system to a stable equilibrium of steady growth, full employment and incumbent electoral success.

But at some point the fig leaf has to fall and the truth — that there are no painless solutions, only different types of pain — will have to be stated explicitly. Here’s a glimpse of that future in the form of an old (2010) column by New York Times columnist and Nobel Prize-winning economist Paul Krugman:

Default Is In Our Stars

Not in ourselves.I think it’s fair to say that a majority of economists believe that excessive private debt played a key role in getting us into this economic mess, and is playing a key role in preventing us from getting out. So, how does it end?

A naive view says that what we need is a return to virtue: everyone needs to save more, pay down debt, and restore healthy balance sheets.

The problem with this view is the fallacy of composition: when everyone tries to pay down debt at the same time, the result is a depressed economy and falling inflation, which cause the ratio of debt to income to rise if anything. That is, we’re living in a world in which the twin paradoxes of thrift and deleveraging hold, and hence in which individual virtue ends up being collective vice.

So what will happen? In the end, I’d argue, what must happen is an effective default on a significant part of debt, one way or another. The default could be implicit, via a period of moderate inflation that reduces the real burden of debt; that’s how World War II cured the depression. Or, if not, we could see a gradual, painful process of individual defaults and bankruptcies, which ends up reducing overall debt.

And that’s what is happening now: as this story in today’s Times points out, the main force behind the gratifying decline in consumer debt appears to be default rather than thrift.

So basically, we can do this cleanly or we can do this ugly. And ugly is the way we’re going.

Some thoughts

Even now, four years after Krugman’s rhetorical trial balloon, policy makers and economists refuse to admit that inflation is a form of default. But things are going so badly for these guys pretty much everywhere that before long they’ll be forced, as Krugman briefly was, to start spinning default-through-devaluation as the smoother, less painful version of an act that in most walks of life is seen as shameful.

Of course, one person’s smooth transition is another’s swerve into a ditch. Savers now accepting 0.5% interest on bank CDs will be shocked to find out that the government is explicitly trying to devalue the currency by 5% a year, giving those CDs a -4.5% annual return and making saving for retirement — or even preserving capital — impossible.

But leaving aside the moral failings of inflation, Keynesian economic theory also has a glaring analytical flaw: a seeming inability to think through the secondary and tertiary effects of policy. To take one obvious example, if a country begins to explicitly default on its debts by lowering the value of its currency, then the rational response for people within that system is to borrow as much as possible at current low interest rates with the goal of paying back the loans in massively-cheaper money. So…the policy of shrinking current debt through inflation actually leads to a surge in new borrowing and (presumably) an even bigger debt problem in the future. But because it generates “growth” in the short run as the proceeds of all those new loans are spent, it appears to work for a while, which seems to be what matters in this theoretical framework.

Krugman’s admission is also a big step on the journey to the Austrian economics crack-up boom, which hits when a critical mass of people figure out that the government is going to make the currency worth less each year for a really long time. Individuals and businesses lose interest in holding the currency, instead spending it on real stuff as fast as it comes in, thus setting off an asset bubble/hyperinflation.

And about WWII fixing the Great Depression, sorry, but the US invasion of Europe followed a decade of private sector debt defaults which lowered total debt/GDP by more than half. By 1939 the US had already deleveraged and was ready to start growing again. The fact that Washington then increased spending and borrowing is almost irrelevant — or maybe actually negative because the bullets, tanks and planes the government bought were subsequently used or destroyed without adding to US real wealth. So a case could be made that the 1950s and 1960s would have been even better economically if WWII had never happened.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.