Where China and Japan Are Investing Billions

Stock-Markets / Investing 2014 Sep 22, 2014 - 03:45 PM GMTBy: Investment_U

Sean Brodrick writes: Japan and China are the two biggest economic powerhouses in Asia. When their wallets open up, the world takes notice.

Sean Brodrick writes: Japan and China are the two biggest economic powerhouses in Asia. When their wallets open up, the world takes notice.

Now, both countries are directing a lot of investment money... into India.

Japan is leading the way. Last year, it invested $1.2 billion in India - primarily targeting infrastructure. This year, it spent $1.1 billion in India between January and April alone.

While in Japan, India's new prime minister, Narendra Modi, received a pledge from Japan's Shinzo Abe of $35 billion in new private- and public-sector investment over five years.

Specifically, Japan will put its money toward next-generation infrastructure projects, smart cities, bullet trains and more.

It's easy to see why.

India has 1.24 billion people with an average age of 27. That's a customer base that Japan would love to have.

And Modi is business-friendly. That makes the decision to upgrade the relationship between Japan and India to a "special strategic global partnership" an easy one.

Modi has a vision for 100 smart cities in India, modeled after Kyoto, Japan. In addition to the usual infrastructure, a smart city also has top-notch communications, high-tech knowledge and social infrastructure.

Tokyo and Delhi also finalized an agreement on rare earths. Japan will import rare earths, which are rare elements used in many products, from India to diversify supply away from China.

Enter China

And speaking of China...

China has a massive feud going on with Japan, rooted in hundreds of years of conflict. Now, China's attitude seems to be: "Anything Japan can do, we can do better."

After all, China has $3.95 trillion in foreign exchange reserves burning a hole in its pocket. China Investment Corp., the nation's sovereign wealth fund, has $575 billion in assets. It would like to invest at least some of that money.

So, in a visit to India this week, China President Xi Jinping is expected make a major announcement: China will commit up to $300 billion toward the modernization of Indian railways.

China will fund...

- The replacement of existing tracks to increase train speed

- Station development

- Other mega infrastructure projects.

China is also asking India to hand over certain railway corridors for it to build bullet trains to compete with Japan's.

One China spokesman said in press reports: "We can invest far bigger amounts than Japan and finish projects in India far cheaper and faster. We have a proven record in this regard."

What's more, during the presidential visit, China should announce that it will build two industrial parks in the western states of Gujarat and Maharastra. These industrial parks will host manufacturing and energy units.

India is one of the world's most important emerging markets, but it's hardly the only one. Readers of Investment U's premium edition today are learning how to invest safely in these fast-growth (but risky) markets. To learn how to join them, click here.

More to Come

India's power demands are growing rapidly and the country is pressing Japan to provide components for nuclear reactors. India plans to build about 30 nuclear reactors.

The two countries are working out the kinks on a deal to allow India to reprocess nuclear fuel and harvest weapons-grade plutonium.

India already has nuclear weapons so it plans to use the plutonium in fast-breeder reactors that are under development.

China has its own nuclear program. So, I would expect it to present its components as an alternative to Japan's. And China has no qualms about what any customer may do with plutonium.

How to Play This Trend

It sure looks like Japan and China are leading the wave of foreign direct investment in India. This should be a big boost for India's stock market.

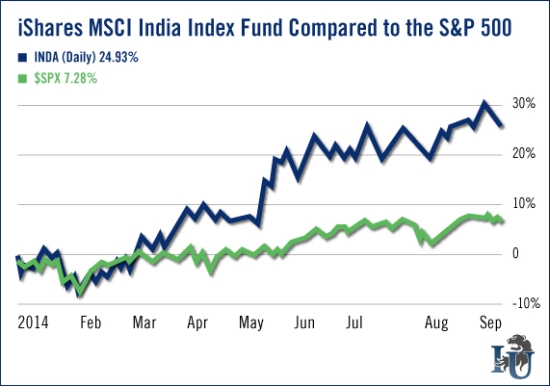

One way to ride this trend would be to buy the iShares MSCI India ETF (NYSE: INDA).

In the chart you can see that the INDA has strongly outperformed the S&P 500 since the start of the year. That sure looks like a trend I'd like to ride.

Good investing,

Sean

P.S. While a handful of countries enjoy newfound wealth, America's roads, power grid and water systems are crumbling. Congress will have to spend $450 billion per year just to fix the mess. And worldwide infrastructure costs over the next six years will total $57 trillion. Join me on a MoneyShow webinar at 3:30 p.m. on Wednesday to discover how to reap extraordinary profit from a megatrend that could rebuild the world. Just click here.

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.