Could Gold Stocks Bottom at 2008 Credit Crisis Low Prices?

Commodities / Gold and Silver Stocks 2014 Nov 07, 2014 - 10:20 AM GMTBy: Jeb_Handwerger

The commodity equities are selling off as The Fed halts QE3. However, we are reaching oversold levels and support areas where short covering could soon begin. Commodities, metals and the junior miners are hitting multi year lows and falling below 2008 credit crisis levels. This crash is not based on fundamentals only on an artificially inflated dollar due to Yen and Euro weakness.

The commodity equities are selling off as The Fed halts QE3. However, we are reaching oversold levels and support areas where short covering could soon begin. Commodities, metals and the junior miners are hitting multi year lows and falling below 2008 credit crisis levels. This crash is not based on fundamentals only on an artificially inflated dollar due to Yen and Euro weakness.

This is not a time to panic but continue to accumulate as the bear market may be reaching the final capitulation stage. This decline may be a sign that the quantitative easing may have lifted stock market indices, but it did little to improve demand and growth in the economy reflected by demand for energy and metals.

For weeks, I have been expecting a major long term bottom in the precious metals after major capitulation. The liquidation may have occurred this week as investors sold out of panic and fear rather than take a look at the long term fundamentals. Across the board many of the weak hands had to sell quality assets for pennies on the dollar.

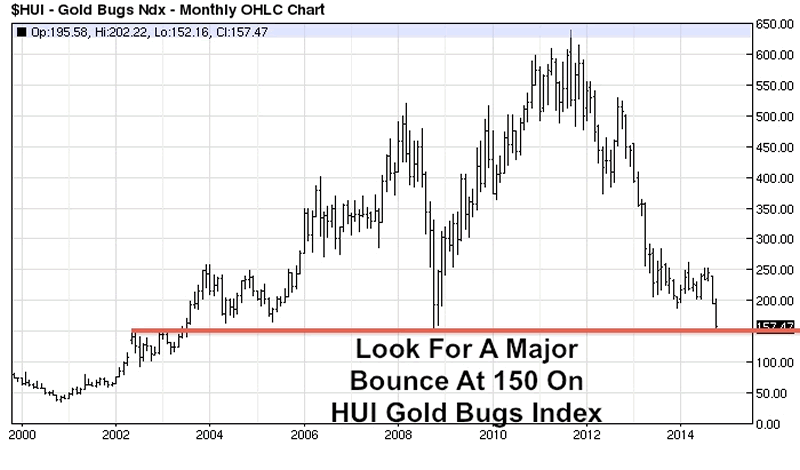

Smart resource investors expecting capitulation have had some of their bids filled at ridiculously low prices. Fortunes are made by the brave who pick up real assets when the majority is not interested in them. I expect a major bounce at 2008 credit crisis lows and the 2003 breakout on the HUI Gold Bugs Index at $150.

I just returned from the New Orleans Conference which was headlined by Alan Greenspan the former Federal Reserve Chairman from 1987 to 2006. It is interesting to note that Greenspan has become bullish on gold. He believes that quantitative easing did not accomplish what it was designed to do. It helped lift the stock market and stabilize the real estate market, however it fell short as the US economy is not really recovering like it should have. Gold is the best hedge against this uncertainty.

I happen to agree with him. Real estate values have jumped from overseas demand and stock market indices are hitting new highs. Only a small fraction of the US have gotten wealthier as the real economy continues to struggle. First time home buying is at a record low.

Greenspan is continuing to warn about the Fed's exit from quantitative easing, which I am quite concerned about as well. Look at the recent volatility in the US dollar and treasuries. How long can this dollar rally last before creating the next financial crisis? When the US dollar is moving parabolically higher like a dot com stock I exercise caution as this could have drastic effects on foreign exchange markets and international trade. The US economy is already slowing drastically due to this rise in the dollar. The mining and oil/gas sector have slowed down drastically and real estate sales are waning. The next round of economic numbers including unemployment may be awful and QE may have to be restarted.

The best way to hedge against this volatility is precious metals and commodities. Accumulate during a bear market when these real assets are on sale. A turnaround and V shaped reversal could be right around the corner.

Contrarian value investors should be looking at emerging junior producers and explorers that are still trading for pennies on the dollar. Keep a close eye on nuclear.

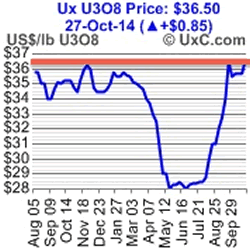

The uranium spot price has made a dramatic move higher as Japan begins turning back on nuclear reactors and large producers such as Cameco announce production declines. There is a lot of buying in the spot market and it should be soon reflected in the performance of the junior uranium miners (URA). Look for a breakout past $37 on the U3O8 spot price.

A town in southwest Japan approved the restart of a nuclear power station. This is a sign that if Japan who suffered greatly from the Fukushima disaster can turn back on reactors then the rest of the world should continue to build newer and safer next generation nuclear reactors. Japan turned off the nuclear reactors following Fukushima in March of 2011. However, nuclear reactors may start coming back online in 2015. Japan's economy can no longer handle importing expensive oil and gas. Nuclear is vital to Japan's economy and used to supply close to one-third of their overall energy needs.

Don't forget that he US is the largest consumer of nuclear power yet produces less than 10% of what it demands every year. For decades, America relied on Russia to supply cheap uranium in the megatons to megawatts program. This deal concluded at the end of 2013 and Russia could continue tightening its control on uranium as a bargaining chip against economic sanctions from the West.

Smart money is buying small emerging junior uranium producers in the US where demand far outpaces supply. There are very few conventional uranium mills in the US. I am continuing to search for beaten down uranium assets in the Southwest United States that have been ignored because of the artificially low spot price. If the uranium price rebounds this area could become quite valuable. Right now a little money goes a long way and large historical producing properties can be bought for pennies on the dollar. In the previous uranium boom, the value of these assets soared. This region could be a major supplier of uranium to US utilities and help with the current supply shortfall in the United States.

Despite this painful market selloff due to the parabolic move in the US dollar, some junior miners are breaking out of downtrends and breaking out on relative strength charts versus its peers in the Junior Gold Miner ETF (GDXJ) or compared to the TSX Venture.

I have found for my premium subscribers companies with a lot of insider buying with smart billionaire investors. These are the type of companies who can quickly change the landscape either through exploration or M&A growth.

The junior gold miners have all been hit hard for the past two months as investors fear the end of Quantitative Easing will bring about deflation. This irrational panic combined with tax loss selling may mark a major bottom over the next 6-8 weeks. We may see a bounce off these levels after the panic gaps down. Watch 150 on the HUI and 750 on TSX Venture. I feel we may be near a major turning point in the entire resource sector. When you see some of the smartest value investors buying stock in a junior gold miner, it makes one question the record short position on the sector.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

Disclosure: Author owns no stocks mentioned.

© 2014 Copyright Jeb Handwerger - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.