Gold Bug Psychology Must be Neutered

Commodities / Gold and Silver 2014 Nov 07, 2014 - 02:51 PM GMTBy: Gary_Tanashian

The precious metals bear market, beginning with silver’s blow out in early 2011 and the general top in the commodity and ‘inflation trade’ along with gold’s lesser blow out later that summer amidst Euro crisis hysterics, has been all about psychology. Well, every bear or bull market is about psychology, but the intensity of this dynamic has been something to behold in the gold sector over these last few years.

The precious metals bear market, beginning with silver’s blow out in early 2011 and the general top in the commodity and ‘inflation trade’ along with gold’s lesser blow out later that summer amidst Euro crisis hysterics, has been all about psychology. Well, every bear or bull market is about psychology, but the intensity of this dynamic has been something to behold in the gold sector over these last few years.

Psych 101

In early 2011 long-term interest rates were rising in response to inflationary pressures, ‘Bond King’ Bill Gross famously shorted the long bond, virtual mobs with pitchforks were storming the Fed’s castle calling for Ben Bernanke’s head and silver went to $50 an ounce, with calls for $100, $200, etc. All psychology my friends.

While on the subject of the long bond, our ‘Continuum’ chart shows that players did not learn 2011’s contrarian lesson with respect to yields as they took Wall Street’s ‘Great Rotation’ hype hook, line and sinker in 2013. What did the 30 year yield then do? Why, it hit our long-term limiter (monthly EMA 100, red dotted line) and has dropped ever since.

Pigs on the Wing & Sheep

If market participants are “Sheeple” as many gold bugs believe, then the average gold bug – as evidenced by so many peoples’ staunch refusal to give up on the shiny relic – are Sheeple squared, because the gold “community” (right there a give away on group think) has distinct leaders or troubadours who, if the faithful will just hang in there long enough, will be proven right as we are all led to the promised land.

Yet the bear market has cruelly put the promised land further and further out on the horizon with each impulse of hope. The gold story is one of righteousness because sound value (and insurance) not beholden to leverage is monetarily righteous. But promoters and/or buffoonish spokespeople have either knowingly or unknowingly used the righteousness of the message to keep people firmly in the grip of dogma all the way down during the bear market.

To make matters worse the ‘pigs’, led by Goldman, JPM and Wall Street in general, have feasted and feasted some more on the propped up paper entity built on what will one day be ‘discovered’ to have been disastrously insane policy making. That is a double whammy for a gold bug who stands for what is right.

A Reality

But these are the markets. You sit at your computer and I sit at mine. We press buttons and make digital transactions in a system that is functioning just fine for now. Within this, psychology is clustered toward speculation and risk taking and against a risk ‘OFF’ environment. This is the reality.

So I would say to gold bugs that what you must do is “put your dogma on a leash” [1], manage risk against your world view and be ready for a) a return to sanity as the system is compelled by the next bear market to reform its ways and b) potentially a grand opportunity to speculate in the diggers of gold out of the ground.

Current Situation

So where are we at? Well, I have a couple pet market writers (un-named and shall remain so) on whom I depend for contrary signals. One just went hyper bearish (with HUI now at the 2008 lows) indicating the potential for a bounce. The other is still sounding 100% right even as he has been bullish all the way down. The fact that he is still apparently tugging at gold bugs’ greed impulse is a negative and implies further downside pending any bounce activity that may crop up.

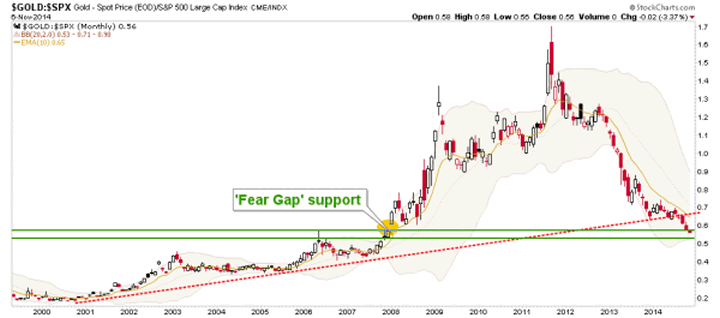

In NFTRH we have been managing what we called the 2008 ‘Fear Gap’ for years now. Once gold made its first major support breakdown, we looked at the potential for the entire sordid mess we used to call “Armageddon ’08” to be closed out with a fill of the upside gap in gold vs. the US stock market. Well… consider it closing if not closed.

I believe that those who will be bullish on gold and the gold miners from the depths of this bear market are going to well rewarded in both their holdings in real monetary value (gold) in a world gone berserk and in their speculations associated with that value (gold stocks of relative quality). But first you must be intact and that means guarding against your own bias, dogmatic beliefs and even certain truths as you know them.

These are the financial markets after all. Be guarded when appropriate and be brave when appropriate. NFTRH has spent all too many years now guarding against bias reinforcement and simply dealing with what look like insane realities. It was too easy to listen to the promoters for many people. That was the easy way out, to have their perceptions reinforced.

We are not out of the woods, and on coming bounces these promoters will be right back at it. When they are neutered or more accurately, when the gold bug community’s actionable perceptions of them are neutered, the sector will resume its bullish place in a global financial market that is ripe for change where today’s pigs will become tomorrow’s bewildered sheep and today’s bewildered sheep… well, you know.

[1] Quoted from a song by long-ago Boston rock band Volcano Suns.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart/trade ideas!

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.