Silver to S&P Ratio: What It Tells Us

Commodities / Gold and Silver 2014 Nov 11, 2014 - 02:58 PM GMTBy: DeviantInvestor

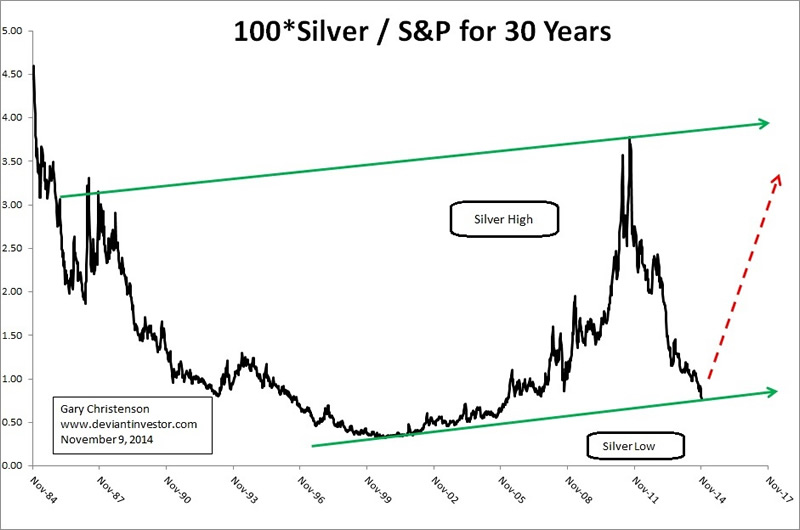

Take the price of silver, multiply by 100, divide by the S&P 500 Index and chart it for 30 plus years. What do we see?

Take the price of silver, multiply by 100, divide by the S&P 500 Index and chart it for 30 plus years. What do we see?

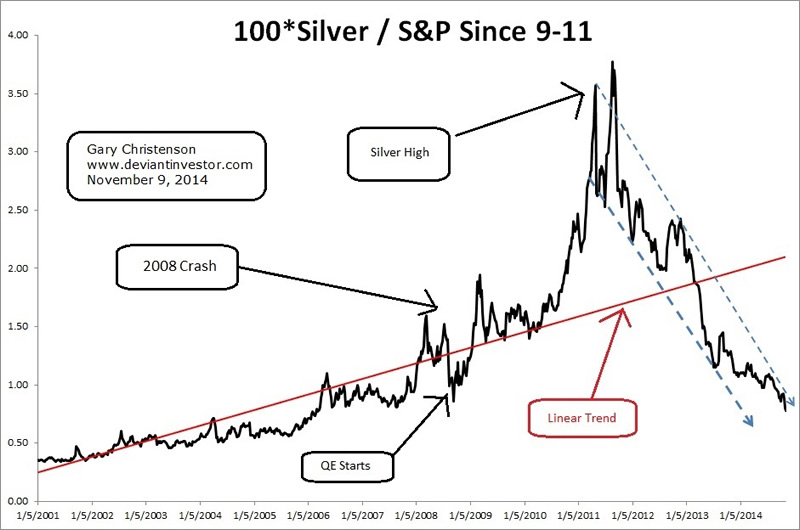

Now look at the 13 years since 9-11 when the gold, silver and commodities bull markets began.

- Silver to S&P Ratio (Si/SP) is currently at an 8 plus year low.

- Si/SP is below its upward linear trend shown in red since 9-11.

- Over the long term the ratio shows the desirability of hard assets such as silver versus the desirability of paper assets such as the S&P.

- The ratio declined from 1980 to about 2001, increased to 2011, and crashed since then.

- QE started in late 2008 and stimulated the S&P off it March 2009 lows. Most of the $Trillions in newly created Fed dollars went into the stock and bond markets, and not into the silver and gold markets.

- Subsequent to 2011, the S&P has charged upward while silver has crashed to about 30% of its April 2011 high.

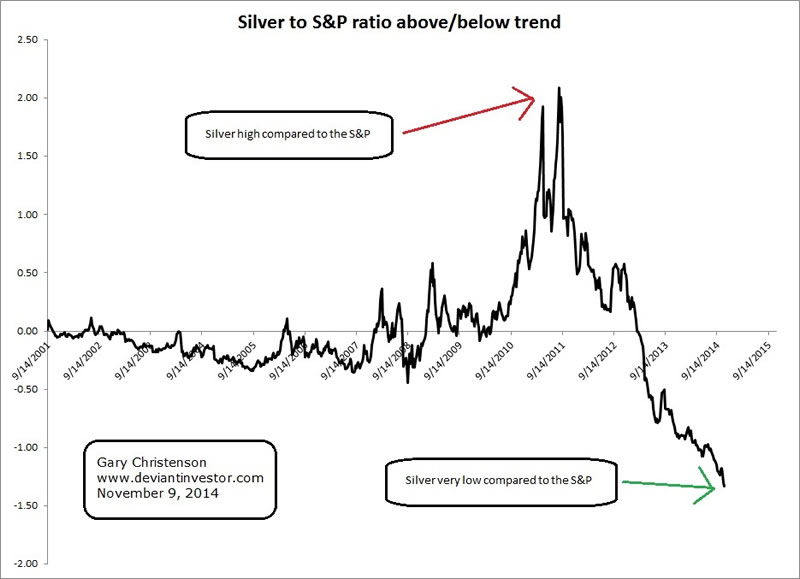

Now examine the difference between the ratio and the linear trend shown above in red.

COMPARISONS:

Item S&P Silver

3 – 5 year history Triple since lows Down by 70%

Recent activity All-time highs 70% below all-time highs

The Fed & QE QE levitates the S&P QE – not much help

Chinese purchases Probably not Huge purchases

Warfare increasing Likely to hurt S&P Likely to help silver

Middle-East trauma Likely to hurt S&P Likely to help silver

Political turmoil Likely to hurt S&P Likely to help silver

We could go on, but it is clear to me that the S&P is near all-time highs and is at risk from declining QE, excessive valuation, increasing wartime threats, Middle-East trauma, and US political turmoil. Silver is near a 5 year low, 70% off its highs, and likely to rise based on the same issues that could hurt the S&P.

The Si/SP ratio shows that silver is deeply oversold and far below its typical levels. The ratio is at an 8 year low, even below the 2008 silver crash lows, and not far above 30 plus year lows.

Based on Friday’s upticks, last week may have been the turning point for silver prices and the silver to S&P ratio. Or perhaps the S&P will continue reaching for the sky even though QE is supposedly diminishing, while silver prices drop further below the cost of production. Both seem unlikely but we shall see.

What is clear is that silver and gold are currently selling at bargain prices and the S&P is selling at very high prices. If the silver market has finally found a bottom then silver is – right now – an excellent investment, financial insurance, and protection for your purchasing power and savings.

For those who bought silver (and gold) at higher prices, the long-term trend is up and will eventually express itself. Waiting for the turnaround is painful, but now is a lousy time to lose sight of the “big picture” and sell at a loss. Instead, now is a far better time to buy.

If you bought silver at lower prices, you probably feel good knowing that your investment is currently profitable even at these post-crash levels. Further, silver prices are highly likely to increase substantially in the next few years.

KISS! Keep Increasing Silver Stack! Keep It Simple – Silver!

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.