Wow, They Really Are Tapering QE Money Printing

Stock-Markets / Financial Markets 2015 Jan 05, 2015 - 11:07 AM GMTBy: John_Rubino

In the sound-money community there is universal skepticism about the Fed's plan to stop monetizing the world's debt. Hardly anyone thinks they'll go through with it and absolutely no one thinks they'll succeed if they do.

In the sound-money community there is universal skepticism about the Fed's plan to stop monetizing the world's debt. Hardly anyone thinks they'll go through with it and absolutely no one thinks they'll succeed if they do.

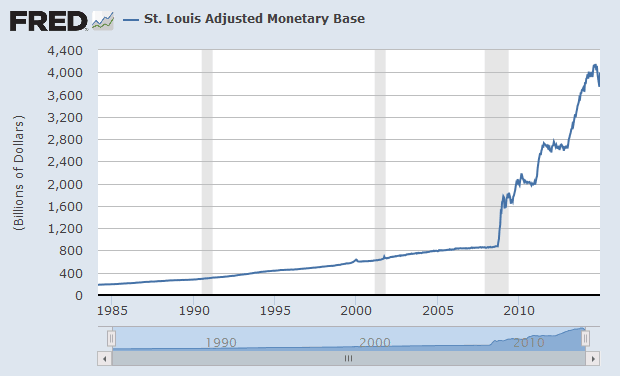

But the Fed is acting like it's serious. Take a look at the monetary base, which is the amount of new currency that's been created and pumped into the banking system. The trajectory since the 2008 crash tells you all you need to know about the "recovery," which turned out to be just the Fed printing money and a few mostly rich people spending some of it. But check out the far right edge where the line turns negative. Not wildly negative, but still, the Fed does appear to have stopped adding and started subtracting. The money supply is falling.

This kind of tightening would normally coincide with -- or cause -- rising interest rates. But that's not yet part of the plan, so even in the face of manifestly tighter money, interest rates have been allowed (or forced) to decline.

But the pressure of tighter money has to be released somewhere, and in this case it's been the foreign exchange market. The euro, for instance, has tanked since mid-year.

Every other major currency is down as well, which is the same thing as saying that the dollar is up big. And a rising currency is functionally the same thing as higher interest rates. Consider: If you borrow money you have to pay back the principal plus interest. A higher interest rate obviously makes the loan harder to repay. But so does a rising currency because in order to pay dollars to a creditor you have to get those dollars, and if they've become more valuable in the meantime you have to pay up.

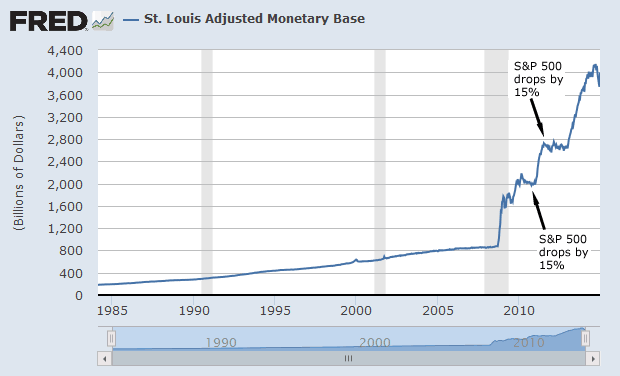

So the US is experiencing two of the three symptoms of tighter money: a falling money supply and rising currency. Will we eventually get the third, rising interest rates? That would be interesting to say the least. To understand why, let's revisit the monetary base chart, with the addition of arrows showing what the stock market did during the previous two attempts at tapering. It tanked -- or at least started to tank -- and the government relented.

Note that during those other two taper attempts the monetary base didn't fall much if at all, and the dollar didn't rise to anything like its current level. In other words, the Fed didn't actually tighten, it just stopped loosening. This latest iteration is already more serious than the two that came before.

So either another stock market scare is coming, and soon, or the economy has finally achieved the fabled escape velocity in which it can grow under its own power without help from performance-enhancing monetary drugs. We should know the answer soon.

Spoiler alert: The sound-money crowd is right. This ends very badly.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.