Financial Slaughter - The Silence of the Lambs

Stock-Markets / Financial Markets 2015 Mar 03, 2015 - 05:17 PM GMTBy: DeviantInvestor

One interpretation is that we are living in the best of all possible worlds. Another is that we are being led to financial slaughter.

One interpretation is that we are living in the best of all possible worlds. Another is that we are being led to financial slaughter.

A few thoughts:

1913: The Federal Reserve was created and dollars have been devalued ever since. (more paper, less gold)

1933: President Roosevelt confiscated gold owned by American citizens. (no more citizen held gold in the US)

1971: President Nixon terminated the convertibility of dollars into gold. (much more paper, less gold)

2000: The NASDAQ crashed along with the retirement dreams for many Americans. (paper assets crashed)

2001: The Patriot Act and the War on Terror…… (more paper)

2008: Financial crash, crisis, and bailout for Wall Street….. (much more paper)

2008: Quantitative Easing, bond monetization, printing currency, and effectively zero interest rates are used to recapitalize banks at the expense of savers, pension funds, insurance companies and the productive economy. (more paper)

2010: QE2 (much more paper)

2012: QE3 (much much more paper)

Quick summary: more paper, less gold

- The dollar has lost approximately 98% of its purchasing power since 1913.

- Governments and central banks have dramatically increased their power and importance since 1913 and particularly since 1971.

- Several $Trillion in sovereign debt now “pays” negative interest rates.

- Savers in the US, Japan and Europe lose purchasing power every day to understated inflation, devaluation of currencies, and near zero or negative interest rates.

- Total global debt is approximately $200 Trillion. There appears to be no plan to repay that debt. Perhaps it will increase exponentially forever or will it default? Which is more likely?

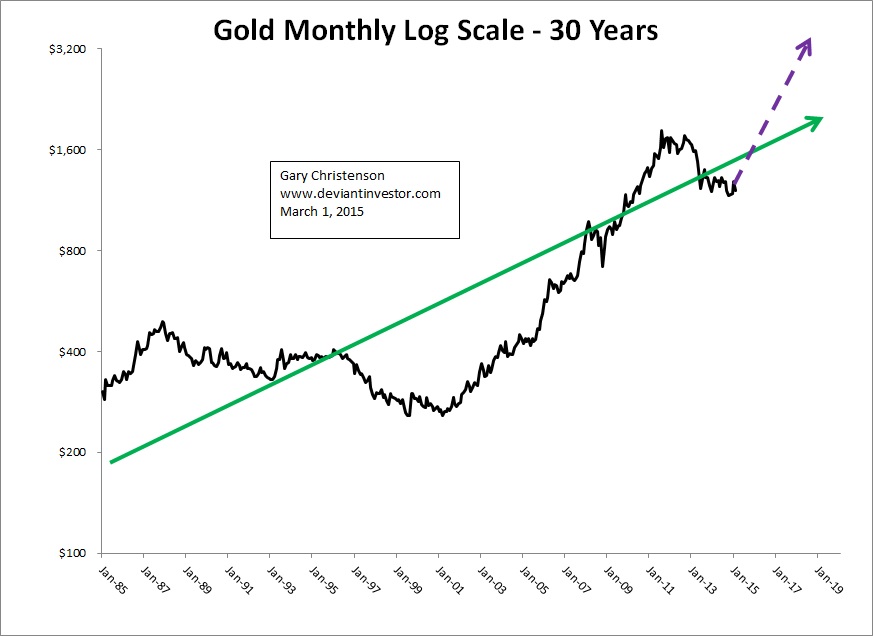

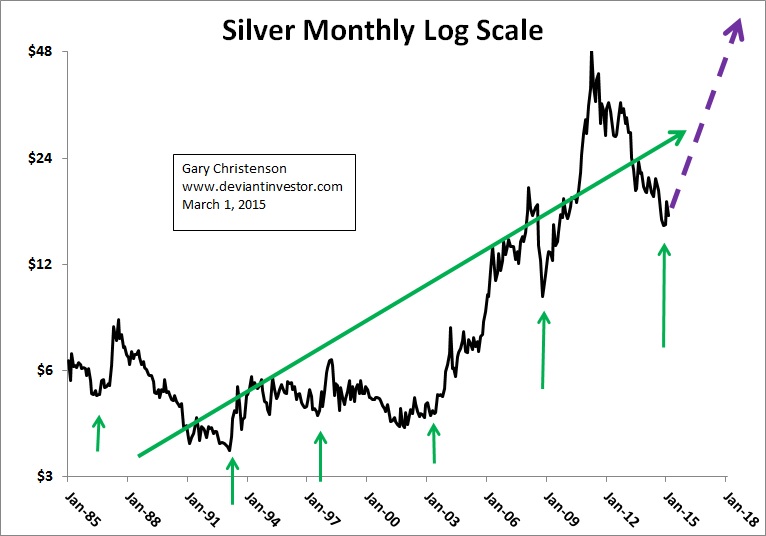

- Gold produces no income and actually costs money to store– and now, the same is true for cash in some countries. Why choose paper assets when gold and silver are real and have maintained their value, on average, for 5000 years, while unbacked paper currencies have inevitably crashed and burned.

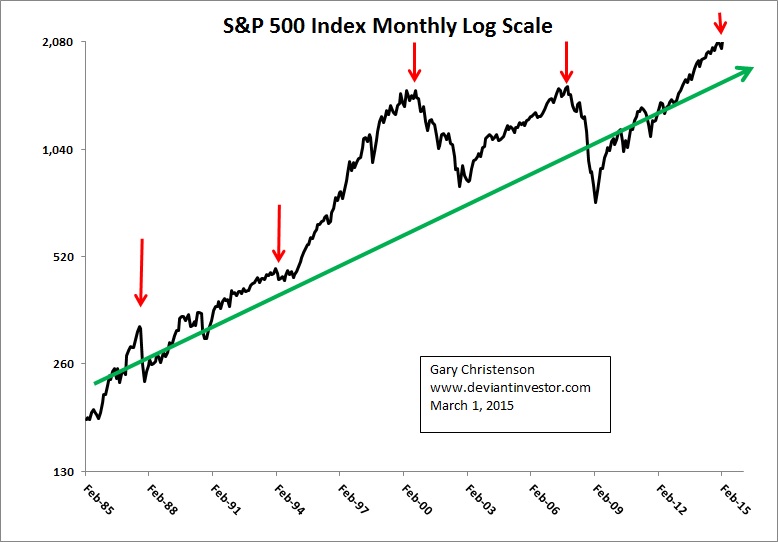

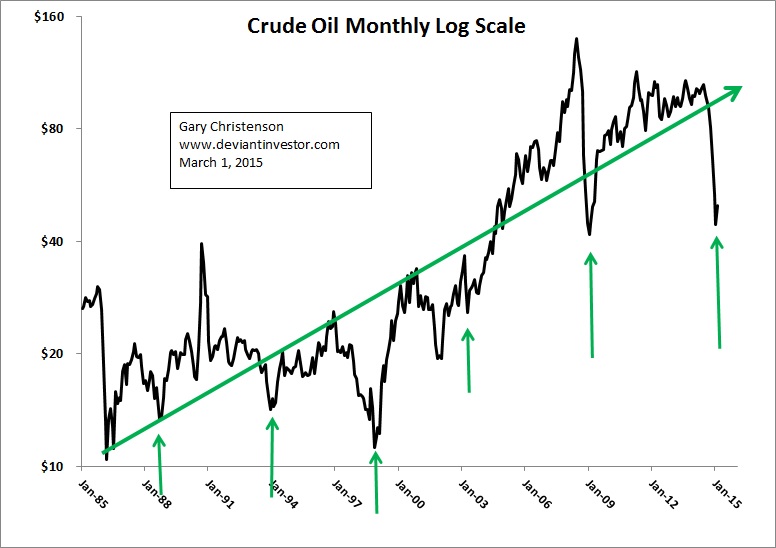

Fiat currencies are inevitably printed to excess, purchasing power declines and assets increase in nominal price. Consider the increasing prices shown on these log scale monthly charts of the S&P, crude oil, gold and silver for the last 30 years.

The S&P, crude oil, gold and silver have exponentially increased in price as fiat currencies have been devalued. Consumer price inflation destroys purchasing power, especially when interest rates are low or negative. Unbacked paper fiat currencies are well and truly on the road to oblivion, and the lambs are being led to the slaughter of assets invested in sovereign debt, fiat currencies, and leveraged paper assets.

It may be the best of all possible worlds for bankers in control of the “currency printing presses,” especially if they have purchased a majority of politicians that protect the financial sector at the expense of citizens and the productive economy. But all paper assets are at risk, may crash, or be destroyed if those assets are based in a devaluing currency, such as the Ukrainian Hryvnia. (Famous last words: “It can’t happen here.”)

If you are depending on your fiat currency savings, Social Security or the benevolence of government, the words financial slaughter may become more relevant. PROTECT yourself with gold and silver.

Keep stacking and don’t be led silently into the slaughter house.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.