The Most Crowded Trades on Wall Street - Apple

Companies / Apple Mar 16, 2015 - 11:45 AM GMTBy: EconMatters

Herd Mentality

Herd Mentality

Here are 5 of the most crowded trades in financial markets, where a lot of group think has led to large fund flows on one side of the trade. This has been a very common phenomenon the last couple of years in financial markets, partly due to participating in the same investment conferences, limited trading opportunities, lack of imagination, investors seeking security with the crowd, Fed incentives, shared information and networking otherwise called industry collusion, trend trading, and going with ideas that have worked in recent history.

Risk/Reward Perspective

Now crowded trades can remain crowded trades for a long time, they can even become overcrowded trades long before they start to reverse themselves. However it is important to know that a lot of funds have already been committed to these trades from a one sided perspective. Thus the price to value relationship or value proposition from a risk reward perspective is just not that great, and in some of these five cases, is in fact pretty bad or skewed in the opposite direction.

Apple

Let’s start things off with Apple this stock has had an amazing run from the large pullback when Samsung pulled ahead of Apple with the better smartphone with a bigger screen. Since then Apple has finally reacted and upgraded their phone`s specs with the culmination being the large screen size in the last phone iteration. Samsung has come out with some small improvements for their last smartphone iterations, but currently Apple probably has the overall consensus best smartphone as viewed by the mass high end smartphone buyers. Samsung is coming out with the Edge Smartphone in April, and this phone`s specs are probably better than Apple`s latest product offering, but it remains to be seen if the specs are noteworthy enough to gain market share from Apple for the high end buyer given Apple`s Higher Brand Value among consumers.

Read More >>David Einhorn Is The Dumb Money on Apple

So You Have Done The Big Screen…What Now?

I think that once Apple finally came to market with the big screen phone there are only small incremental improvements to smartphones from here on out, and smartphone margins are going to come down across the industry. I also think that Apple will no longer have the best smartphone in four months as the other companies bring out their latest offerings to market. I look for one more really good earning`s report from Apple, but that is probably as good as things are ever going to get for this company. The downside risks as all the Hedge Funds and Management Funds unwind this trade on profit taking and seeking better returns elsewhere in the markets is significant.

Smartphones are fully Commoditized

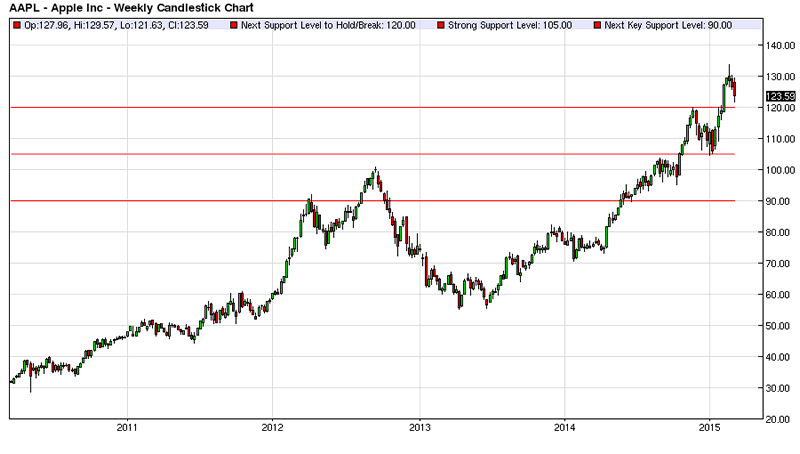

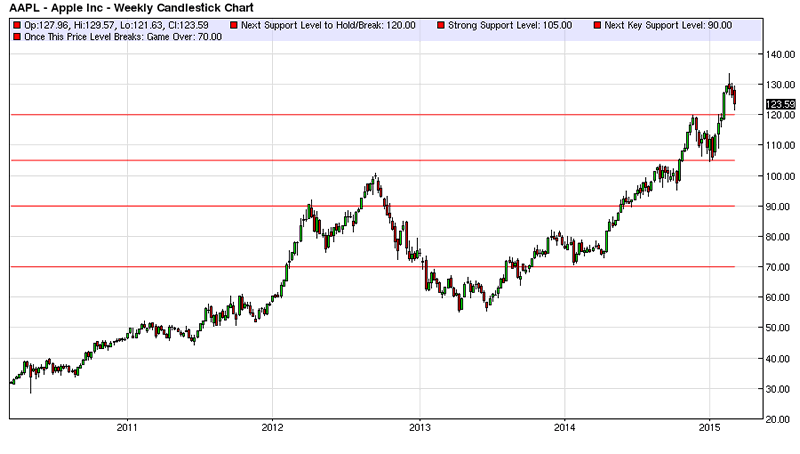

I know this company is sitting on a lot of cash, but cash can be burnt through rather fast on the downside of a major commoditization cycle in a company`s hardware offerings. I wouldn`t be surprised if Apple drops below a $50 stock over the next three years, and remember how fast Apple dropped the last time all the money managers left this stock. The amount of fund managers who currently hold this stock in their portfolios is off the charts from a percentage standpoint, it is probably the second most crowded trade on the street.

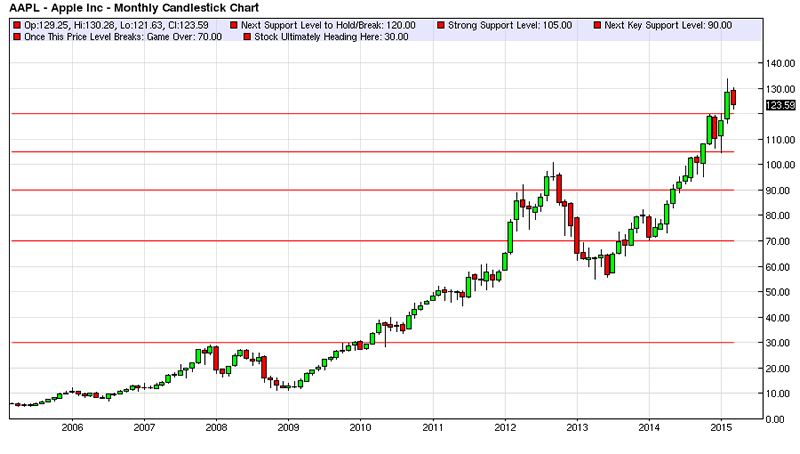

In fact, I would categorize Apple as an overcrowded trade right here, not that it cannot go higher, but probably an ideal candidate for legging into a short position at anything above $130 a share, if it ever gets back to those levels. Maybe hope for a spike on second quarter earnings and start building a short position in this overvalued stock. The ideal time for establishing a short position was when it spiked on all that hysteria over building the next I-Car, speaking of how companies can burn through loads of cash reserves by going outside their core competencies.

Read More >>Read More >> Selling The Shale Boom: It's All About Reserves

Apple Meets the Definition of an Overcrowded Trade

But from the standpoint of who is left to buy this stock, those already heavily invested on the street, and the downside risk from these elevated levels as the Fed ends its easy money policies, Apple is setting up for one of the greatest exoduses that we have seen on the street in ages. I wonder if similar to the last time Apple dropped like a rock and a bunch of fund managers got left holding the bag citing valuation arguments and the increased need to bail their underwater positions out with increased share buybacks; if the same phenomenon occurs again.

Read More >>> Michael Lewis is Right “Spoofing” Proves Market Rigged on Daily Basis

Deer in Headlights

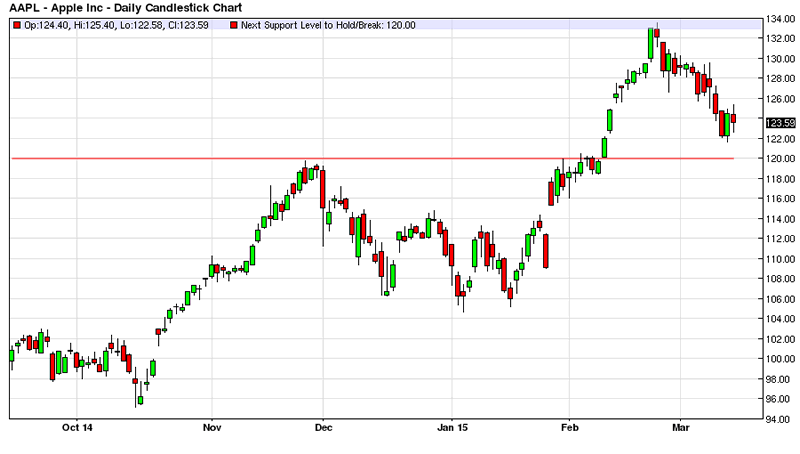

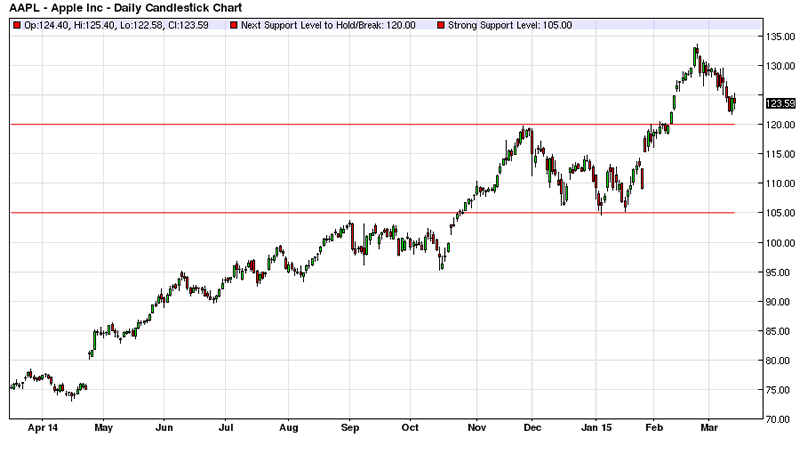

This stock price is much higher this time around, and once the exodus starts, and key technical support levels fail, the very nature of how overcrowded this trade is will become apparent to investors. They can lose so much value on their positions in less than 6 months’ time once the sentiment turns on this name that I would say Apple is the most dangerous holding on the street right now for portfolio managers. Once this name starts breaking you cannot worry about slowly unwinding the position, you just have to start dumping this stock like a fire sale because everybody else will be trying to get out at the exact same time. Those slow to anticipate the magnitude and breadth of the selloff in this Halo Stock once the selling momentum snowballs will be left looking like Deer in Headlights.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.