Gold, Crude Oil, Stocks & Bonds Four Month Markets Forecast

Stock-Markets / Financial Markets 2015 Apr 08, 2015 - 01:43 PM GMTBy: Chris_Vermeulen

Everyone is looking for the holy grail of the financial market which will tell what will happen next in stocks, commodities, bonds etc… Knowing that the holy grail of trading does not exist I am going to step out on a limb and share my four month stock market forecast along with commodities and bonds.

Everyone is looking for the holy grail of the financial market which will tell what will happen next in stocks, commodities, bonds etc… Knowing that the holy grail of trading does not exist I am going to step out on a limb and share my four month stock market forecast along with commodities and bonds.

It is vital that you understand this is a 2-4 month forecast only and as the market evolves my outlook will change as I follow price action as closely as possible.

Here are some key points you need to know:

- Bonds should perform well for a few months and possibly a long time until the bear market in US stocks takes hold and is well under way. BUT, the bond bubble will burst eventually when rates start to climb. This could be June, or much later in the year but until then I expect them to rise as the safe haven.

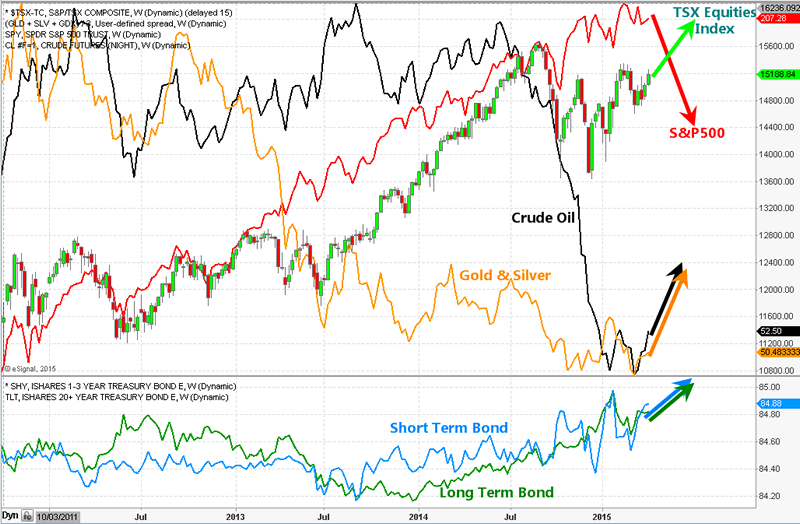

- Commodities typically outperform equities during the late staged of the bull market which is what I feel the US stock market is. Resource stocks and resource rich countries like Canada should hold up well, and possibly make new highs going into summer.

- Notice how gold and oil have moved from opposite corners of the chart compared to the US and Canadian stock indexes.

- During the 2000 and 2008 bear market we saw gold, silver, oil and mining stocks get hit very hard in the second half of the bear market. Will this happen again? I do not think it will because this time rates are at zero and there is only one way to go when they are at the bottom… Up!. This means stocks and bonds will likely both enter a bear market, maybe not at the same time, but they will eventually. This means the only places to protect your capital will be commodities, resource based investments, or simply cash CAD & USD.

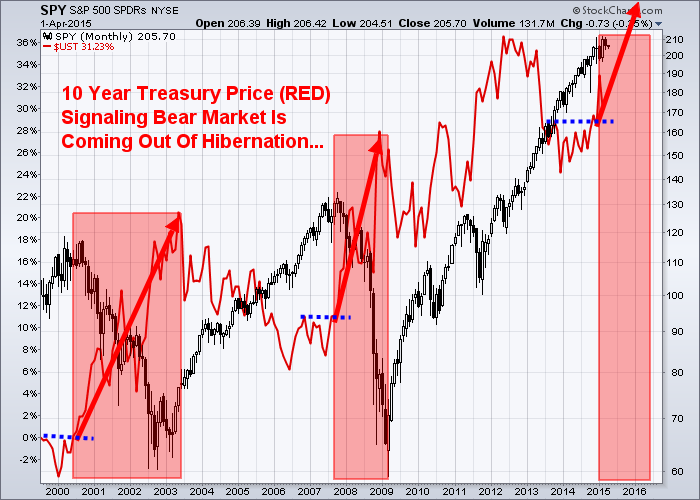

Take a look at this 10 year bond price overlaid on the S&P 500 index. So far this year bonds have popped and rallied above short term resistance which we have seen in the past. Big money is rotating into bonds for the time being and this is a warning sign of a stock market top. If you want to learn more about the technical and fundamentals in motion about what is about to happen, why, and when read my ebook “The Global Economic Collapse Of 2015”

Market Forecast Conclusion:

In short, safe havens for investor’s capital will be more of a dance during the next bear market in US equities.

With many countries devaluing their currencies and a potential bull market in commodities I expect the Canadian Loonie and US Green Back to hold the value if not rise over the next year or two.

If you want my long term investing signals my ETF swing trades so you can protect your capital and profit during the next bear market – Sign Up Today!

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.