Global Debt Now $200 Trillion

Stock-Markets / Global Debt Crisis 2015 May 14, 2015 - 09:55 PM GMTBy: GoldCore

- McKinsey Institute says global debt is $199 trillion and unsustainable

- McKinsey Institute says global debt is $199 trillion and unsustainable

- Total global debt is $27,204 for every person living today

- All major economies have “higher levels of borrowing relative to GDP” than in 2007

- 3 risk areas – rising Chinese debt, government and household debt

- Debt report ignores U.S. unfunded liabilities of over $100 trillion

- Major cause of risky, unprecedented debt levels – QE and ultra loose monetary policies not acknowledged

- Risk of new global financial crisis – wealth taxes, currency wars and devaluations and bail-ins

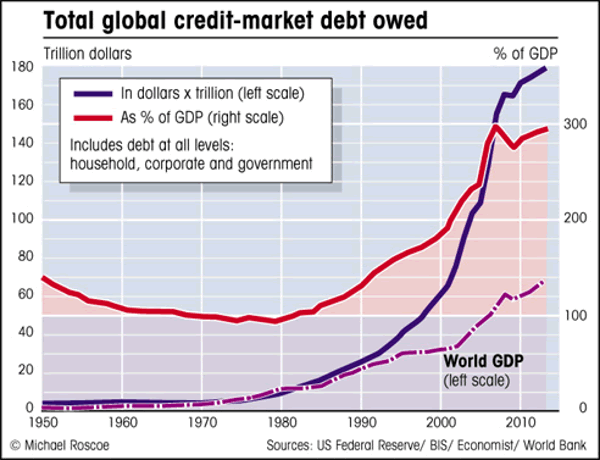

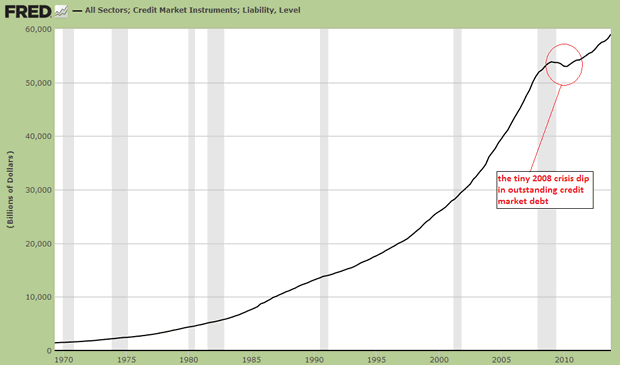

Global debt is now in the region of $200 trillion. The McKinsey Global Institute recently published a report highlighting the bloated, unsustainable levels of debt that have been accumulated globally and the huge risks when interest rates begin to rise again.

McKinsey concluded that total global debt was $199 trillion and the little covered report was released in February – 3 months ago – meaning that the figure is likely over $200 trillion. With a global population of 7.3 billion this works out out at over $27,200 of debt for every man, woman and child alive in the world today.

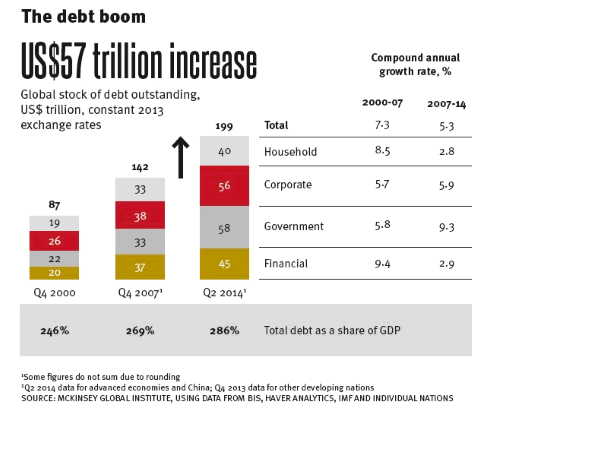

Almost 29% of that debt – $57 trillion – has been accumulated in the relative short period since the financial crisis erupted in 2007 – just 8 years.

This has increased the total debt-to-GDP ratio by 17% and “poses new risks to financial stability and may undermine global economic growth.”

The report, entitled “Debt and (not much) deleveraging”, analyses the debt situation in 47 different countries – 22 of which have advanced economies and 25 with developing economies.

Of the 22 advanced economies every one was found to have higher debt-to-GDP ratios today than they did in 2007. For many, the ratio had grown by more than 50%.

The three major areas for concern according to the report are rising government debt, rising household debt and rising total debt in China – which has increased a staggering four-fold since 2007.

The McKinsey report states bluntly that “government debt is unsustainably high in some countries.”

Government debt has expanded by 25% since the crisis began and much of it stems directly from the crisis.

The report states that for the six of the most highly indebted nations deleveraging has become impossible – at least without “implausibly large increases in real-GDP growth or extremely deep fiscal adjustments.”

With regard to household debt the report states that household debt-to-income ratios in some countries exceed those of the crisis countries in the run-up to 2008.

In those crisis countries – the report cites the U.S., the U.K., Ireland and Spain – households have managed to pay down some debt. According to the report, in advanced countries – like Australia, Canada, Denmark, Sweden and the Netherlands – but also in Malaysia, South Korea, and Thailand household debt relative to income has exploded.

China’s debt has quadrupled since 2007 to $28 trillion. This represents 282% of GDP. The McKinsey Institute expresses concern about China’s financial system thus:

“half of all loans are linked, directly or indirectly, to China’s overheated real-estate market; unregulated shadow banking accounts for nearly half of new lending; and the debt of many local governments is probably unsustainable.”

They believe the Chinese government could bail-out the financial system if necessary but suggest that debt be reined in.

The report offers its solutions to these three growing crises but fails to acknowledge the root cause of the problem – the policy response of governments and central banks in recent years and the debt based monetary system.

Not acknowledged in the report is the fact that governments and central banks opted to bail out banks, at the expense of taxpayers and engaged in quantitative easing which again aided banks and their balance sheets but further indebted taxpayers and sovereign nations.

In a world where currency comes into existence as a debt and the interest on that debt cannot be paid until new currency is created in the form of new debt, governments are left with a choice between continuous debt expansion and borrowing or deflation and possible depression and economic collapse.

Unless and until the debt based system is replaced there can only ever be an increasing debt load and an urgency for economic growth with the consequent degradation of our environment and a debt enslaved humanity.

The solutions offered by the McKinsey report, particularly with regard to dealing with government debt, instead focus on ever more government and corporate power and financial repression.

For example, in dealing with government debt the report suggests “more extensive asset sales, one-time taxes on wealth, and more efficient debt-restructuring programs.”

The summary of the report makes this conclusion:

“Debt undoubtedly remains an essential tool for financing economic growth. But how it is created, used, monitored, and (when necessary) discharged still needs improvement.”

It is not clear what “one-time tax on wealth” McKinsey have in mind and whether debt restructuring will involve “bail-ins.”

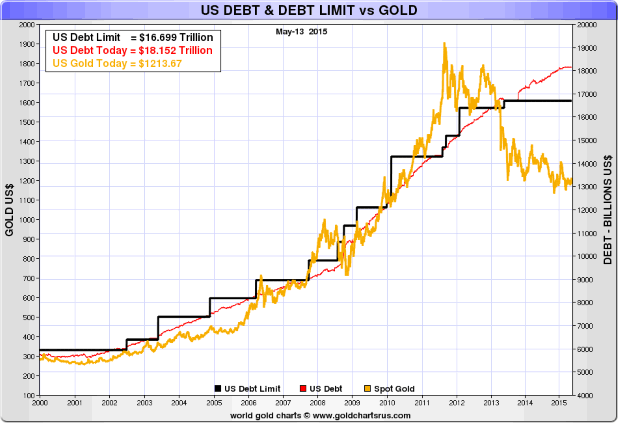

Another glaring omission in the McKinsey report is the dire fiscal position of the U.S. who now have a National Debt or Federal Debt of $18,44 trillion and a real national debt and “unfunded liabilities” alone of over $100 trillion.

The attempt to solve what was essentially a global debt crisis with mountains of more debt means we will have another global financial crisis – the question is when rather than if.

This will have an impact on our economic recovery and on asset prices and hence the importance of diversification – both in terms of asset diversification but also in terms of geography and where and how your assets are owned.

Must read guide to Bail-ins here: Protecting your Savings In The Coming Bail-In Era

MARKET UPDATE

Today’s AM LBMA Gold Price was USD $1,214.75, EUR $1,063.59 and GBP $768.91 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,193.00, EUR 1,062.43 and GBP 761.55 per ounce.

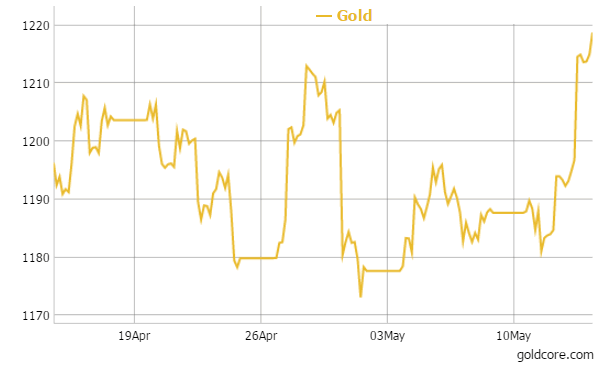

Gold in USD – 1 Month

Gold climbed $21.60 or 1.81 percent yesterday to $1,214.80 an ounce, and silver outperformed and surged $0.57 or 3.45 percent to $17.11 an ounce.

Gold traded sideways in Asia overnight and gold in Singapore was firm at $1,214.10 an ounce near the end of day trading. Gold and silver appeared to consolidate in early trading in London on the sharp gains seen after the poor U.S. retail sales number yesterday.

Gold and silver are both near a five week high after climbing on the weak U.S. retail sales data that heightened concerns that the Fed would not raise interest rates soon – something we have said would likely happen. The U.S. dollar fell in value against other currencies on the news and is weak again today – particularly against silver and the Swiss franc.

Gold is being supported by jittery bond markets, rising bond yields and dollar weakness this week.

Recent economic data, including the retail sales number yesterday, has been more negative than positive. This is contributing to volatility in bond markets and some selling pressure in equity markets. There are increasing concerns about the economic outlook globally.

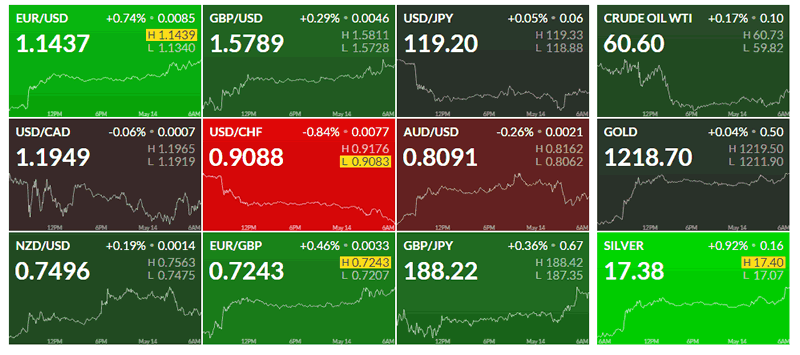

Finviz – 1 Day

The U.S. dollar has come under further pressure and remained at three month lows today after the poor retail data proved a huge disappointment to those expecting a strong economic rebound from a weak first quarter – blamed on the weather.

German and U.S. bond yields surged to their highest in over five months as a vicious selloff extended to its tenth session. The startling rise in yields has made equities look more expensive in comparison to government debt and kept stock markets subdued.

Gold prices may benefit if there is a supply disruption from South Africa due to South Africa’s Association of Mineworkers and Construction Union (AMCU) pay rise dispute. The AMCU are seeking basic pay for entry-level workers in the gold mining industry to be more than doubled, which means difficult negotiations and perhaps a strike which we saw in the platinum sector last year that lasted five months.

In late morning European trading gold is up 0.32 percent at $1,220.54 an ounce. Silver is up another 1.2 percent at $17.40 an ounce. Palladium and platinum are up 0.15 and 0.26 percent at $790 and $1,150.00 an ounce respectively.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.