Don't Drown in the Sea of Global Debt

Economics / Global Debt Crisis 2015 May 27, 2015 - 12:41 PM GMTBy: ...

MoneyMorning.com  Peter Krauth writes: Debt is the proverbial double-edged sword, offering access to costly assets, but sometimes driving overleveraged borrowers into bankruptcy.

Peter Krauth writes: Debt is the proverbial double-edged sword, offering access to costly assets, but sometimes driving overleveraged borrowers into bankruptcy.

Only politicians and some Keynesian economists could convince themselves – along with a good portion of the masses – that more debt is the solution to the world's already crushing levels.

It's gotten so backwards, it's downright scary.

Yet there are some practical things you can do to avoid getting sucked under by the growing sea of debt.

The Staggering Growth of Borrowing

According to a study recently published by the McKinsey Global Institute, a research and consulting firm, worldwide debt levels have exploded. Although common sense had many expecting that world economies would deleverage after the Financial Crisis, the exact opposite has taken place.

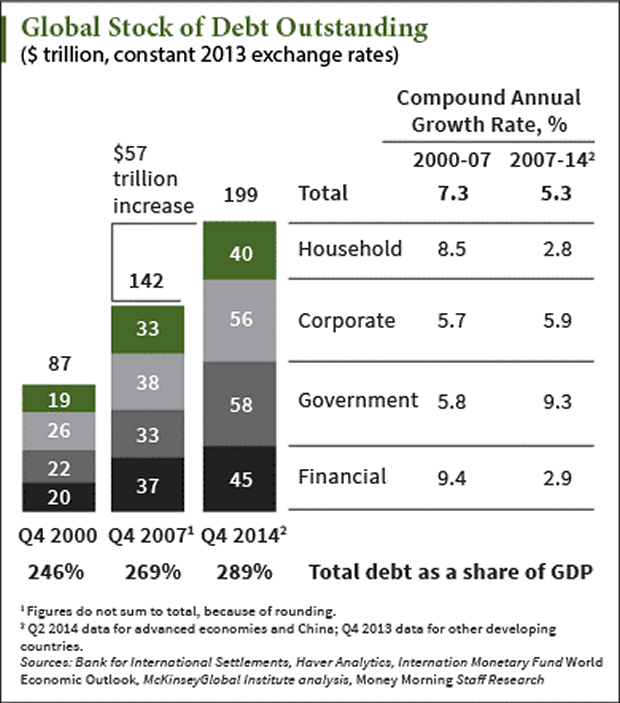

We've now seen global debt balloon by an additional $57 trillion since 2007, raising the world's debt-to-GDP ratio by 17%. In other words, we're now more overleveraged than before the crisis.

Global debt levels have reached an astronomical $200 trillion (see chart at left), representing $27,200 owed for every single human on the planet. Unsurprisingly, growth in government debt has outpaced that of financial, corporate, and even household levels, growing at an aggressive 9.3% annually between 2007 and 2014.

Not surprisingly, a large portion of government debt growth originated specifically because of the crisis. New taxpayer guaranteed debt was used to repay or otherwise secure delinquent or trash debt.

And yet when used properly, debt is a solid, proven financing option to fund crucial projects like infrastructure expansion, acquire income-producing properties, and facilitate homeownership. In excess, the servicing costs of too much debt slows growth and ups the risk of future financial crises and exacerbates their accompanying fallout.

McKinsey's Debt and (Not Much) Deleveraging report examines the state of debt across 47 nations – 22 advanced and 25 developing.

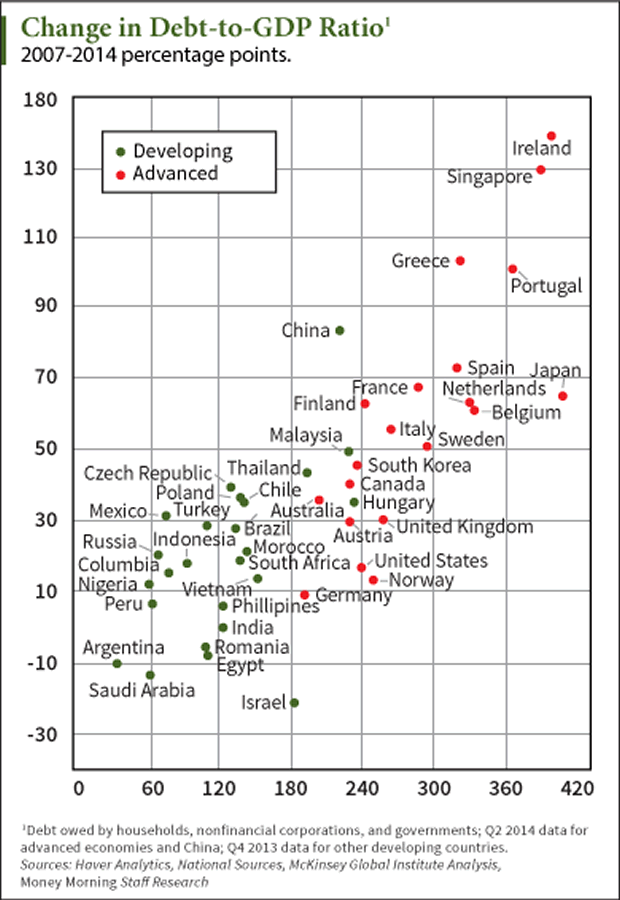

Three main concerns emerge in the report: Large and ever-increasing government debt, household debt, and total debt, specifically in China. China gets singled out for dubiously quadrupling its debt to $28 trillion, reaching 282% of GDP in 2014 and placing it ahead of some advanced economies. Half of all lending is linked to its overheated real estate market.

Overleveraged real estate financing is a problem reaching well beyond China. The study finds that mortgages are the main source of household debt in advanced economies. Low rates – thanks in part to the Fed and its ZIRP – have spurred larger mortgages, leading in turn to house prices being bid ever higher.

Debt-to-income, debt service ratios, and price changes point to seven troublesome economies. McKinsey says the Netherlands, South Korea, Canada, Sweden, Australia, Malaysia, and Thailand are at highest risk.

So does the consulting firm offer any concrete solutions to these problems?

Sadly, no. Instead, the Institute spews out all-purpose solutions to government debt like more widespread asset sales, one-time taxes on wealth (which I've warned you about before), and more effective debt-restructuring programs.

Improving Your Personal Debt Situation

Given the dire state of government and household debt, what can you do to improve your own situation and avoid becoming a victim of leverage?

- Take charge and review your own overall debt situation. Get a handle on all of your outstanding debt: how much you owe, to whom, when it's due, and the interest rates you're paying.

- Figure out if some of your debt allows for early repayment. Typically it does, but prepayment penalties have made a reappearance after a protracted absence from many of the lending markets.

- Attack the high-interest debts first. Consider whether you might consolidate high-interest loans (like credit card debt) into a secured line of credit, which may offer much lower interest rates.

- If you have a mortgage, refinance to lower rates if possible. Hedge your risk against interest rate movement by locking in your mortgage for as long as possible at the lowest rate possible. When rates rise, perhaps considerably and suddenly, you'll be sitting pretty knowing you're protected with a low interest rate for the long term.

Also, if things sour and we face high inflation or even hyperinflation in the future, your debt will at least be partially offset and inflated away. That's because you'll have the benefit of paying back an old debt with new dollars that are worth much less, putting you in a favorable position.

Like I said at the outset, debt can be a great tool if employed properly and in moderation. Use it improperly, and the results will deeply undermine your financial stability. But if used temperately, you can benefit while limiting downside risk.

Source :http://moneymorning.com/2015/05/27/dont-drown-in-the-sea-of-global-debt/?clickers=20150527_MM_API

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.