Inflation Is Lurking, but This Asset Can Protect You

Housing-Market / US Housing Jul 02, 2015 - 03:48 PM GMTBy: ...

MoneyMorning.com  Peter Krauth writes:While the investing world is focused on Greece, events unfolding right now in Africa offer another important cautionary tale.

Peter Krauth writes:While the investing world is focused on Greece, events unfolding right now in Africa offer another important cautionary tale.

Thanks to reckless political and economic mismanagement, Zimbabwe holds clues to the future of other nations – like ours.

Granted, this failed state's policies have been more egregious than those perpetrated by the U.S. government against its people. Nonetheless, some of the outcomes could be similar. And I'm going to tell you one way to protect yourself.

Zimbabweans have been robbed by inflation for years and right now are now being offered compensation that's no better than an insult.

It's a frightening scenario. And those who think "it can't happen here" need only think back to the massive losses caused by runaway inflation during the Oil Shock days of the 1970s.

But preparing for it is easier than you'd think.

No One Wants to Be a "Quadrillionaire" like This

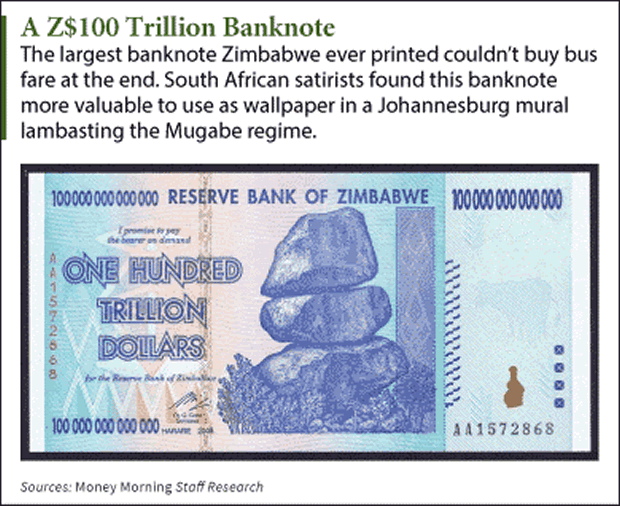

Five U.S. dollars in exchange for 175 quadrillion Zimbabwe dollars.

Under the country's demonetization program between June 15 and September 30, that's exactly what's being offered to bank account holders.

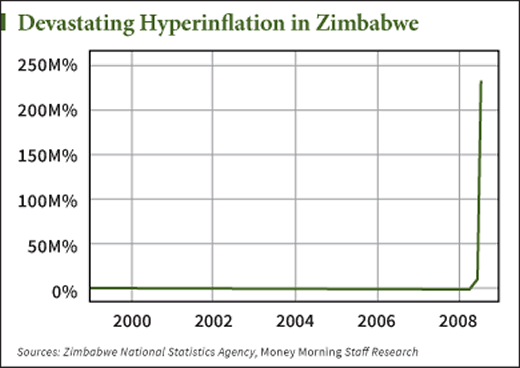

Use of the country's currency was abandoned in 2009 following inflation that eventually exploded to an incomprehensible 500 billion percent.

Zimbabwe is an example of how a wonderfully advanced and economically sound country (sound familiar?) can go awry.

After a bloody, 15-year civil war between the breakaway Rhodesian regime and nationalist guerillas, Zimbabwe gained its independence from Britain in 1980.

At the time, the Zimbabwe dollar was worth considerably more than the U.S. dollar. What's more, at independence, Zimbabwe was the breadbasket of Africa. It proudly boasted one of the most advanced and diverse economies on the continent.

It wouldn't stay that way for long…

By the early 1990s, Zimbabwe's euphemistically named "Economic Structural Adjustment Program," formulated in part by the "ever-so-helpful" International Monetary Fund and World Bank, weighed badly on the economy.

Making matters worse were President and Prime Minister Robert Mugabe's "land reforms," which abandoned the "willing buyer, willing seller" paradigm laid out in Zimbabwe's founding document, the Lancaster House Agreement, and saw highly productive commercial farms expropriated – often violently – and in many cases given to Mugabe's political flunkies.

Mugabe instituted price controls and printed endless amounts of cash, saying, "Where money for projects has not been found, we will print it."

Those words could've served as Zimbabwe's epitaph – or the sub rosa motto of the U.S. Federal Reserve in the years since the 2008 Financial Crisis.

Hyperinflation brought Zimbabwe ridiculous banknotes denominated up to Z$100 trillion dollars as prices eventually doubled every few hours.

But the effects were nothing to laugh at.

Those same price controls and hyperinflation led to severe shortages for a number of staples, including meat, milk, sadza (cornmeal), and gasoline.

Unemployment eventually hit 80%. Starvation and disease stalked the land. Life expectancy plunged to 44 for men and 43 for women – among the lowest in the world. Infant mortality more than doubled by 2004, topping 12%.

And sadly, Zimbabwe is not some rare, isolated case. Just look at Venezuela…

An Unfolding Disaster Closer to Home

At Mercado Libre, a "Latin American eBay," a new Apple iPhone in Caracas will run about $68,000. No kidding.

In Venezuela, too, price controls and money printing have led to critical shortages and hyperinflation, currently running over 64%.

Of course, falling oil prices have wreaked havoc on the economy. Nicolás Maduro's government revenue from petroleum exports account for more than 50% of national GDP and about 95% of overall exports.

The situation has degraded so badly that, according to Reuters, Clorox Co. (NYSE: CLX) stopped operating in Venezuela in 2014, and now 3M Co. (NYSE: MMM) and Mattel Inc. (Nasdaq: MAT) are contemplating doing the same thanks to crippling inflation and economic uncertainty.

Yet with trillions upon trillions of currency units printed around the world in the past eight years, the risks of high inflation and even hyperinflation are growing in the U.S. as well.

So how can you protect yourself from the ravages of inflation and get paid while watching your investment grow?

In two words: rental housing.

A Red-Hot Trend…

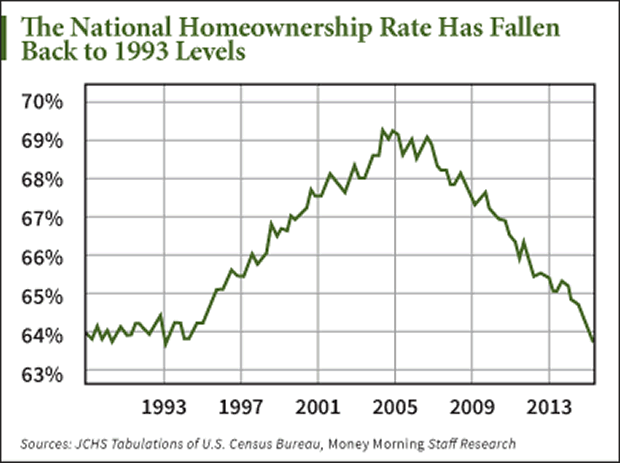

A recent study by Harvard University's Joint Center for Housing Studies shows that U.S. homeownership has receded back to 64%, a level it was at 22 years ago.

According to the Center's Chris Herbert, "the trend does not appear to be abating."

Demand for apartments is so strong, rents are bumping higher at a much faster rate than inflation. Baby boomers and Gen-Xers alike have dropped out of the homeownership game.

Rents increased 3.2% last year (that's twice the official rate of inflation) as people have returned to the rental market in droves.

That has produced dramatic results, with almost 50% of renters now considered cost burdened since they're spending 30% or more of their income on shelter, and more than a quarter of all renters spend a whopping 50% of income.

Meanwhile, new rental housing units are being added at rapid clip, seeing the highest levels of new construction last year since 1987. And it's still not enough.

So the way to play this opportunity is through America's foremost rental real estate investment trust (REIT).

…And an Unassailable Inflation Hedge

Equity Residential Properties Trust (NSYE: EQR) is quite simply the largest residential REIT in the nation.

Boasting more than 109,000 apartment units spanning 24 states, this REIT is in the business of buying, building, and remodeling apartments in some of America's largest and fastest-growing cities like New York, Boston, Washington, L.A., San Francisco, and Seattle.

Being a REIT, Equity Trust is obliged to pay out 90% of its net income, which represents an attractive 3.10% yield for unitholders.

The company currently has an operating margin of 35.5% and a hefty profit margin of 27.7%.

Equity Trust is well-capitalized and strongly positioned for further growth, with an additional 5,000 rental units currently being built.

And no wonder… In the last quarter, company earnings were up a massive 131%.

As for eventual interest rate hikes, CEO David Neithercut welcomes them, saying higher rates are likely to be due to higher employment, growing wages, and an improving economy. And that means even higher rents.

Equity residential has a $25 billion market cap and trades about 1.6 million shares daily, offering plenty of liquidity.

It's also a great way to include some hard assets in the form of real estate in your portfolio, providing you with tangible protection against inflation… or maybe even hyperinflation.

Source :http://moneymorning.com/2015/07/02/inflation-is-lurking-but-this-asset-can-protect-you/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.