China's Stock Market Rollercoaster Ride Continues

Stock-Markets / Chinese Stock Market Jul 03, 2015 - 10:35 AM GMTBy: EWI

But There is a way to endure the wild ride -- with Elliott wave analysis

But There is a way to endure the wild ride -- with Elliott wave analysis

"Chao gu" is the Chinese term for speculating in stocks. Roughly translated, it means "stir-frying" shares. Lately, though, for millions of Chinese investors, it means getting fried.

Enter the "nerve-shredding," "whiplash-inducing," rollercoaster "tantrum" of China's stock market. After soaring to 7-year highs on June 12, both the Shanghai Composite and Shenzhen stock indexes collapsed in a respective 21% and 25% sell-off (as of June 30), frequently marked by wrenching intraday swings the likes of which haven't been seen in 20 years.

In the words of one June 28 news source (bold added):

"You have to have a very strong stomach to trade in China. You have to be prepared for days when you are up or down more than 5% and there is no clear fundamental explanation." (FinanceAsia)

In fact, not only isn't there a bearish fundamental explanation for the market rout, but those fundamentals widely seen as bullish for stocks have also failed to stem the slide. Take, for instance, these recent stock-boosting initiatives on the part of the People's Bank of China:

- A .25% cut to both its 1-year lending and deposit rates

- A decrease in banks' reserve requirements to loosen the lending spigot

- The first-ever approval of local government pensions to buy stocks

That China's stock market shrugged off these (and other) supposedly bullish catalysts hasn't gone unnoticed. In the words of one Chinese investor, these moves imply "the stock market is kidnapping the government." (The Globe & Mail, June 30)

Well, he's sort of right. The moves imply the government is not in control of the market. Actually, on June 5, our own Asian-Pacific Financial Forecast expressed this exact sentiment and wrote:

"China's current bull market is not a product of government stimulus or of investor ignorance or -- as a prominent short-seller told CNBC this week -- 'the largest pump-and-dump in history.' "(Bloomberg, 6/1/15).

So, what is it a product of? Well, our Asian-Pacific Financial Forecast provides this Elliott wave explanation:

"Actually, it's the initial wave within China's wave V up, which followed the end of its wave IV contracting triangle."

In other words, Chinese stocks have been in a bullish Elliott wave formation, but those don't develop in a straight line; you should expect pullbacks, whether or not there is a good "fundamental" explanation for them.

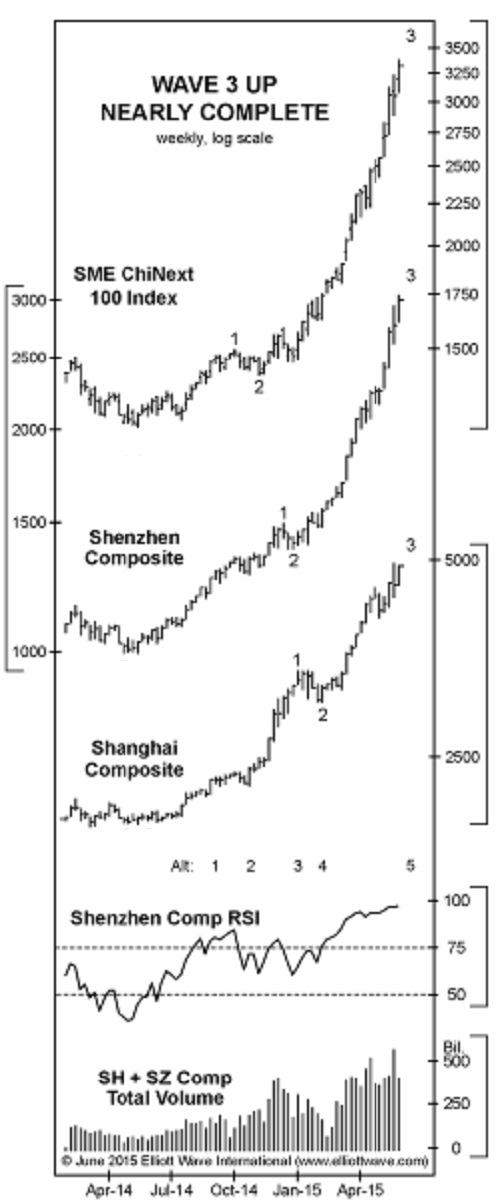

In fact, before the current rollercoaster ride began, our Asian-Pacific Financial Forecast wave count showed China's stocks nearing a wave 3 peak, setting the stage for an important decline. On June 5, we wrote:

"The indexes should soon correct in wave 4 for some weeks"

One week later -- on June 12 -- China's stocks turned down in the stomach-churning decline we see today.

Whether this decline marks a long-term top for China's bull market -- the same June 5 Asian-Pacific Financial Forecast shows you what key indicators to look for, and when.

The best part is, EWI has bundled exclusive charts and commentary from that subscriber-only report and made it available as a FREE resource to all Club EWI members.

This free resource, titled "China Stocks: Where Have They Been and Where Are They Going?" may be the most valuable report you read on the developing trend in China's stock market. And the best part is, it's absolutely FREE to all Club EWI members. If you haven't joined already, a life-time membership to Club EWI is also FREE!

Or -- for existing Club EWI members, click here for instant access to the entire "China Stocks: Where Have They Been and Where Are They Going?" report.

This article was syndicated by Elliott Wave International and was originally published under the headline China's Stock Market Rollercoaster Ride Continues. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.