Stock Market Critical Support Holding

Stock-Markets / Stock Markets 2015 Jul 13, 2015 - 12:40 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Bull Market

Intermediate trend - SPX may have started an intermediate correction

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

CRITICAL SUPPORT HOLDING

Market Overview

After many months of sideways trading, there is no question that SPX has started to correct. The rolling-over process - primarily the result of a bottoming 7-year cycle - has been slow, but steady. So far, the result has been to pressure prices into a short-term downtrend, but with several more months before the large cycle makes its low, the odds are very good that this correction of only about 4% will evolve into something larger.

Cycles are abstract, but they are always associated with a tangible catalyst. In this case, the Greek situation has been the primary cause of investors' uncertainty. This weekend could put an end to this condition and cause a short-term rally - or not, if Greece's latest offer is again rejected. If this happens, the 2040 level, which has been critical support stands a good chance of being broken, in which case a more protracted decline would start. But even if the Greek situation is finally settled, as long as the cycle is in a downtrend, other catalysts should appear as an excuse for continued market weakness.

Indicators Survey

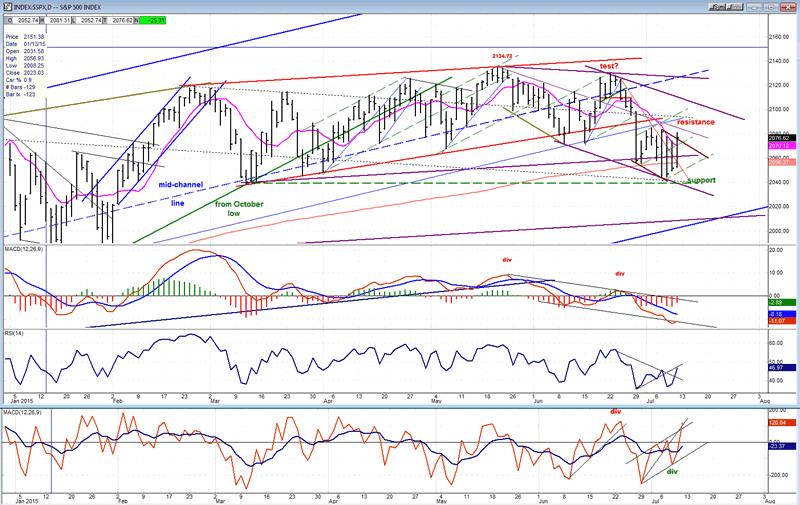

In spite of the rally, the weekly MACD remains in a downtrend. At 13.89, it remains positive but last week it traded below the October low. RSI is trying to stabilize at neutral (50).

The daily MACD turned up slightly on Friday for a reading of -11.07. The daily RSI also turned up to a reading of 46.97. The daily A/D is continuing its uptrend, is showing positive divergence, and achieved a reading of 120 on Friday, which is getting overbought by recent standards.

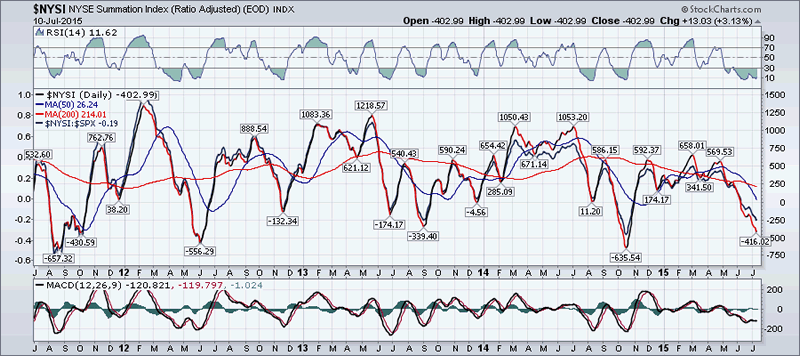

The NYSE Summation Index (courtesy of MarketCharts.com) is still in a downtrend in spite of the fact that the McClellan oscillator turned positive on Friday. Its RSI is oversold with positive divergence -- a ripe condition for a rally.

The 1X P&F filled a phase projection on Friday, but has a potential count to a higher level.

The 3X chart shows that the rounding top is most likely completed since it has started a declining pattern on the right side of the chart. However, it also shows clearly that the 2040 must be broken for a more serious decline to get underway. If this happens, everything above that level will become distribution with a potential count of several hundred points.

Chart Analysis

The beginning of a downtrend is highly visible on the Daily Chart (courtesy of QCharts.com, along with others below). The high of 2135 was made on 5/20 and followed by a minor decline. It was re-tested successfully a month later before a steeper decline occurred. The lower high and lower low pattern has formed a channel which is incomplete until we get another touch of the outside trend line; unless the weakness accelerates with the index dropping below 2040 and creating a steeper downtrend line. This could happen as early as next week if the ongoing talks about Greece's future fail to produce positive results.

After the wedge formation was completed, expectations were that there would be a normal retracement to the starting point of the wedge which was 2040. This was essentially satisfied with last week's retracement to 2044, but this is a minimum requirement and there is nothing to prevent the index from continuing lower. Up above, I mentioned that if we dropped below 2040, the distribution zone above that level had a potential count of several hundred points. However, there is also a smaller, but still substantial zone of distribution above 2072 which could send the index to the low 1800s if activated, which it was with the index trading below 2072. These potentials, along with expectations that the 7-year cycle low is still months away places SPX in a precarious position. Bulls can draw a little comfort that this scenario has yet to be confirmed, but we should be aware that this is a real possibility based on valid technical analysis.

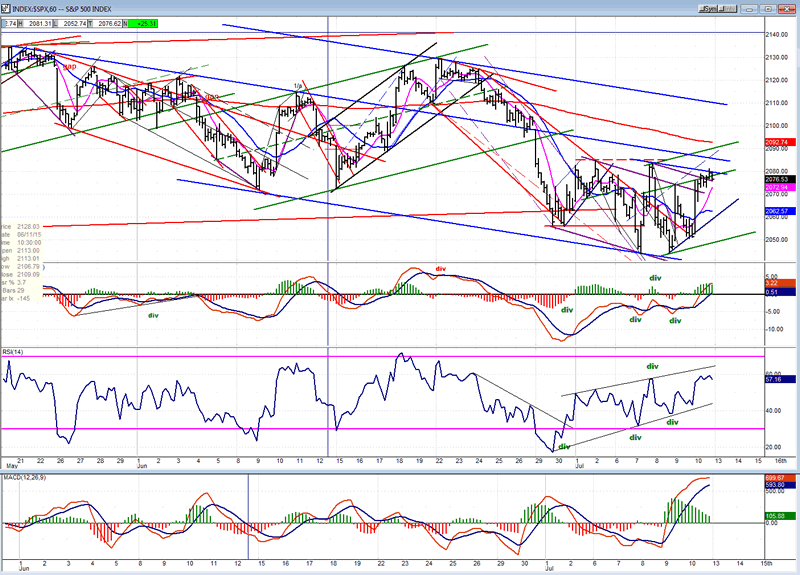

The section of the Hourly chart presented here consists of the downtrend channel outlined in the daily chart. Last week I pointed out how the index has declined in a series of small channels which had parallel green trend lines for boundaries. The one in the middle of the move is easily noticeable. You can see what happened when the bottom line of that channel was penetrated. After the low was made on Thursday, I drew three green parallels identical to the ones above. So far, the middle one has contained prices after the initial surge. The question is whether the rally stops there or continues to the one above -- or beyond! If we reverse from here and break the lower green parallel, this could turn out to be a big negative, especially if we continue lower beyond the 2040 level.

Because the Friday rally lost its upside momentum after the first hour of trading, the indicators have started to roll over. If they continue, they will issue a sell signal and this will be reflected in the price action (or vice-versa).

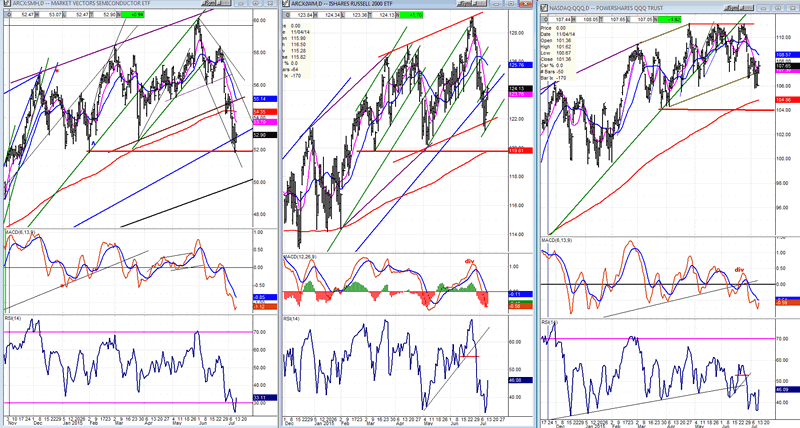

SMH - IWM - QQQ

I have substituted SMH (the semi-conductor ETF) for XBD because it is another market leader which is weakening noticeably. The red line drawn on all three charts represents the equivalent of the critical support level of 2040 on the SPX. SMH, which recently made a new high, has had a sudden drop to that level and barely bounced on Friday. The other two indices shown here also continue to weaken, but remain well above that support line. Ultimately, they will all have to break it to signal that an intermediate trend is underway.

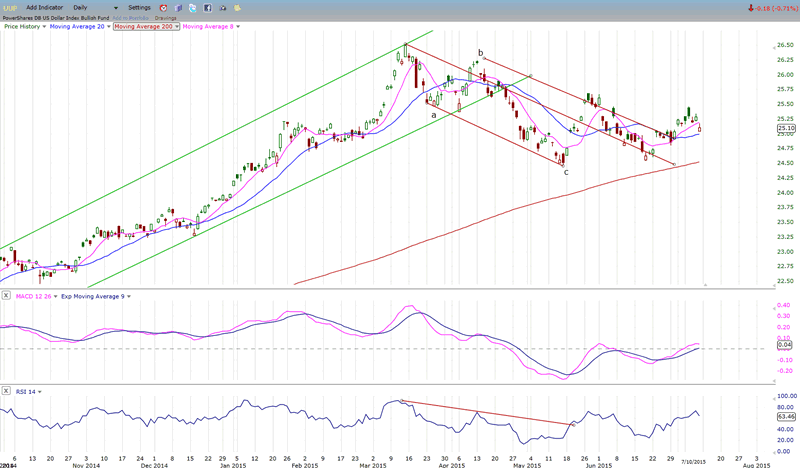

UUP (dollar ETF)

UUP is having some difficulty getting back into an uptrend and is extending its consolidation. It looks as if it may need more time in a sideways move.

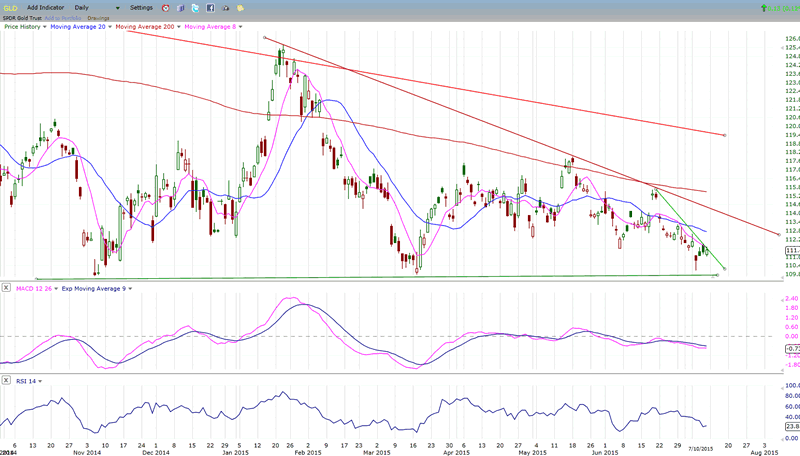

GLD (Gold trust)

GLD is also not able to reverse and must hold above the established support level to avoid the risk of another down-leg. With cycles close to bottoming, it has a good chance of doing so.

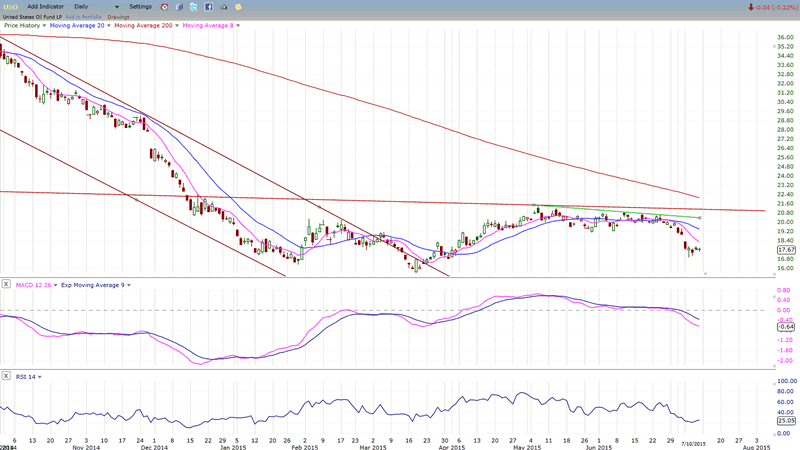

USO (US Oil Fund)

USO is either re-testing its former low, or preparing to make a new one. The bias is towards the latter at this time.

Summary

Greece continues to dominate the market action. What happens this weekend could shed a little more light on the future short-term trend.

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.