Stock Market Investors Take the Low Risk Road

Stock-Markets / Stock Markets 2015 Jul 17, 2015 - 09:05 PM GMTBy: DeviantInvestor

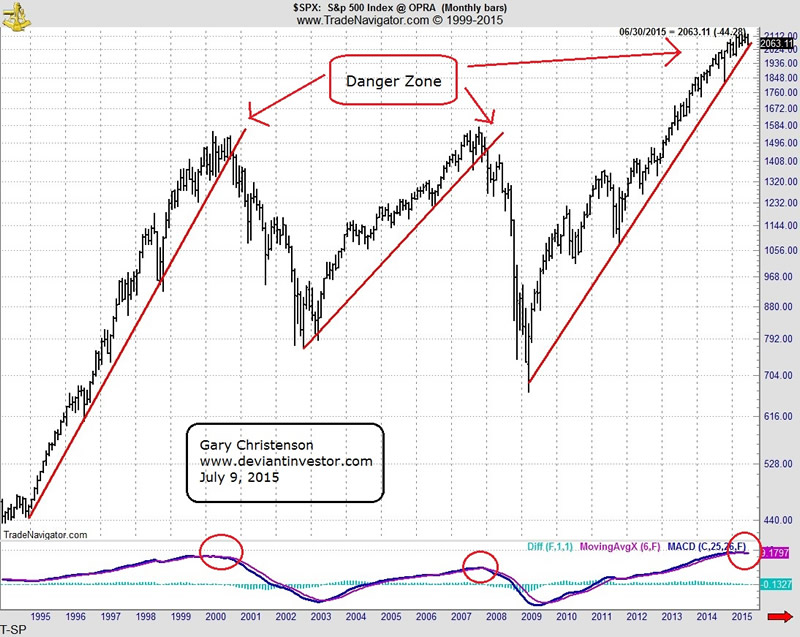

The S&P 500 Index has hit numerous new highs in the past three years. Note the log-scale graph below and the broken support lines from 2000 and 2007. The current support line, depending on where it is drawn, is on the verge of breaking.

The S&P 500 Index has hit numerous new highs in the past three years. Note the log-scale graph below and the broken support lines from 2000 and 2007. The current support line, depending on where it is drawn, is on the verge of breaking.

Further, Paul Mylcheerst says the modified monthly MACD has given a sell signal on the S&P. The same indicator gave sell signals close to the peaks in 2000 and 2007.

There is significant risk in the S&P 500 Index in spite of the fact that central banks and governments have successfully levitated the stock and bond markets.

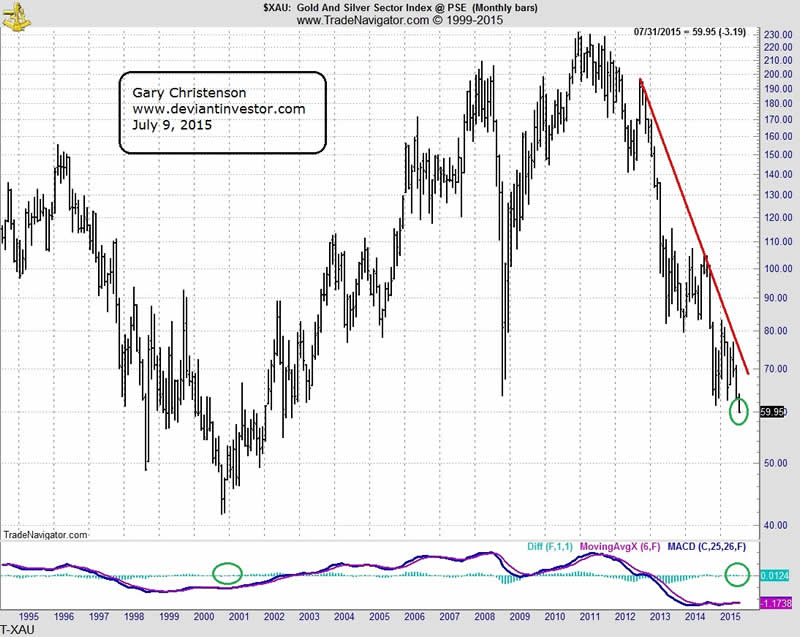

By contrast, the XAU, an index of gold stocks, has fallen to a 13 year low, and the monthly MACD indicator that gave the sell signal on the S&P has tentatively indicated a buy signal on the XAU.

What about the ratios?

Consider the ratio of the XAU to the S&P 500 Index. The ratio is at the low end of the 20 year range and at a 14 year low because the XAU stocks have been crushed and the S&P has been levitated.

The S&P up and XAU down trends appear ready to reverse. The charts show extremes in prices and in the ratio.

The low risk trade is to sell S&P related stocks and to buy gold, silver, and gold and silver stocks. Sell high and buy low!

CONCLUSIONS:

- The S&P 500 Index hit an all-time high in May 2015.

- The XAU index of gold stocks hit a 13 year low this month – July.

- The XAU to S&P ratio shows that gold stocks have been weak for several years and appear ready to reverse higher.

- Gold prices have been crushed since August 2011 while paper bonds and stocks have been “strongly encouraged” by global central banks.

- The MACD (modified by Paul Mylcheerst) has given a monthly sell signal on the S&P 500 Index (don’t discount this), a buy signal on the XAU, and is close to a monthly buy signal on gold.

Take the low risk road. At this time the S&P looks like a high risk path while gold, silver and the XAU look like a low risk road.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.