10 Stock Market Sectors Most Vulnerable to Cyberattacks

Companies / Cyber War Jul 25, 2015 - 09:35 PM GMTBy: Investment_U

Anthony Summers writes: Target (NYSE: TGT). Home Depot (NYSE: HD). Apple (Nasdaq: AAPL). EBay (Nasdaq: EBAY). Bank of America (NYSE: BAC).

These are just a few names on the growing list of companies that have experienced major data breaches in recent years. Both the public and private sectors are seeking better ways to confront cyberthreats as they become more common.

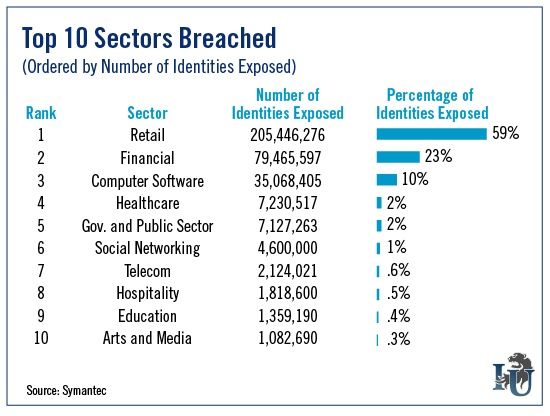

How common? In a new study, Symantec (Nasdaq: SYMC), a leading provider of security and data protection services, stated that the number of reported data breaches increased 23% last year. Roughly 348 million identities were exposed. (For tips on how to protect your data, check out the latest from Sean Brodrick here.)

As you can see in this week’s chart, the sector hit hardest by these attacks was retail. And it’s really no wonder. With tens of millions of transactions taking place each day, retail companies are attractive targets for hackers looking to steal credit card and banking information.

The financial sector came in second, with 79 million identities exposed. And halfway down the list we come to the government and public sectors. This is an area you can bet will see increased attacks over the coming years as more and more politically motivated hacks take place.

The Director of National Intelligence, James Clapper, expects an ongoing series of attacks that will create increasing costs to the U.S. economy and diminish our competitiveness. For example, the cost of an attack on the U.S. power grid is estimated at $1 trillion.

That’s on top of knocking out power for millions of Americans for days, weeks or even months.

To make matters worse, the U.S. Industrial Control System Cyber Emergency Response Team reported that 32% of threats to U.S. infrastructure occur in the energy sector. These trends are motivating government efforts worldwide to invest capital and create strategies to improve infrastructure security.

Sounds scary? Absolutely. But for investors, it’s also a signal for opportunity.

As the demand for cybersecurity services booms, the value of companies that provide better protection are bound to soar. Investors can profit from this trend by getting in now rather than later.

A simple way to invest is through the PureFunds ISE Cyber Security ETF (NYSE: HACK). Its market value has risen 25% since its inception in November 2014. One of its holdings, Proofpoint, Inc. (Nasdaq: PFPT), has shot up 374% since its IPO. The company has risen 90% in the last 12 months.

In the coming years, those who keep a thumb on this industry’s pulse are likely to earn great returns. Be sure to grab your share of the profits.

Editorial Note: The threat to our nation’s power grid is one of the biggest security issues we’re facing today. And yet, hardly anyone is talking about it! Fortunately, a handful of companies are working hard to ensure America’s lights don’t go out permanently. To discover the identities of these firms - and why the public and private sectors are shoveling millions their way - click here.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.