Doomsday Clock Strikes One Minute To Midnight For Global Stock Market Crash

Stock-Markets / Financial Crash Aug 18, 2015 - 10:43 AM GMTBy: GoldCore

It is only a matter of time before stock markets collapse under the weight of their lofty expectations and record valuations.

It is only a matter of time before stock markets collapse under the weight of their lofty expectations and record valuations.

China currency devaluation signals endgame leaving equity markets free to collapse under the weight of impossible expectations.

The Telegraph’s John Ficenec has written an excellent piece warning of a possible market crash in the coming weeks.

He identifies eight key “signs things could get a whole lot worse.”

1 – China slowdown

2 – Commodity collapse

3 – Resource sector credit crisis

4 – Dominoes begin to fall

5 – Credit markets roll over

6 – Interest rate shock

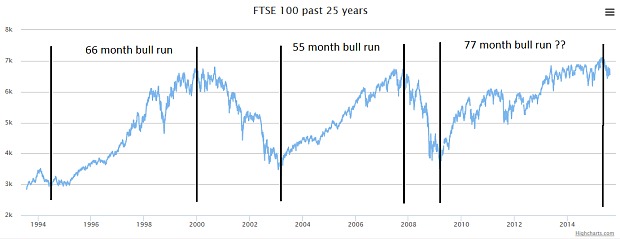

7 – Bull market third longest on record

8 – Overvalued US market

John Ficenec is a market and finance expert and is Editor of the Questor column at Telegraph Media Group working across the Daily and Sunday titles and online. He is a qualified accountant who trained at KPMG before moving into asset management and the private equity industry. He has worked in financial journalism since 2011 and joined the Telegraph in 2013. He won ‘Article of the Year’ in the 2013 CFA Society of UK awards.

As we know, a picture paints a thousand words and the article is replete with a number of excellent charts which should give even the most complacent investor pause for thought.

The convincing thesis can be read in GoldCore Commentary here

DAILY PRICES

Today’s Gold Prices: USD 1,117.30, EUR 1006.17 and GBP 714.34 per ounce.

Friday’s Gold Prices: USD 1,116.75, EUR 1002.11 and GBP 715.29 per ounce

(LBMA AM)

Gold in USD – 1 Year

Gold and silver gained over 2% and 3% last week. After those gains, both precious metal took a breather on the COMEX on Friday. Gold and silver were mixed – gold was flat and silver fell 1%.

This morning, gold is 0.4% higher to $1,118.60 per ounce. Silver is 0.2% higher to $15.37 per ounce.

Platinum and palladium are 0.5% and 0.2% higher to $1,001 and $623 per ounce respectively.

Download Essential Guide To Storing Gold Offshore

BREAKING NEWS

China Surprises for a Second Time This Week With More Gold Data – Bloomberg

Gold Holds Gain After Posting First Weekly Advance Since June – Bloomberg

Gold steady as focus returns to U.S. rate hike view – Reuters

Bears Miss Gold’s Best Rally Since June as Analysts See Declines – Bloomberg

China Says Gold Hoard Climbs 1.1% in Data Transparency Push – Bloomberg

IMPORTANT COMMENTARY

Doomsday Clock Strikes One Minute To Midnight For Global Market Crash – The Telegraph

Beware a China crisis that could crash down on us all – The Telegraph

How The Wall Street Ponzi Works——The Stock Pumping Swindle Behind Four Retail Zombies – David Stockman’s Contra Corner

The ‘Big Long’ Gets Bigger As Goldman And HSBC Gobble Up Tons More Gold – Seeking Alpha

Germany Continues To Lead The West In Physical Gold Demand – GoldSeek

Billionaire Stanley Drucknemiller Loads Up On Gold, Makes It His Largest Position For First Time Ever – Zero Hedge

Download Essential Guide To Storing Gold Offshore

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.