Solar Stocks the Biggest Investment Opportunity in Energy Right Now

Companies / Solar Energy Sep 09, 2015 - 03:52 PM GMTBy: Investment_U

David Fessler writes: By 2035, the electricity sector - which should be worth a cool $4 trillion annually - won’t look anything like it does today. That’s because a huge disruptor is affecting the way energy is generated and distributed...

David Fessler writes: By 2035, the electricity sector - which should be worth a cool $4 trillion annually - won’t look anything like it does today. That’s because a huge disruptor is affecting the way energy is generated and distributed...

I’m talking about solar.

Right now, solar is a $120 billion a year industry. Over the last two decades, solar has grown at a 30% compound annual growth rate. And there’s no reason to think that won’t continue.

In fact, industry analysts believe that in two decades, solar will be 10 times the size it is today. That means investors who put money in the sector now will be richly rewarded in the coming years.

It’s the single biggest investment opportunity I know of in energy.

Residential and Commercial Installations Are Booming

At the moment, the bulk of U.S. electricity comes from coal, natural gas or nuclear-fired power plants. Solar is changing that.

Out west, land is plentiful and bathed in sun much of the year. Western power generators are taking advantage of this fact, building huge solar farms on a utility scale. In addition, residential and commercial installations are booming.

Why the big increase? It’s not because of the federal tax incentives. (They expire at the end of 2016, and it’s unclear whether Congress will renew them.) The true cause is that generating electricity with solar has finally reached grid parity.

That means it costs as little to generate electricity from solar as it does from other sources. Up until now, that’s been a huge roadblock.

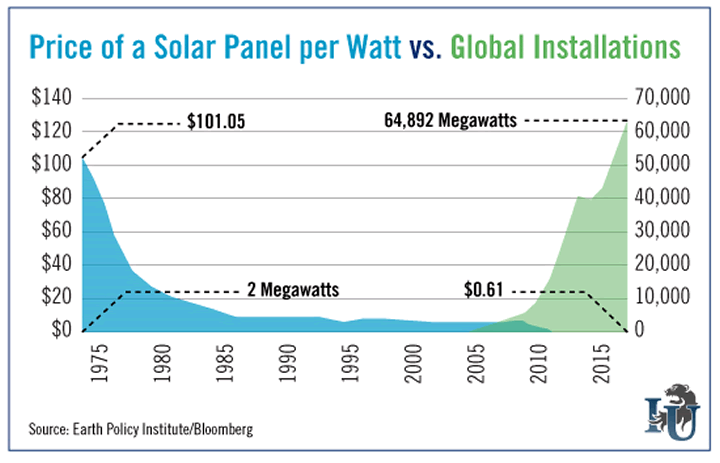

As Rachel Gearhart, Managing Editor of my new free e-letter Energy & Resources Digest, recently pointed out, the cost to produce energy via solar has fallen dramatically while the number of global installations has rocketed.

In 2014, costs dropped 10% from the year prior.

Of course, naysayers still point to the lack of storage. But, as I love to say, technology is marching on...

Both Tesla Motors Inc. (Nasdaq: TSLA) and SolarCity Corp. (Nasdaq: SCTY) are now offering energy storage modules. Though just a beginning, these should help address that problem.

Back Up the Truck and Buy

In the last month, SolarCity shares have dropped about 20%. That’s because there is a perceived link between renewables (including solar) and oil prices...

Nothing could be further from reality.

Nothing could be further from reality.

The price of oil has no bearing on electricity generation - especially solar power. The sun shines the same, regardless of what’s happening with oil. But here’s the good news...

When low oil prices drag down the price of solar stocks, that just means it’s time to back up the truck and buy. As with all other companies, the stock prices of these firms are ultimately driven by one thing: earnings.

SolarCity is a great example. At the tail end of July, it reported a 67% year-over-year revenue increase. As costs drop and sales rise, those numbers should only get sweeter. It’s no wonder that Stephen Byrd from Morgan Stanley recently upgraded SolarCity to “overweight” from “equal weight,” upping his price target to $93 per share. That’s almost double the stock’s current price.

Byrd says he expects the company to grow its business by 40% annually over the next five years. I’m inclined to agree.

SolarCity is already the largest installer of solar systems in the country. With shares beaten down - unnecessarily - now is the perfect time to take a serious look at this company. The stock hit a high of more than $60 back on August 5. Since then, it’s plummeted by more than 40%. Yet nothing has fundamentally changed inside the company.

Investors reacted negatively to hedge fund manager Jim Chanos announcing his plan to short SolarCity shares. Shares have also dropped, as I mentioned, along with the price of oil. But it’s these types of events that long-term investors can safely ignore.

Just remember: fossil fuels are a finite resource. As their supplies diminish, they will eventually get more expensive. Solar, on the other hand, will only continue to get less expensive.

Now’s a great time to beat the crowd into the sector.

Good investing,

Dave

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.