Knockout Punch for Gold Bugs

Commodities / Gold and Silver Stocks 2015 Oct 02, 2015 - 12:24 PM GMTBy: Jordan_Roy_Byrne

Two months ago the precious metals complex became extremely oversold and ripe for a rebound. Two months later and the overbought condition and bearish sentiment has been alleviated to some degree. Sadly for bulls, Gold barely rebounded while both Silver and gold miners performed worse. The broad precious metals sector appears to be in position for a breakdown that could be a knockout blow to gold bulls and gold bugs.

Two months ago the precious metals complex became extremely oversold and ripe for a rebound. Two months later and the overbought condition and bearish sentiment has been alleviated to some degree. Sadly for bulls, Gold barely rebounded while both Silver and gold miners performed worse. The broad precious metals sector appears to be in position for a breakdown that could be a knockout blow to gold bulls and gold bugs.

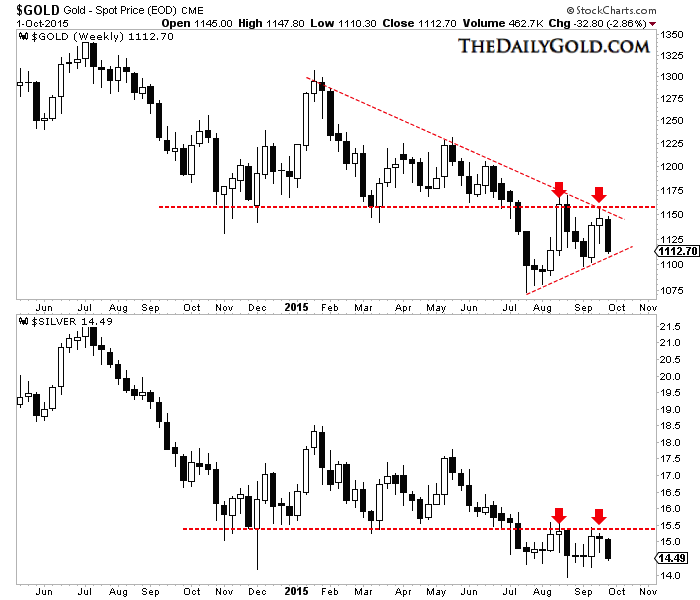

The weekly candle chart of Gold and Silver is shown below. Gold failed to clear $1160 in August and failed to close above $1150 last week. Gold is already down $33 this week and threatening to break lower from a triangle consolidation. Meanwhile, Silver has tried to surpass $15.50 but has failed a handful times. It is threatening to close at a new weekly low. The metals broke support in the summer and are threatening to break to new lows after retesting resistance (former support). This is textbook stuff.

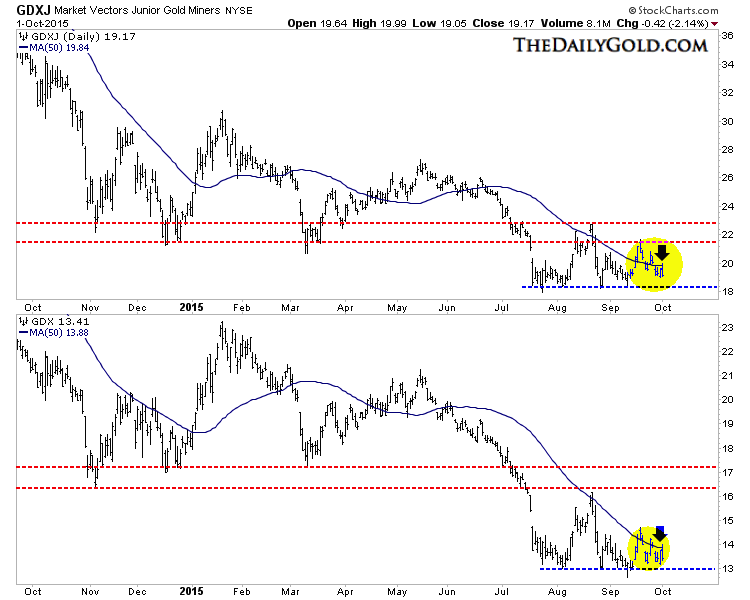

The prognosis is the same for the miners. The daily bar charts for GDXJ and GDX are below. While the miners have held support, they have failed to generate anything during the rebound in Gold. Both GDXJ and GDX fell below their 50-day moving averages on Monday and have failed to recapture them. After Wednesday’s strength the miners failed again at their 50-day moving averages, leaving a bearish reversal and very little breathing room.

Another reason to be concerned is bearish sentiment has been unwound. From a bird’s eye view sentiment is certainly very bearish and that supports the inevitable sustained rebound. However, near term indicators such as put-call ratios, speculative positioning and discounts to net asset value do not indicate extremes. While there are a fair amount of speculative shorts in the metals, there are also some speculative longs left. In other words, there are still potential sellers out there who can drive the price lower. These longs need to liquidate before true capitulation can been reached.

In the days and weeks ahead, investors and traders need to be vigilant and focus on taking advantage of the volatility. The precious metals sector is threatening to break lower. Shorts should use stops while longs should remain patient and wait for this potential breakdown to run its course. Personally, I’m hoping to accumulate my favorite junior miners as Gold nears major support at $1000 and as sentiment and technical indicators reach extremes.As we navigate the end of this bear market, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.