You Will Hear the Roar of the Printing Presses from Mars

Stock-Markets / Quantitative Easing Nov 01, 2015 - 04:47 PM GMT“We are exiting the eye of the giant financial hurricane that we entered in 2007, and we’re going into its trailing edge. It’s going to be much more severe, different and longer lasting than what we saw in 2008 and 2009… The U.S. created trillions of dollars to fight the financial crisis of 2008 and 2009. Most of those dollars are still sitting in the banking system and aren’t in the economy. Some have found their way into the stock markets and the bond markets, creating a stock bubble and a bond super-bubble. The higher stocks and bonds go, the harder they’re going to fall.” – Doug Casey, Casey Research

“This huge recession that started in 2007, and the bottom was 2009 and 2010, has cyclically recovered. So, people think it’s going to be happy days again, but it’s not… You’re going to see very high levels of inflation. It’s going to be quite catastrophic.” – Doug Casey, Casey Research

“Bond investors are signaling to us that they don’t believe the Fed is in control anymore. The Fed by contrast is brushing aside the market’s deflation concerns. It all feels very much like Japan circa 1995 in the wake of the yen’s then surge. . . The collapse in inflation expectations tells us that the market believes the central banks, despite their monetary profligacy, are failing to prevent the western economies from turning Japanese, and thus at risk of repeating their devastating slide into outright deflation in the 1990s.” – Albert Edwards, SocGen

MK note: Markets, we are told, are predictive. If so, what is the stock market telling us at current levels? What is the bond market yield telling us? What is the gold market telling us? Of the three, only stocks are predicting a bright economic future. Gold and the bond yield are both telling us that the global economy is in the grip of disinflation and perhaps on the verge of going over the cliff – to a full blown deflation.

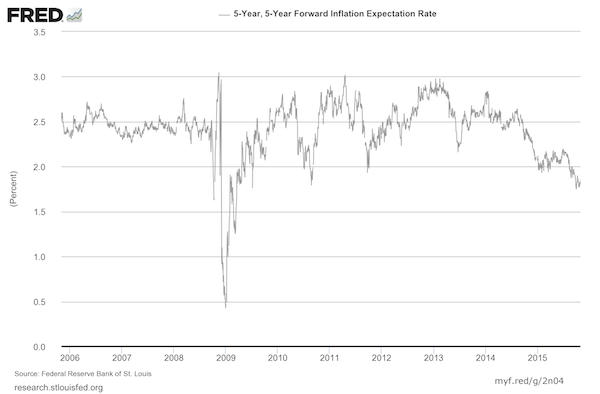

The St. Louis Fed’s inflation expectation index for five years out is now at levels not seen since the 2008 crisis and an indication how markets see the situation. That expectation could change in a heartbeat, but it gives us an idea what markets are telling us now.

Stocks, having returned to old highs, are obviously the outlier, and one wonders what it is that motivates the upside. This morning’s Financial Times ran a headline that reads “Central bank moves drive equities” and quotes HSBC’s Ben Ladler as saying, ” [Central bank action] makes people feel more confident when they know policy-makers are on their side. People had gotten too bearish.” Really? Odd that the same policy that drove gold down because the Fed came off “hawkish” would drive stocks up. One wonders to what degree the retail public is involved in all of this – either the stock or gold markets. In the past, we have questioned the artificiality in the stock market as something to be concerned about – that concern is boosted by the headline and remarks in this morning’s FT.

So, which market[s] is telling us the truth and which is peddling fiction?

I’ll put my money on the bond and gold markets, and remind our readers, that gold performed extremely well during the disinflationary period both before and after 2008. We should also keep in mind that very strong global demand pushed prices radically higher after it became apparent that the previous financial bubble had created widespread systemic risks and the potential for an economic crash – the very same set of circumstances both Casey and Edwards now predict above.

Doug Casey, as you can see from the quotes featured above, sees a turnaround from the current disinflationary environment to “catastrophic” levels of inflation. Albert Edwards sees it a bit differently – disinflation, perhaps deflation, first, then inflation. “I have not one scintilla of doubt,” he says, “that the western central banks have set us up for an even bigger version of the 2008 Great Financial Crisis/Recession – but this time rock bottom interest rates and large fiscal deficits will mean only one thing; QE will be stepped up to such a pace that you will hear the roar of the printing presses from Mars.” As hinted earlier, I come down in the Edwards camp.

That said. . . . .

Both analysts recommend gold and that is a good thing because gold will protect the private investor no matter which way the economic rabbit jumps – deflation and hyperinflation and all stops in between. When considering a monetary era when one could hear the roar of the presses from Mars, Edwards sees gold as a “must-have holding.”

Doug Casey offers this summation of gold’s recent price history: “There’s no question that gold has had a severe retracement since its high in September of 2011. I understand their feelings. But we’re not talking about feelings here; we’re talking about markets. Markets cycle. This one has cycled about as low as any gold market in past corrections, and now I think it’s time for it to cycle up again.”

As for stocks, the outlier in this comparison, Deutsche Bank’s Alesandar Kocic says, “given the current [low] level of inflation, S&P should be trading at half of its value.

Reader invitation: If you like this type of gold-based analysis, you might want to consider becoming a regular visitor to this page – our live daily newsletter. We publish important information, forecasts, commentary & analysis on the gold market daily. Please bookmark if you have an interest. For free, in-depth analysis and special reports, we invite you to subscribe free of charge to our regular newsletter. New release notifications are sent by e-mail.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.